As it did when the results of the 2016 referendum, the impact of a no-deal Brexit would be visible immediately across financial markets and more slowly in the wider economy. There would be three big things to watch with regard to markets: government-bond yields, share prices and crucially the value of the currency.

Brexit uncertainty has given professional anxiety throughout every area of society prior to the UK’s departure from the EU, but the after-effects on the exchange rate could see the British pound crash in one particular circumstance. Finance experts from foreign exchange, asset management and stocks have all commented on the very real potential of a no deal Brexit for the UK and noted the pound could “break” as a result.

If Theresa May cannot negotiate her deal to be supported or a version of it to be backed should and regretfully the UK leaves the EU with no solid plan on how to go forward own a post-EU environment, a no deal scenario will legally occur.

Nothing is certain, but if the UK “crashes” out of the EU with no deal, the pound could fall across the board. For exchange rates, we could see the pound break well below 1.10 against the euro again, and head towards the low 1.20s against the US dollar as many banks have predicted. The fundamental issue for traders is the consistent lack of clarity and any certainty of a back-up plan. Uncertainty is, without a doubt, one of the biggest causes of volatility for currency.

The pound is yet to return to pre-Brexit rates against the euro (1.45), and as of writing it’s down 13% against the Euro compared to the day of the referendum.

To put this in real terms for the average person on a day to day scenario, heading to a Eurozone holiday destination you would receive approximately £150 worth of euros less for every £1,000 exchanged.

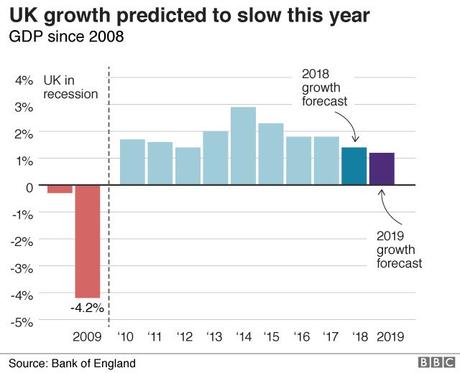

Due to the uncertainty, its affected UK growth which ultimately feeds back through the economy and a country’s currency is the cleanest way of measuring the health and strength of its economy. Predictions don’t look too appetising either:

Jobs and passports

A slowing economy or certainty reduced growth forecast, lower business investment tends to hamper how efficient we can be economically – that is known as productivity – and reducing productivity will reduce our economic potential and eventually a weaker pound.

It may come as a surprise but the British economy has more people in employment than they have for 40 years – a strange and positive piece of economic news. The reasons for this are that business have opted to invest in people rather than intangible assets such as office space or AI systems for autonomy.

After the 2008 crisis (if history is anything to go by), companies retained their workforce as they were well trained and integrated rather than invest in expensive, major projects. In the short term, this was cheaper and a more flexible option and this seems like pre-Brexit (no-deal or not) this is occurring again.

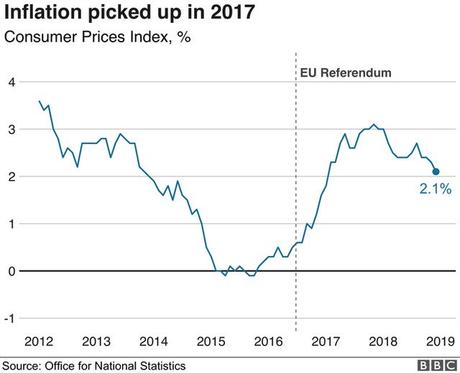

Income in real terms, once the cost of living is accounted for, is on the rise, they remain lower on average than ahead of the financial crisis. Inflation is increasing at a significant rate and if you regularly transfer money then this will be another, unforeseen, hidden cost. Post-referendum, inflation has increased offering a higher cost for goods and services:

You may have noticed, certainly may have felt it, pay rises have been at best, sluggish, but higher-than-expected inflation has also played a part, in particular in 2017 aka prime Brexit time. That year alone ensured prices rose by 3%, almost twice as much as expected pre-referendum. The rise in inflation largely reflected a drop in the exchange rate in the aftermath of the referendum – which meant that sterling is worth about 10% less than it was previously. For more on how inflation affects the economy, take a look at our summary.

All top or respected economists, financial commentators believe, without question that a No-deal Brexit outcome will weaken the pound and the wider economy. For holidaymakers, you may require 15 months validity on their passport before you travel. Last year, the passport office issued information about the changing requirements for entry to certain areas of the world. They advised you should keep at least six months on your passport before you travel. Its thought millions of UK passports now under threat of becoming invalid due to the legal changes that Brexit will through up.

No-deal for holidaymakers?

Let’s be honest, when we follow the currency fluctuation, one of our first thoughts when we see a drop is whether is going to be unaffordable to go on holiday this year. The fall in the value of sterling since the vote has reduced the spending power of the average British holidaymaker or traveler. It’s not all doom and gloom – Andrew Brown from Post Office Travel Money says the average British tourist spends £800 on a break. If the worst-case scenarios do come to fruition, this could mean a no-deal would add an average £80. It’s annoying but not life-changing.

Not all negative

A weaker pound may mean it’s more expensive for UK holidaymakers to venture abroad – but on the upside, it makes the UK a more attractive destination. For foreign tourists and UK tourism sector, a record 39.2 million overseas visitors came to the UK in 2017, spending £24.5bn. This arguably wouldn’t have happened with a pound at the strength of the early 2000s.

For business investment, generally, they don’t invest purely on currency fluctuation and no one wants to catch a falling knife but franchises, businesses, property (of significant value) and investments will all carry a 5-15% discount depending on how much the pound drops. To sophisticated investors, they are shopping and procuring potential business opportunities right now ready to execute should the pound cash.

In theory, a weaker pound makes UK exports more attractive. Sales to overseas customers were stronger than anticipated pre-referendum – but they rose by less than would have been expected. Surveys over the last couple of months have suggested export orders cooled, a reason could be customers fear a no-deal scenario could spell delay and extra charges on delivery.

If there is a deal – the government has hinted at hopes of a “deal dividend” for businesses and consumers proceeding with investing when they may have previously been waiting.