Disclaimer; This post is sponsored by Lexington Law but the content and opinions expressed here are my own. ( Lexington Law Disclaimer )

Dream home, dream car, dream wedding, dream vacation: having a dream doesn't cost you anything, but working towards fulfilling your dream does come with its own price tag.

Back in India if you ever needed a loan for anything, you would reach out to your uncle's friend or even your friend and bam - you'd have your loan! Word of mouth, goodwill, and your personal rapport with the lender did the needful. If not a personal loan, the bank would ask for a guarantor and your loan request would get approved. But here in the US if you need a loan, the bank will ask for just one thing- CREDIT SCORE !

For all my International readers- a credit score is a number between 300-850 that depicts a consumer's creditworthiness.The higher the score, the better a borrower looks to potential lenders. A credit score is based on credit history which is the number of active accounts, debt, and repayment history. Lenders refer to this credit score to determine how much credit the borrower can be apportioned, at what interest rate he should be lended credit and how fast he or she would be able to repay. One needs to maintain good credit for any kind of loan- student, house mortgage, car, and credit cards.

Hubs and I have been very prudent and have always maintained a good credit score. As immigrants, we did face a lot of trouble building a credit history as we couldn't own credit cards for a very long time. But as soon as we were able to, we adhered to the rules of the GOOD CREDIT SCORE GAME. We paid our bills on time, we never overindulged, we invested wisely, and did all that was in our power. But life happens, the unforeseen happens, people fall off the wagon and fail to maintain a good credit report.

Every year millions of Americans are denied car and home loans owing to poor credit. A derogatory remark by a creditor on late payment can seem harmless but in the long run it can harm your credit score which can show up on your credit report for a good seven years. The current economy might not be ideal but the mortgage interest rates are at an all time low- a silver lining out of all the crisis. This is the time to renegotiate your interest rate with your lender. But to benefit from these offers, you have to have a credit score in good standing. Enter the credit repair guru: Lexington Law firm.

Lexington law is a trusted leader in credit repair. Lexington Law is the oldest and most respected name in credit repair, and the only player in the category with the legal experience and technology to both advocate and drive results for consumers.

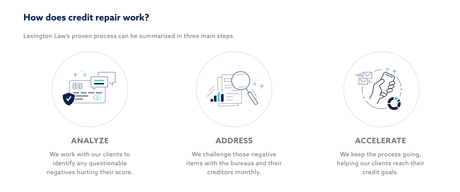

Credit repair is the process of identifying and addressing unfair, inaccurate or unsubstantiated negative items on a consumer's credit report. Lexington Law's proven process helps hundreds of thousands of people work to repair their credit every year. Lexington Law believes that you have a right to a fair, accurate, and substantiated credit report. Lexington Law can navigate the credit repair process by harnessing the power of knowledge and the law to fight for their clients' rights to good credit.

- Lexington Law has their own proprietary app, which means round the clock access to best-in-class information.

- Lexington Law has long-standing relationships with all three of the credit bureaus: Equifax, Experian, and TransUnion. They work closely with all these credit bureaus to flag and work on any errors that might show up on your credit report.

- Lexington Law is a CROA (Consumer Credit Protection Act) compliant organization. This means it is regulated extensively with auditors and regulators. Just as one would hire a CPA or MD to manage their taxes or health, consumers should demand nothing less from their credit repair partner.