Despite last Friday’s disappointing jobs report, stocks are staying strong. The S&P 500 hit yet another new high on Wednesday—its highest level since January 2008, while the Nasdaq is at a level not seen since toppling from its “irrational exuberance” days of late-2000 as the Internet bubble was bursting. The ECB seems to be getting a workable plan together to support the eurozone banking system and sovereign debt. The German Constitutional Court elected not to block the plan for a European Stability Mechanism rescue fund, which pleased global investors. Now all eyes await the next in a series of statements from central bankers—this time from our own FOMC and Chairman Bernanke on Thursday.

Despite last Friday’s disappointing jobs report, stocks are staying strong. The S&P 500 hit yet another new high on Wednesday—its highest level since January 2008, while the Nasdaq is at a level not seen since toppling from its “irrational exuberance” days of late-2000 as the Internet bubble was bursting. The ECB seems to be getting a workable plan together to support the eurozone banking system and sovereign debt. The German Constitutional Court elected not to block the plan for a European Stability Mechanism rescue fund, which pleased global investors. Now all eyes await the next in a series of statements from central bankers—this time from our own FOMC and Chairman Bernanke on Thursday.

Many of the sector iShares are near their all-time highs, including Healthcare (IYH), Consumer Services (IYC), and Consumer Goods (IYK). Telecom (IYZ) is at a 52-week high. And economically-sensitive sectors like Financial (IYF), Materials (IYM), Energy (IYE), and Industrial (IYJ) are all on upward trajectories, ostensibly in anticipation of stimuli from both the ECB and FOMC. In particular, IYM has taken a sudden leap over the past week above all of its moving averages to lead all sectors. Only safe haven Utilities (IDU) is down from its price at the beginning of August…although defensive-oriented Consumer Goods (IYK) appears to be quickly retreating from its highs. Notably, small caps and mid caps both have been greatly outperforming the large caps since August 1.

Emerging markets also have taken a positive turn over the past week, but the U.S. still looks like the place to be for global investors. Despite data showing net outflows from domestic equity mutual funds, U.S. stocks are strong. The presumption is that foreign investment continues to flood into our equity markets. If individual investors decide to get on the bandwagon, stocks could really get bullish.

As usual, Apple (AAPL) did its part to keep investors and consumers forking over the dough as the company unveiled its highly-anticipated iPhone 5 on Wednesday, calling it “the most beautiful consumer device that we’ve ever created.” It boasts greater processing power, 4G LTE compatibility, longer battery life, an improved camera that shoots up to 1080p video, and a larger screen (4 inches rather than 3.5 inches). They also introduced an all-new iPod touch (with the “Retina” display) and a reinvented iPod nano. Loyalists are pleased, I’m sure, and will likely start upgrading from perfectly good equipment immediately—whether or not they really need the new features and whether or not they can truly afford the upgrade. (No wonder outstanding consumer credit has been increasing.) Such is life for the most dominant corporate juggernaut of the 21st Century, better known as Apple. The stock hit another all-time high above $683 on Monday.

Sadly, Wednesday also gave us yet another example of how easy it is for any crackpot or agitator with a video camera and Internet access to foment a culture clash and virtually destabilize the world. U.S. Ambassador to Libya Chris Stevens—a true friend to the Libyan people, and in fact all Arabs and Muslims fed up with oppression—was the latest casualty when murderous protests erupted over some obscure low-budget film posted to YouTube by an unknown Israeli-American that was highly offensive to Islam.

The Information Age has created instant communication across a planet that houses religions and cultures that cannot peacefully coexist under the best of circumstances and intentions. Want to create global chaos? Simply use your iPhone to film yourself burning a Quran or disrespecting Prophet Muhammad and then upload it to YouTube. In this country, we might respond to such behavior by voicing disapproval, or better yet, withholding the attention it seeks. But when it is viewed in fundamentalist societies elsewhere, buildings burn and innocents die. Any American—whether friend or foe—automatically becomes a target of extremists, akin to a KKK lynching. It’s at once irrational, medieval, horrifying, thuggish, and infuriating.

Let’s move on to the charts. The S&P 500 SPDR Trust (SPY) closed Wednesday at 144.39. The 140 level has held as strong support. It has been trading within a bullish rising channel since the beginning of June. A bullish ascending triangle within the rising channel appeared to have failed last week, but perhaps I was drawing it too tightly. The lower of the two lines shown seems to have held as price broke out last Thursday above the 142 resistance line from April-May. However, SPY still remains within the long-established rising channel. Price is back above the 20-, 50-, 100- and 200-day SMAs. The oscillators like RSI, MACD, and Slow Stochastic are getting somewhat overbought as price straddles the upper Bollinger Band, so some kind of pullback might be in order.

If markets do pull back from here, there are several interim support levels, including resistance-turned-support at 142, prior support at 140, the rising 50-day SMA (near 140), the bottom of the rising channel near 139, the 100-day SMA (turning up and nearing 137), and then the 200-day SMA near 135.

The VIX (CBOE Market Volatility Index—a.k.a. “fear gauge”) fell back down to test support from the August lows around 14, and then closed Wednesday at 15.80. RSI and MACD are both near the neutral line but look as though they could fall further, which would be bullish for stocks.

Despite the market’s strength and persistently high correlation, Sabrient subsidiary Gradient Analytics has continued to identify stocks with a high probability of underperformance due to forensic accounting issues. Most recently, negatively-graded companies like Titan Machinery (TITM), International Rectifier (IRF), and Vera Bradley (VRA) have fallen after their quarterly earnings reports disappointed investors.

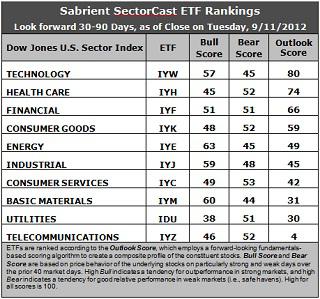

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) remains in the top spot with a score of 80. Stocks within IYW are displaying relatively low forward P/Es, strong projected long-term growth, and solid return ratios. However, the analysts have been reducing forward earnings estimates overall. Healthcare (IYH) returns to the second spot with a 74, as stocks within the sector regained some support from Wall Street analysts relative to Consumer Goods (IYK), which fell to fourth place behind Financial (IYF).

2. Telecom (IYZ) stays at the bottom of the Outlook rankings this week with an anemic Outlook score of 4. Stocks within the sector are hobbled by the highest forward P/Es and the worst return ratios, plus net downgrades from Wall Street. Utilities (IDU) remains in the bottom two with a score of 30, just below Basic Materials (IYM) at 31, which got hit with additional analyst downgrades. IDU continues to be hampered by a high forward P/E and the worst projected long-term growth rate.

3. Overall, I would categorize the rankings as neutral, with conservative sectors like Consumer Goods and Healthcare in the top 5, joining economically-sensitive sectors Technology and Financial as the only sector iShares scoring above 50.

4. Looking at the Bull scores, Energy (IYE) is the clear leader on strong market days, scoring 63. Utilities (IDU) is still by far the weakest on strong days, scoring 38. In other words, Energy stocks have tended to perform the best when the market is rallying, while Utilities stocks have lagged.

5. Looking at the Bear scores, Utilities (IDU) continues to lose its status as investors’ favorite “safe haven” on weak market days. Surprisingly, Consumer Services (IYC) has been holding up quite well on weaker days, although admittedly there haven’t been many lately. Basic Materials (IYM) has been abandoned the most by investors during market weakness, as reflected by its low Bear score of 44, which is just slightly worse than Energy (IYE) and, surprisingly, Technology (IYW). In other words, Materials stocks have tended to sell off the most when the market is pulling back, while Consumer Services stocks have held up the best.

6. Overall, Technology (IYW) again shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 182. Telecom (IYZ) is the worst at 102. As for Bull/Bear combination, Energy (IYE) is the best at 108, while Utilities (IDU) is by far the worst with a dismal 89.

These scores represent the view that the Technology and Healthcare sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within IYW and IYH include Cognizant Technology Solutions (CTSH), CACI International (CACI), Edwards Lifesciences (EW), and Watson Pharmaceuticals (WPI).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.