Courtesy of Sabrient Systems and Gradient Analytics

In the ongoing bad-news-is-good-news saga, last week’s surprisingly weak jobs report led to speculation that the Fed would delay hiking interest rates, which is perceived as a positive for equity investors. So, bulls are getting a boost for the moment, although those previously hard-won round-number price levels for the major indexes are now serving as ominous overhead resistance that will likely require a strong new catalyst to break through. Whether stocks are destined for downside or upside from here, Q1 earnings season starts this week and will likely provide the catalyst.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

The major market indexes continue to toil below recent support-turned-resistance thresholds, including S&P 500 2,100, Dow Jones Industrials 18,000, and NASDAQ 5,000. The holiday-shortened week started out with a bang on Monday, but then drifted lower in anticipation of the jobs report on Friday and this week’s start to earnings season and the Q1 reports. As it turned out, Labor Department data for March showed that U.S. employers added the fewest jobs in over a year, with only 126,000 jobs versus expectations of 245,000, but the unemployment rate remained unchanged at 5.5%.

Heading into Q1 earnings season, the bar has been lowered considerably. According to S&P Capital IQ, S&P 500 companies are expected to post earnings growth of -3.0% Q1 2015, which would be the first decline since Q3 2009. Revenues are expected to fall -1.3% in Q1 2015 due to the strong dollar and weak commodity prices. Among the 101 S&P 500 companies that pre-announced their earnings guidance, 85 offered negative outlooks while only 16 were positive. Moreover, only five of the ten U.S. business sectors are expected to report positive Q1 2015 earnings growth, with Financial, Healthcare, and Consumer Services (Discretionary/Cyclical) the leaders and Energy, Basic Materials, and Utilities the laggards.

As a result, the boo-birds are telling us that the expected economic weakness is the start of a bigger slide (or even a reversal) in the economic recovery. But in our current slow-but-steady recovery, which is good in that growth is not overheated and investor sentiment is not overly exuberant, there is always going to be some volatility in each quarter’s results rather than posting a consistent level of growth. We got a big drop in oil prices, which was good for most consumers but bad for large swaths of the nation’s economy, particularly within Energy, Capital Goods, and Materials segments. We saw labor issues at West Coast ports that impacted many imports and exports. We had severe winter weather across much of the country that lasted longer and was even worse than the nasty stuff we endured last year. Now oil prices are creeping back up, port strikes have been settled, and spring weather has arrived.

The 10-year U.S. Treasury yield closed last week at 1.90% and continues to generally trend lower after a brief spike higher in February. The euro is trading around $1.10 after falling 11% against the dollar during Q1, which was the worst quarter in its 15-year history as monetary policy diverged between the Federal Reserve and the ECB. During 2014, foreign investors increased their holdings in U.S. Treasuries by $374.3 billion in 2014, which has put downward pressure on longer-term interest rates, and that trend has continued to accelerate.

Also worth noting is ConvergEx’s quarterly review of ETF money flows, which seems to be indicating that capital has been flowing out of domestic equity and into fixed income, commodities, and overseas equity markets. Domestic equity ETFs lost $12 billion (including $23 billion in redemptions from SPY), while fixed income ETFs gained an impressive $19 billion of inflows and commodity ETFs (particularly oil related) gained, as well.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 14.67, which is back below the 15 threshold between investor fear and complacency. It seems to be coiling around the 15 level in preparation for a larger move one way or the other.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 206.43. For the seventh time in four months, it is seeking reliable support from the lower uptrend line of the long-standing bullish rising channel. The 100-day simple moving average has joined forces to help provide even stronger support. Each test of support seems to be creating a successively smaller bull flag continuation pattern. Oscillators RSI, MACD, and Slow Stochastic are all struggling in neutral territory and seeking a direction. It seems that there will be a strong move one direction or the other, and my inclination is a continuation to the upside, although it is likely that May will bring about more trepidation among bulls who fear seasonal weakness (i.e., “Sell in May and go away”). Below the 100-day SMA and the uptrend line resides the critical 200-day SMA (approaching 202) followed by round-number support at the 200 price level.

Some negatives include the failure of the Dow Jones Transportation Average to confirm a new high in the Dow Jones Industrial Average (i.e., Dow Theory buy signal not confirmed) and the declining tops on the MACD. Positives include the continued bullish look of the Russell 2000 small caps chart.

Also, small caps tend to be lesser impacted by the strength of the dollar (forex), and they can benefit more from a strengthening domestic economy.

Latest sector rankings:

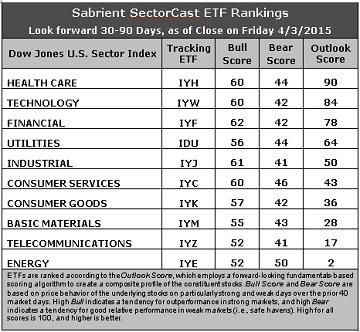

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Healthcare has moved into first place with a robust Outlook score of 90. Healthcare displays the best sell-side analyst sentiment (positive net revisions to earnings estimates) and above average scores in most factors in the model, including return ratios, forward long-term growth rate, and insider sentiment (buying activity). Technology takes second at 84 and displays solid factor scores across the board, including the highest return ratios. Financial takes third with a score of 78, with solid analyst and insider sentiment and the lowest forward P/E. Notably, the 3-tier bunching of recent rankings has become a smoother top-to-bottom distribution, which is more favorable.

2. At the bottom remains Energy and Telecom. Energy continues to hold the bottom spot with an Outlook score of 2 given the persistent weakness in oil prices and the ongoing downward earnings revisions from Wall Street. Energy is among the worst in all factors in the model, and in fact its forward long-term growth rate is virtually zero.

3. Looking at the Bull scores, Financial displays the top score of 62, followed by Industrial at 61. Energy and Telecom score the lowest at 52. Once again, all scores are above 50. The top-bottom spread remains narrow at only 10 points, which reflects high sector correlations (i.e., broad risk-on buying). It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold.

4. Looking at the Bear scores, Energy displays the highest (i.e., best) score of 50, which means that stocks within this sector have been the preferred safe havens (relatively speaking) on weak market days. Telecom and Industrial share the lowest score of 41. The top-bottom spread remains a narrow 9 points, which reflects high sector correlations on particularly weak market days (i.e., broad risk-off selling). Ideally, certain sectors will hold up relatively well while others are selling off. Again, it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Healthcare displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. Looking at just the Bull/Bear combination, Consumer Services (Discretionary/Cyclical) is the strongest, followed by Financial and Healthcare, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Telecom scores the worst.

6. Overall, this week’s fundamentals-based Outlook rankings still look mostly bullish to me, with five of the top six economically-sensitive or all-weather and showing the top Bull scores (above 60). Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), retains a neutral bias and suggests holding Healthcare, Technology, and Financial in that order. (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is between its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs from the Healthcare, Technology, and Financial sectors include Market Vectors Biotech ETF (BBH), First Trust NASDAQ Technology Dividend Index Fund (TDIV), and PowerShares KBW High Dividend Yield Financial Portfolio (KBWD).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Healthcare, Technology, and Financial sectors include United Therapeutics (UTHR), Celgene (CELG), NICE Systems (NICE), DST Systems (DST), Starwood Property Trust (STWD), and The Blackstone Group (BX). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to maintain a bullish bias, the Sector Rotation model suggests holding Financial, Healthcare, and Technology, in that order. But if you prefer a defensive stance on the market, the model suggests holding Healthcare, Energy, and Consumer Services (Discretionary/Cyclical), in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted — but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!