Courtesy of Scott Martindale, Senior Managing Director, Sabrient

But the big story is Apple. This amazing company once again has shown us why it is such a market leader in so many ways, e.g., innovation, branding, service, customer loyalty, value…and of course, stock performance. Sabrient continues to carry a Strong Buy rating on it, with a perfect Growth Score of 100. Apple more than doubled earnings on a huge revenue increase and higher gross margins. After closing Tuesday at $376.85, price jumped afterhours on the news to above $400, and today it settled at $386.90. It is now up about 20% year to date. Goldman Sachs immediately upped its 12-month price projection to $525. Suddenly, AAPL is not only a growth stock but maybe a value stock as well.

Another market catalyst this week is the “Gang of Six” Senators, led by Democrat Mark Warner and Republican Saxby Chambliss, who have proposed a bi-partisan debt reduction proposal to address the imminent debt ceiling problem. It seems to be getting some traction.

The combined impact of strong corporate earnings and the Gang of Six has been a market catalyst. Gold hit a new all-time high on Monday, but is now consolidating a bit as investors wonder whether a flight to safety is necessary. And the dollar has fallen back into the lower end of its tight trading range.

Let’s look at the SPY chart. It made a double-bottom in June at the 200-day moving average followed by a textbook rise back to the upper Bollinger Band (and beyond) in an impressive 8-day rally. It then took the next 7 days to consolidated gains within what I saw as a developing bull flag (or pennant) pattern, culminating in two bullish hammer candlesticks on Friday and Monday. Although it lost support at the convergence of 132 (prior support) and the 50- and 100-day simple moving averages, the lower trend line of the bull flag held, and we got the upside resolution that I expected – with surprising power. Today (Wednesday) was basically a low-volume consolidation of Tuesday’s gains, without much profit-taking.

The TED spread (i.e., indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) closed at 23.78, which is back inside its recent 20-25 trading range. Last week, it appeared to be breaking out through resistance at 25, which was an indication of elevated levels of fear, but it has now fallen back. Similarly, the CBOE market volatility index (VIX) tested resistance around 22 before falling back to close at 19.09 today.

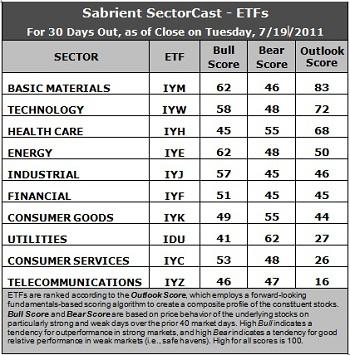

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Not much change in the rankings this week. Here are some observations in Sabrient’s SectorCast scores this week.

1. Basic Materials (IYM) and Technology (IYW) are still the leaders, ahead of Healthcare (IYH). Stocks within IYW saw a slight reduction in relative analyst activity, but it was quiet overall ahead of this week’s big earnings announcements. On the other hand, stocks within IYM got more of a lift from their analysts.

2. Financial (IYF) remains moribund in both the rankings and in actual performance. It is the only sector that is still below all of its major daily moving averages, even though it carries the best aggregate projected P/E, which reflects favorable valuations at current levels. Investors appear to be unconvinced as analysts continue to downgrade forward estimates.

3. Healthcare (IYH) remains in third place, but its recent lackluster performance might be due to uncertainty around how much of the Federal spending cuts will be placed upon this sector.

4. Utilities (IDU) and Telecom (IYZ) remain near the bottom as they receive little enthusiasm among analysts and relatively high projected P/E (unfavorable valuations).

5. Although its overall Outlook score is modest, Consumer Services (IYC) continues to get the bulk of the analyst upgrades and still sports one of the highest projected long-term growth rates. It is held back primarily by the worst return on sales (poor margins) and a high projected P/E.

6. Overall, the Outlook rankings seem to be stabilizing in a “something less than cautiously bullish” stance, with Tech still highly ranked but falling a bit, and Industrial, Financial, and Consumer Services all below the midpoint 50 score.

7. Looking at the Bull scores, Basic Materials (IYM) and Energy (IYE) are clearly the leaders on strong market days with a score of 62 each. Utilities (IDU) is the weakest with a 41.

8. As for the Bear scores, Utilities (IDU) is the clear investor favorite on weak market days with a score of 62, followed by Healthcare (IYH) and Consumer Goods (IYK) as the only other sectors above 50. Basic Materials (IYM), which has the best Bull score, has been a laggard on weak market days along with Financial (IYF) and Industrial (IYJ).

Overall, Basic Materials (IYM) displays the best combination of Outlook/Bull/Bear scores. Adding up the three scores gives it a total score of 191. Energy (IYE) continues to have the best combination of Bull/Bear with a total score of 110.

Top ranked stocks in Basic Materials and Technology include Rockwood Holdings (ROC), Yamana Gold (AUY), Cirrus Logic (CRUS), and Apple Inc. (AAPL).

Low ranked stocks in Utilities and Telecom include Clean Energy Fuels (CLNE), Calpine (CPN), SBA Communications (SBAC), and DigitalGlobe Inc. (DGI).

These scores represent the view that the Basic Materials and Technology sectors may be relatively undervalued overall, while Utilities and Telecom sectors may be relatively overvalued, based on our 1-3 month forward look.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.