Oregon Live: More than 220,000 Oregonians who buy their own health insurance are poised to pay higher premiums next year — some of them a lot higher. State regulators on Thursday announced rates for people who aren’t covered by their employers or government programs. And the news is not good.

While some insurers proposed rates similar to or better than this year’s, officials are ordering them to be raised — saying they need to close a sizable gap between what insurers have collected and what they spend on claims.

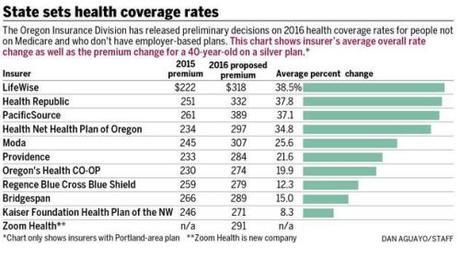

As a result, the least expensive “silver” plan premium available to a 40-year-old next year will run $271 per month under the new rates. That’s up $49 per month over this year’s low rate. Bronze plans offer the least coverage under new federal ratings, and platinum the most.

Those prices are not the last word. About half of Oregonians used the health insurance exchange to buy plans in the individual market, and most of those qualified for federal tax credits averaging almost $200 per month. Also, the rates released by the state won’t become final until after public hearings later this month.

Still, it’s clear that the premium hikes already seen in other states following federal health law changes are finally hitting Oregon. Moda Health, which covers more than 100,000 Oregonians in the individual market, would raise premiums an average of 25.6 percent under the state’s rates.

The rate hikes won’t affect most Oregonians, the majority of whom are covered by employers, Medicare or Medicaid. (Oh goody, just the minority take a financial hit.)

Officials say the rate increases reflect changes to the market due to the federal law commonly known as Obamacare, which kicked in in 2014. More people, including sick people, bought policies in part because insurers were prohibited from denying coverage for preexisting medical conditions. A new tax penalty also encouraged people to buy plans.

While the least expensive catastrophic-coverage plans were all but eliminated by the new law, Oregon did not see the big hikes in 2014 that other states did, and state officials have often boasted that Oregonians enjoyed some the lowest premiums in the nation. But officials now say those premiums were too low.

Insurers’ financial reports for 2014 show medical expenses and other costs far outstripped the amount they collected in premiums, according to the state. Specifically, they spent $830 million on individual plans and collected $703 million in premiums, meaning they tapped reserves for more than $100 million to make up the difference.

This year, many insurers had proposed far lower rates than were set by the state. Zoom Health, a new company, proposed a silver plan premium for 40-year-olds of $233 per month, which would have been a market low. The state proposed the company increase the premium to $291 per month.

Other insurers proposed the increases themselves. Lifewise, which offered the lowest silver rate this year at $222, asked to boost it to $318. The state approved the hike, which is the biggest among individual plans

State Insurance Commissioner Laura Cali said that while her job is to make sure consumers are not overcharged, she also has to ensure rates cover insurers’ costs. Otherwise, predatory pricing could over the long term drive some companies out of the market. She said that Oregon is likely to still enjoy better rates than other states thanks to one of the most competitive markets in the country.

Pat Allen, director of the state Department of Consumer and Business Services, said “We need to ensure a market that long term is stable, competitive and ensures pricing that is much closer to the cost of delivering health care.” The state is holding public hearings June 23-25, and the public can also comment online.

Some insurers still hope to make a stronger case for lower rates. For instance Kaiser Health Plan of the Northwest, which had sought to cut its rates slightly, instead had its rates boosted by about eight percent.

“We appreciate the Division’s efforts to maintain a sustainable health insurance market for Oregon consumers,” said Keith Forrester, a Kaiser vice president. “However, we have confidence that we have priced for long-term stability.”

DCG