Incredibly Pound exchange rates appreciated following the landslide vote held in the house of commons. May’s proposal was unequivocally turned down by the vast majority which will take her firmly back to the drawing board. Investors had clearly guessed correctly and rather than a large depreciation in the Pound the GBP strengthened as sentiment moved towards the more likely outcome of no Brexit and the UK remaining in the EU.

The Prime minister’s defeat has blown Brexit wide open and following the result, the opposition leader Jeremy Corbyn tabled a vote of no confidence. May recently won a vote of confidence from her own party but a parliamentary vote could blow the whole situation wide open, potentially leading to a general election and leadership race for the conservative party. All of which would unsettle the Pound dramatically and delay Brexit well beyond March.

Brexit vote landslide

In order for May to get her Brexit deal passed, she required the support of 320 MP’s in order to proceed with the deal that was agreed with the EU. The vote’s outcome however only highlighted how polarised member of parliament are on the deal and inevitably how little support May’s deal has.

The outcome was profound with only 202 of 432 MP’s voting to support the prime ministers deal. The 230 who opted to vote down the deal making history as the largest ever government loss in the house of commons. Easily surpassing the 166 votes which was set by a minority Labour government in 1924. That particular vote related to whether to cease criminal proceeding against a communist newspaper.

Now May faces a confidence motion which essentially lets MP’s decide whether the government should be allowed to continue. Leading parties then have 14 days to win a further vote of confidence if they are unable to seize a vote of confidence a general election would be triggered. If this was the outcome Brexit and Article 50 would without doubt have to be delayed and revoked as a general election cannot happen for at least 25 working days.

What now for Brexit?

May’s vote being turned down only served to muddy the Brexit waters further. The path that Brexit takes now seems uncertain, the only real certainty would appear to be that Brexit will be delayed. The EU president Juncker already offering an extension to 2022.

Regardless of the ‘meaningful vote’ outcome, the Conservative party remain confident of retaining government; However, if they don’t, leading parties would have the opportunity to scramble to form a government within 14 days. May would resign and a new alternative would be voted in.

If there wasn’t a clear government within the 14 days a general election would be scheduled, and winning party would rehash Brexit. This eventually could lead to a ‘peoples vote’ or a no-deal subject to the victors of either the second confidence vote or a general election.

If May (as the Tories expect) wins the vote of confidence, she would table a ‘plan b’ within a few working days. This plan would be formulated taking into consideration part of the current deal which her party doesn’t accept. This presumably would then be passed for approval to the EU. If the EU acknowledge the very real possibility that the UK may indeed crash out of the union without a deal it might revise its stance. The global economy is cooling, European governments are facing more challenges from right wing parties and Germany the principal contributor to the EU looks like its heading into recession. All of which conclude that the EU would preferably retain its close ties with the UK, especially at a time of potential need.

Whilst the French president has retained his position, clarifying that the Brexit deal wouldn’t be renegotiated, it would seem unlikely that he will receive a second term in power, if he even manages to see out his current one. Macron’s approval ratings have hit rock bottom in recent weeks and despite a rise of 5% he clearly isn’t delivering for many French voters.

If however a new government is formed and they continue to struggle or better the current deal they may opt for a peoples vote. Currently, it remains unclear exactly what Labour might do, with Jeremy Corbyn neither voicing any plans or supporting a second ‘peoples vote’. If he were to trump May and form a government or win a general election the whole Brexit process would potentially be torn up and started again. A scenario which would do little to please UK electorates or likely to be voted for.

Pound rises as traders see more probability of UK remaining

Uncharacteristically the Pound strengthened following the MP’s vote, the rationale behind this is that as each Brexit hurdle becomes unsurmountable the closer the UK comes to remaining in the EU and the less likely the UK is to opting for no-deal. Whilst this currently is the case if May loses a vote of confidence the Pound would almost certainly plummet. The conservative party has no front running replacement and Corbyn would unlikely be able to gain enough support, especially at such a critical time in the UK’s political history.

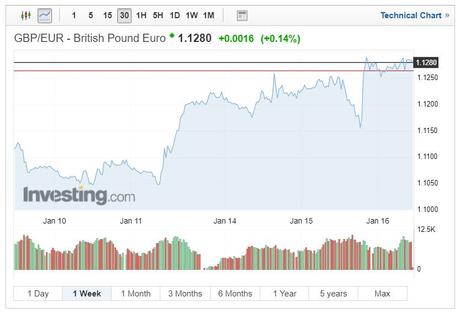

Shortly before the vote the pound was sold of and the Pound – Euro currency pair dropped from a post vote high of 1.1253 and falling to 1.1155, the currency pairs fortune improved after the vote with touching a high of 1.1289.

Pound -Dollar fluctuated just as aggressively rising from an initial tumble to 1.2883. Day trading had seen Pound – Dollar touch a low of 1.2702 with Pound regaining and holding on to its gains after the vote. The next few days will be critical for the Pounds stability. If May retains confidence and tables a valid ‘plan b’ the Pound – Euro pair could easily break 1.15, likewise the Pound -Dollar could approach the 1.30 marker. If parliament elects to challenge the EU’s resolve and take support away from Prime minister May the Pound could be dramatically weakened.