In my previous post on The 10 Years Financial Independence Target, I laid out the strategy to compound our money to reach financial independence in 10 years. The strategy involves having a dividend yield of 6% in the investment portfolio. There are quite a few questions on whether 6% dividend yield is achievable? Also, how do we get that 6% dividend yield?

In my years of investing experience, I've learnt that it is indeed achievable to get 6% dividend yield in our investment portfolio. Over the years, I've learnt to pick some good stocks that have generated on average 6% or more dividend yield for my portfolio. Some of these stocks I've held it for many years and they are still generating stable and good dividends for me. In fact, the dividend yield should increase over the years if its a good stock and of course the price of the stock will increase too.

Here is a glance of some of the stocks which are generating good dividends in my portfolio:

Above are 11 stocks in my portfolio which are generating on average 5% and more dividends. With the exception of Singtel, all other stocks are generating 6%-8% dividend yield for me. Unfortunately, most of the stocks are not giving more than 6% dividend yield based on current price. I bought most of the stocks when the price was significantly lower.

If you've missed the boat, fear not because there will always be an opportunity to buy stocks at lower prices again. When the market is bad, that is the time to buy. But, it is important to pick good stocks so that they can ride out the bad economic situation at that time.

Let me share some tips and what to look out for when identifying companies to buy based solely on my experience to achieve 6% dividend yield.

1. REITs and Business Trusts are good stocks to get dividend income

The first thing you will realise is that REITs and business trust is the answer to get higher dividend yield. As compared to blue chips such as Singtel, DBS or other big companies, the dividend given by REITs and business trust is mostly higher due to the fact that they are income generating assets. They own assets which they rent out to get rental income. REITs also have to give out at least 90% of their income to shareholders in the form of dividend.

2. Sustainability of rental income affects dividend yield

As dividends are given out from the rental income which the REIT or business trust receive, the sustainability of it is important. If you invest in a retail REIT such as Capitamall or Suntec, the retail sales, traffic flow and the positions of the malls will affect its rental income. Economic changes will also affect its rental income.

For example, there has been discussions that retail sales will be affected due to the emergence of online shopping. If lesser people shop at the stores, the stores will have lesser income and thus may not want to renew their lease. If the shop space is left empty, then rental income will be affected.

The location of the malls is also important when it comes to sustainability of rental income for retail REITs. For example, Frasers centrepoint trust has malls which are located in sub urban areas such as Woodlands causeway point, Yishun North Point etc. The malls are also mostly located next to MRT stations. This brings a lot of shopper traffic to their malls and thus they are able to attract better tenants who are willing to pay more rental.

Other REITs such as commercial REITs, hospitality REITs and logistics REITs will also have factors affecting its rental income. Commercial REITs rental income is affected mostly by economic market conditions, hospitality REITs are affected by the number of tourists who come and stay in Singapore or the supply of new hotels and logistics REITs are affected by economic market conditions also. This is just a general statement but if we really want to dive deeper, there are lots of factors for each REIT to talk about.

Master lease is another factor to look at for sustainability of rental income. Starhill global reit which owns Ngee Ann City has master lease with Toshin which owns Takashimaya in the mall itself. This has contributed to stable income for the REIT as there is certainty that the tenant will continue to pay its rental income under the lease contract.

3. Is the REIT able to generate higher rental income progressively?

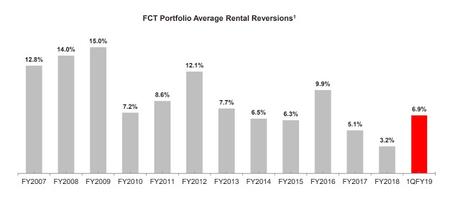

Besides the sustainability of the rental income, we should also look at REITs and business trust which can generate higher rental income. This is called rental reversion. Lease of the tenants do expire according to their contract. When the lease expires, tenants may renew their lease with the REIT or business trust. Good REITs will be able to generate positive rental reversion for many years. An example of this REIT is Frasers Centrepoint Trust. They have managed to generate positive rental reversion since 2007. This is 12 years and going strong. Rental reversion is the metric that shows whether new leases that were signed have higher or lower rental rates than before.

Another way the REIT can generate more rental income is through yield accretive acquisition and Asset Enhancement Initiatives (AEI). REITs will often look out for good properties to take over. A recent big acquisition is by Frasers Centrepoint Trust where they took a major stake in PGIM Real estate AsiaRetail Fund which owns the Asiamalls in Singapore. Frasers Centrepoint Trust also did an AEI few years back where they expanded North Point in Yishun and this has resulted in higher rental income due to more space which they can rent out.

For commercial REITs such as Capitaland Commercial Trust, they did a series of yield accretive acquisition such as acquiring Asia square tower 2 and they are doing AEI on Raffles City which will increase their rental income. Hospitality trust such as Far East Hospitality is expanding with its newly built Outpost hotel Sentosa opening this month. This will add to its income which it gets from its hotel rooms and also events management revenue.

4. Make a trip down to the REIT's property

We should make a trip down to the REITs we invest in especially those that are in our home country. Having a look and feel of the human traffic, business activity of the property itself can tell a lot about whether its a good investment.

For retail REITs, most likely we would have visited before so what makes the malls stand out from the rest of its competitor? Some retail REITs are smart enough to take advantage of the rise of ecommerce such as Capitaland Mall is opening the new Funan mall in June 2019 with drive through click-and-collect and hands-free shopping service, where shoppers can choose to either pick up their purchases at Funan's concierge when they are done, or have their shopping bags delivered to their homes.

For hospitality REITs, we can make a trip down or read the reviews on online websites such as booking.com or TripAdvisor. The reviews can tell a lot about its business activities.

For commercial and industrial REITs, it gets a little more tricky as we can't really visit these commercial offices or industrial buildings. But, we can still look at reports to gauge the occupancy and business activities. For this kind of REITs, most of the time they are more affected by economic cycles so its important to know what is going on around the world. Reports from CBRE are good sources of information to read more on commercial property activities.

Buying REITs is like buying properties. When I invest in REITs, I will make sure I buy it at a reasonable price. You can see whether the price is reasonable by looking at the NAV or the dividend yield. The NAV is the net asset value which is the net value of all its assets (mostly properties for REITs). The dividend yield will tell you how much rental income you are getting and whether its worth the investment.

For example, when we buy a physical property for investment, we will also look at the location, then the reasonableness of the price (whether its below or above valuation) and then we will look at how much rental income we will get. Taking the rental income divided by the price we pay, we will get the % return. When investing in REITs, we should approach it like buying a real property also and most of the time this will make sure we get good value out of our investments.

It takes patience to get good value on our investments. Some of the REITs I waited a few years before I finally invested in it. When the price is right, I will know at that time because I've been reading up and researching all along.

In Summary

From my own personal experience, investing in REITs and business trust has been a rewarding experience. While waiting for the REIT to continue growing, I get dividends over the years to have some certainty on the return on investment in my portfolio. Even if the REIT does not do well later, the loss will be cushioned by the dividends we received.

Within the investment, I also buy and sell the REIT along the way to take some profit when it goes up and buy again when the price goes lower. 6% dividend yield and return on investment is possible and I've managed to achieve this consistently over the past few years. There are ups and downs over the years but the overall % return should still be there. Hope this post has helped you to get some insights on how to achieve 6% dividend yield in your investment portfolio.