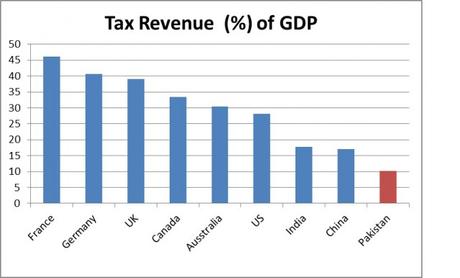

Pakistan collects far less tax (as a percentage of GDP) than most countries. So far the PML(N) government has not been able to significantly increase the tax ratio. (Chart: Dawn)

The Pakistan Muslim League (Nawaz) (PML (N)) government is completing its second year in power on May 11, 2015. It is astonishing to observe that the accountability process for democratically elected government has improved significantly.

Under a CIPE grant, the first such public accountability process was initiated by Policy Research Institute for Market Economy (PRIME), an independent think tank based in Islamabad. PRIME started a simple exercise by taking concrete promises from PMLN’s economic platform and, through a scientifically designed scoring process, monitoring the government’s performance under three key sections: Economic Revival, Energy Security, and Social Protection. These sections were further divided into 82 sub-categories.

The report is widely accepted as an unbiased measure of the government’s performance. The report received significant coverage in local media, both print and television. PRIME Executive Director Ali Salman suggests that “IMF Staff Mission assessment of Pakistan’s economic situation and reforms have many agreements with PRIME’s Tracking Report.”

The accountability process has recently moved to the next level, as the government’s Standing Committee on Finance publically accused the PML (N) government of making decisions on taxation measures in isolation, without taking the Standing Committee in confidence.

“It is the collective wisdom of the committee that the government should take the standing committee into confidence beforehand,” stated Said Omar Ayub of PML (N), the head the Standing Committee on Finance. The committee recommended that the government bring all tax-related matters in the plenary session of the National Assembly for approval – or at least take the committee into confidence before publically declaring new measures.

Another PML (N) minister, Qaiser Ahmad Sheikh, said, “The government has misused the powers of levying taxes through Statutory Regulatory Orders. He said these powers were only meant for emergency purposes but the government was frequently using them.”

PRIME’s most recent report suggests that “The PML (N), in its economic platform, stressed the need for improving tax collection and tax administration by bringing the informal economy into the tax net, taxing all income, and reducing the number of taxes. However, the excessive build-up of circular debt, GST [General Sales Tax] on petroleum products, and poor investor confidence can be termed as negatives and are hampering the growth of economy.”

Not enough concrete steps taken towards taxation reforms in the country. Perhaps the next step for the Standing Committee on Finance is to embark upon an extensive tax reform initiative in the country.

Hammad Siddiqui is Deputy Country Director for CIPE Pakistan.