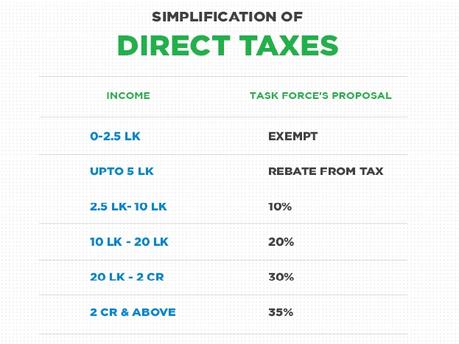

The government panel has suggested that the people earning between 5 to 10 lakhs will pay 10% tax. Whereas the people earning more than 20 lakhs will pay 20% tax. The government panel suggested the tax according to the people's income.

The task force has also proposed a tax bracket of 35% to all those who are earning more than 2 crores. This means that all the super-rich people earning more than 2 crores per year will pay a 35% tax.

The tax force has proposed radical changes in the personal income tax slab. According to the recommendations, the tax force has lowered the personal income tax. The tax force charged taxes on people on basis of their income.

Currently, the personal income is taxed at 5% for people earning between 2.5 to 5 lakhs. Whereas it was 20% for the people earning 5 lakhs and 30% for the people earning 10 lakhs per year. Therefore, 35% of tax is imposed on people earning more than 35%. With the help of sources, we found that the panel has suggested five tax brackets of 5%, 10%, 20%, 30%, and 35%. These are the tax brackets that are suggested against the prevailing structure of 5%, 20%, and 30%.

But now the panel had made a suggestion that all those earning 5 lakhs will rebate from the taxes. This means that the people earning 5 lakhs per year will be charged with 0% tax. The panel also suggested that people earning between 20 lakhs to 2 crores will pay 30% tax. Whereas the people earning more will be charged with a 35% tax.

This is the recent information that we got from the tax panel. To know more, stay updated regularly with our page.