No, it’s worse than that, they are running what is effectively an infomercial for higher oil prices. In the course of watching CNBC for 8 hours yesterday, I counted well over a dozen times when CNBC commentators mentioned that the removal of 30Mb of oil from the Strategic Petroleum Reserve had no effect on the price of oil and, in fact, that prices were now higher than before Obama announced the oil would be released. Seems like a compelling case for tight oil supplies, right?

Well, maybe right if CNBC was not LYING. While oil has been PLEDGED to be released from the SPR – NONE has been released so far. That’s right – not 30 Million barrels as CNBC says, not 15M, not 5M – NONE, ZERO, not any… Is it possible that CNBC is simply grossly incompetent and just has their facts mixed up – every hour on the hour without one single guest saying anything other than the opposite of the truth? Perhaps – they are, in fact, extremely incompetent news people – but I think this goes a little beyond that. I’ll report and you can decide.

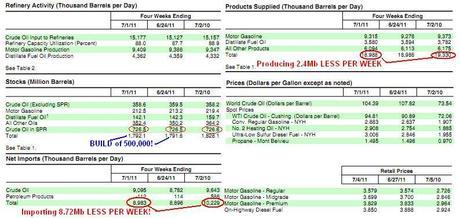

Here’s yesterday’s EIA report – which CNBC has, incidentally, been reporting as a draw even though, clearly there was a net BUILD of 500,000 barrels for the week. But forget that lie, that’s just the normal BS they throw at unsuspecting viewers each week in their endless quest to jack up the price of crude. Look at the 3 circles on the "Crude Oil in SPR." It doesn’t take a degree in investigative journalism to determine that NO OIL has been removed from the SPR at all. This is the OPPOSITE of what CNBC is saying. That is, I believe, a lie.

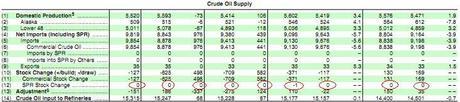

Now, in the interest of giving CNBC the benefit of the doubt – in order to try to assume they are not engaged in a scam where they work with speculators to inflate the price of oil by making up stories, exaggerating or outright lying about critical energy reports or just generally maintaining a state of fear among their viewers as they sucker retail buyers into overpaying for what is, in fact, a readily available, easy and cheap to extract commodity – I will go deeper into the report, where it specifically looks at the SPR stock changes:

Nope, turns out they are evil, lying, manipulative bastards after all – who’d have thought? In the UK, they are cracking down on Mr. Murdoch’s News of the World for hacking phones and bribing government officials – victory was declared for the people as News Corp is shutting down the paper immediately – why can’t the American people grow a spine and shut down CNBC’s propaganda broadcasts?

By the way, if you want a list of other crooks who are manipulating the market, check out this list of bidders who bought the oil from the SPR FOR AN AVERAGE OF $107.20, which was $25 OVER the spot price of oil that day! Barclay’s Bank took 200,000 barrels, BP bought 500,000 and plans to put them in a ship, Conoco Bought 2M barrels, also destined for a ship. Exxon bought 1.51Mb, JP Morgan is taking 1.5Mb and loading it on a ship and Shell is putting 3Mb on a ship and another 150,000 in a barge but will take 500,000 by pipeline so at least SOME of the SPR oil will actually go on the market.

Yesterday, they reported a 1.1 Million barrel net draw of our nations’ 359 Million barrel commercial stockpile and oil flew from $97 at the NYMEX open to $99.42 at 10:50, which was actually 10 minutes BEFORE the inventories because, of course, the NYMEX traders knew the fix was in because, as I pointed out above, not only was no oil actually removed from the SPR but that we were shorted 8.9 Million barrels of imports compared to the same week last year.

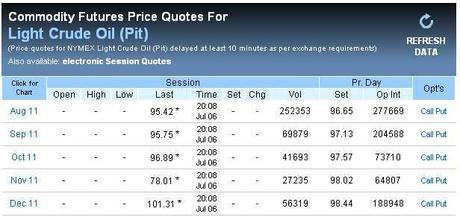

Now it’s crunch time and the August oil futures (/CLQ11) finish trading on the 20th, so just 9 trading days for the NYMEX traders to roll about 240,000 of those 277,000 open August contracts they don’t really want over to the 204,000 open September contracts that they won’t want either. Notice they have a little problem coming up when they bump into the log-jam of 188,000 alread-open December contracts so we have lots of fun ahead of us playing with the NYMEX boyz.

We also have the USO Aug $38 puts at $1.20 in our $25KP (now $50K and rising) along with various other short plays that should have us well along the road to $100K, which is our goal for the 2nd half of the year – congrats to those who had faith in reality – we just got a big dose of it!

Not to many reasons to go bottom-fishing today. The Dollar will be smacked back down to yesterday’s low as this kind of jobs number puts QE3 back on the table. I still don’t think the Dollar gets below 75 and that can be double bad news for stocks if it begins to rally back off that line during trading hours as we’re probably going to open down 1% but there isn’t much support all the way back to our 1.25% lines (see yesterday’s chart) once we fail the 2.5% lines on our major indexes.

We took a lot of aggressive short plays yesterday (as well as earlier in the week) so – Wheeeeeeeeeeee! is the word of the day for PSW Members. Our SODA short was already looking good and now we’ll see if the other Momo stocks join it on the downside – as I said, when you play in a technical market, don’t be surprised when it suddenly turns out you have no fundamental support at all once the data comes out.

As I have been saying: Once local government debts, costs of re-capitalizing state-owned banks, bonds issued by state-owned banks, and railway bonds are included, China’s total debt amounts to 70 to 80 percent of GDP, roughly the level of public debt in the United States and the United Kingdom. Since most of China’s debt has been borrowed in the last decade, China is on an unsustainable trajectory at the current rate of debt accumulation, particularly when economic growth slows down, as it’s expected to do in the coming decade.

Weakness in second-quarter manufacturing production largely contributed to the slowest rate of growth in emerging markets in two years, according to a study released Thursday. The HSBC Emerging Market Index came in at 54.2 for the second quarter, down from 55.0 in the first quarter, HSBC said in its quarterly assessment of purchasing-managers indexes in 16 countries. The current reading is below the long-run series average of 54.8.

We’ll see how this all plays out, if our 2.5% levels hold on this poor news, it’s going to be hard to stay convicted on the short side over the weekend so let’s be careful out there.

Have a great weekend,

- Phil