Financial Armageddon talk is all across the alternative media. Lax lending that caused the crisis for the banks in 2008 has now been transferred to governments worldwide. Unlimited money printing in the US by the Federal reserve will continue until the economy improves. Commodity prices spiked on this news and will most likely continue to increase in value due to monthly injections of freshly printed money. Boy does it sound like we are screwed.

MUFF is very concerned primarily about inflation. Central banks in Europe, US and Japan are printing money for fun while China is stimulating through a colossal infrastructure spend. Historical monetary events (of stealth default through money printing) does not fill MUFF with confidence we are on the right path to. We do not seem to learn from past mistakes (a generation passes as does the wisdom) when it comes to excessive debt and sound money. In this post MUFF is going to try to summarise four key protection strategies that could work out very well regardless of a Financial Armageddon or severe inflation.

For more information see the following books When Money Dies (2010), Paper Promises (2012) and Financial Armageddon(2007) my previous posts cover how MUFF is investing: MUFF investment challenges and Risk Versus Reward.

In Europe under capitalised banks are basically lying about their assets value they are insolvent. Several PIIGS governments are being forced to pay ever increasing interest on their government bonds whilst bailing out the banks. The ECB is trying all options to bail out countries against the backdrop of a fractured political landscape.

As the ECB cannot buy government bonds outright, get this, it is giving money to the banks, to buy the bonds, and then buying them back from the banks!!!! - complete fraud in my opinion. Supposedly this will be sterlised (printing no new money), who are they trying to fool - the debt is too large, the supposed assets over valued. The debt and interest cannot be fully paid back. The ECB will take significant paper losses equating to an increase in the money supply in the future. More money created dilutes existing money which is now worth considerably less. To whose benefit?

Most "answers" so far have been to "kick the can down the road" - print money instead of dealing with the issue head on greed has created too much un-payable debt. Why does the west not copy Iceland - they defaulted on their debt, brought criminal charges against the people who abused the system and their countries goo will then started again from a new sustainable base. They are thriving again. The benefit of money printing is for debt holders (creditors). The young are enslaved with excess debt while struggling to find a decent job to pay off. The retired and savers are being stiffed by ultra low interest rates and high shadow inflation.

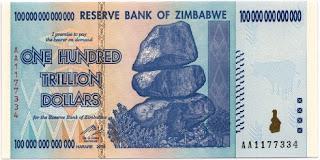

This does not bode well for the generations of the future who have to pay the bill. They also have the possibility of Financial Armageddon to deal with. By this MUFF means hyperinflation leading to mass joblessness and massively reduced living standards.

"Greed is good" - Gordon Gecko, Wall Street

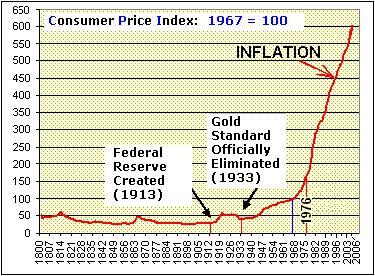

Quantitative Easing (buying government debt using printed money) in the US, Europe, and Japan is all about currency debasement to reduce the value of the debt. They are paying the debt back with less valuable currency. The elite has done everything in its power to maintain this status quo. They ensure that they get their debt repayments instead loosing out as the debt is defaulted to allow society to starting on a new sure footing as in the case of Iceland.

The elites are squeezing the productive middle class worker bee families with inflationary policies. The middle class is the productive class. A self perpetuating spiral of job losses due to destroyed demand and lower living standards. If the vampires that sucks the blood from the middle class victims continue who will be left to serve?

Protection Theme - Scarcity (Precious Metals)

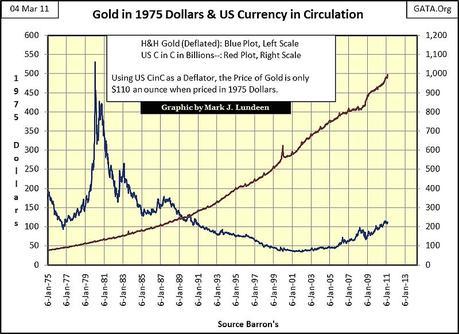

Zimbabwe hyperinflation insanity

MUFF started investing in silver and gold after a house-warming party in 2004. I was discussing investing with an investment banker and he was very bullish on gold in particular. What really turned my head was that one of his colleagues had gone all in - sold the house and the car and put everything into gold bullion. He retired at 45 very rich. This really caught my interest. At this point in time I thought I may have missed the boat. But is wasn't too late for MUFF.On investigating gold and silver there were some really strong arguments to hold a good percentage of wealth in them. The most striking reason at the time was a potential risk of Financial Armageddon which we nearly saw in the summer of 2007. Gold lost value at the time but was (and has been since) the fastest recovering and over performing asset. All of the world currencies are termed "fiat" - they have no backing other than the implicit guarantee of the issuing government. These governments are continuing to dramatically devalue their currencies hence gold has been rising around 20% per year.

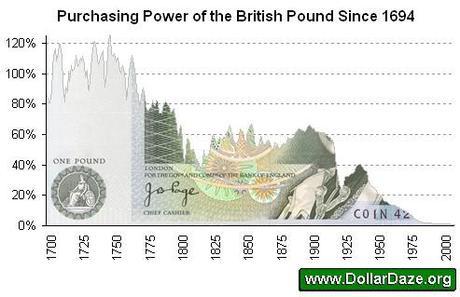

Inflation has taken off since currencies were taken off a commodity standard (gold or silver) |  Inflation adjusted gold is nowhere near the 82 high |

- Years of under-investment meant that increases in gold and silver supply is slow to come to market

- South African gold production is in decline

- Stockpiles of silver were used instead of new mine supply; this has suppressed the silver price and we potentially have a supply deficit now.

- New uses for silver are exploding (solar and water treatment for example as well as medicine and cars, i-pads to name a few)

- Money is being debased (printed) across the world and unsustainable debts in major western economies - Unsustainable debt loads and systematic failure of Europe, US and JAPAN

All of these key demand and supply dynamics point to precious metals as being a good store of value going forward. That's what MUFF and even Mrs MUFF are pursuing.

Key Concept - Find a bull market and ride it to the top

Protection - Finite Resources

The MUFF tribe is happy with its comfortable lifestyle. Safe in our neighborhood (well apart form the riots last summer). Hot water for a shower in the morning. Jump in the car or go on the train somewhere nice. Enjoy a film on our TV at night in a well lit and centrally heated house. Energy greatly improves our lives and makes us happy. I hope a great number of readers of this blog agree that energy is a wonder of modern civilization.

Energy is key to modern civilization as a result many wars have been waged for it. More will take place in the future. Here is a short video on how important some people perceive oil priced in dollars is very important for the US:

MUFF believes that oil and gas were created over a very long time from decaying matter in special circumstances. It is not magically created as some commentators attest to (if so why as we drilling in the North Sea, Gulf of Mexico and now the Arctic?). Energy is a finite resource and we are using it up at faster and faster rates as the world industrializes. In the west I would argue we would pay extra for energy instead of going without so a drastic drop in consumption is unlikely. As energy is getting more difficult to obtain its price will naturally appreciate and stay in line with inflation so in my humble opinion it is an important area to invest in.

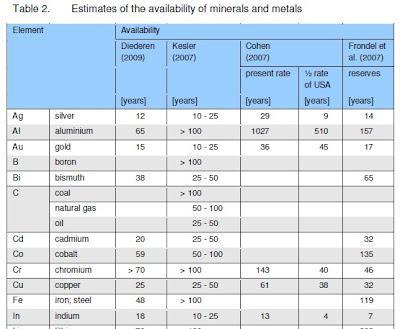

A brief note: Energy is not the only limited natural resource. Indium for example is used in solar panels and has8 years supply left by some calculation and silver 10-12. Access to clean fresh water is a basic human need but is is becoming more scarce as we have a rapidly growing world population.

Key Concept: One planet of resources and we are running out of them

- invest in finite resources.

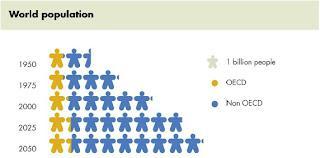

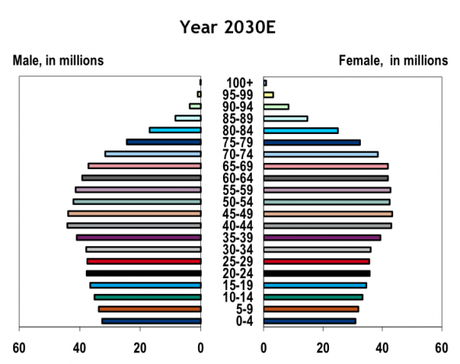

Protection - Demographics

We had a huge increase after the end of world war 2 when all of the servicemen families settled down and started families around 1945. So all of the children born around this time are now beginning to retire. It is well known that retired people change their spending preferences.

Developed World Demographics - very top heavy

Decreased spending habits

- Business spending stops - daily commutes, business clothes

- Downsizing of residence / no need for a new residence - probably have all of the main possessions they require such as furniture, garden equipment etc.

- Reduced calorie consumption - food and alcohol

- Less disposable spending money - new TV's and gadgets

- health care needs

- heating

- care home

Protection - Necessities of Life

We know that items bought now will cost more in the future when measured in paper money. Bread 10 years ago used to be 50 pence a loaf now it is £1.40 a loaf, Petrol has increased from around 70p per liter to £1.30 a liter. Commodities are not increasing in price the medium of exchange (the pound in this case) is loosing purchasing power. So why not buy necessities now while you have some free cash and use them later.

Example consumables to stockpile:

- Razor blades and shaving gel (or even replace with a cut throat razor which you can sharpen yourself...)

- Grains and beans with a long shelf life

- Shower gel, bars of soap, condoms and household cleaners (bicarbonate soda and white vinegar)

- Toilet rolls

- Fuels such as firewood

- Gardening seeds

- Alcohol - Wine (also as an investment)

- Clothing

A common recommendation is to hold 10% of your investments in precious metals (MUFF holds a much higher percentage...50%). Investing in resources and health care comes down to how much you have to invest. A years worth of consumables should only cost a few hundred pounds and if you diversify into long shelf life food this will cost a few hundred pounds more.

We are the ones to take full responsibility for the security of our families. We must be able to provide shelter, warmth, food excess resources should be invested and not squandered on our planet. We can make saving and investment decisions that will protect our individual wealth and hopefully provide the capital to build the key infrastructure of tomorrow. Happy investing!

MUFF

As a semi early retirement extreme dad I recommend some entertainment for the kids - Muffin the Mule

Welcome New MUFF Readers! Take a look around. Start at the first article, browse the all posts or just go for a Random Post

Keep in Touch: RSS Feed, follow MUFF on Twitter or subscribe to posts by email: