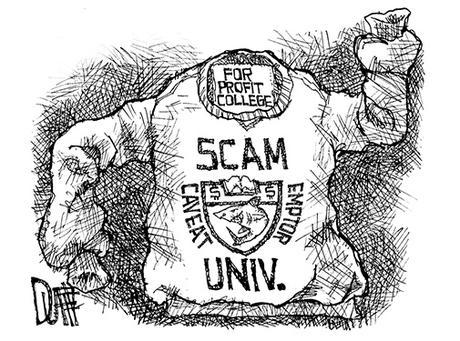

For-profit colleges are a phenomenon that have grown over time and make up the “fastest growing segment of higher education.”[1] While it may seem like a positive occurrence that more people are getting access to a college education, there are serious problems with for-profit colleges, many of which leave student unemployed and jobless, while having fleeced them of extremely large amounts of money.

In order to get a handle on for-profit colleges (FPCs), it would be prudent to examine the history of the institution. FPCs began making headway in the late 1800s, known as commercial colleges, and grew quite quickly. “By 1871, more than 150 commercial colleges were operating across the U.S., and by the early 1890s, estimates went as high as 500.”[2] While such colleges taught a variety of skills, from bookkeeping and stenography to operating mock banks and stock exchanges, success and quality of instruction varied from school to school. “Some schools were reputable establishments offering ‘able commercial lectures and thorough training,’ but others were, as the U. S. commissioner of education put it in 1872, “purely business speculations.”[3]

Like today’s FPCs, commercial colleges back then also aided people who couldn’t get into traditional colleges. Such schools, "played a particularly important role in opening up education to women, people of color, Native Americans, and those with disabilities, especially blind and deaf people.”[4] FPCs continued to have a small stake in the college market accounting for only 0.2 percent of college students in the US in the 1970s.

However, it should be noted that FPCs grew following World War II as federal financial assistance for student increased, especially under the GI Bill and the Higher Education Act of 1972 which allowed for federal funds such as the Pell Grant to be used at for-profit universities.[5]

Yet, there is a serious problem with for-profit universities and federal and state governments as it relates to financial aid. With regards to state aid it was noted in 1999 that FPCs were getting a sliced of state aid as “About half of the states [awarded] some money to students enrolled at for-profit institutions. In New York, for example, nearly 26,000 students at for-profit colleges received about $85-million in need-- based aid from the state's huge assistance programs, which totaled $640-million in 1996-97”[6] and they were actively attempting to get more state aid, arguing that they met all the needed standards and yet weren’t getting increased aid. In the current day, the situation has changed with FPCs being granted state aid and even fighting to keep it[7] in some states while losing it in others.[8]

With federal funds, the problem revolves around Title IV eligibility. Title IV is granted by the Department of Education and requires that the college in question must be accredited by at least one of the department’s approved accrediting agencies, be registered by one of the states, and meet other requirements on a regular basis. In order to get such eligibility, a for-profit school “must either provide training for gainful employment in a recognized occupation or provide a program leading to a baccalaureate degree in the liberal arts.”[9]

The problem is that most currently existing colleges have Title IV eligibility as they make the majority of their funds from federal aid. However, due to that fact, what is occurring is not only an effective subsidizing of FPCs, but also students often get buried under debt due to the high prices of these schools and the universities themselves walk away consequence free.

This situation is made all the worse when one examines the default rates of students who go to for-profit colleges (which are higher than those students who go to non-profit colleges[10]), but also the fact that such universities harm certain groups of people more than others, namely veterans.

An FPC can only receive a maximum of 90 percent of its revenue purely from federal student aid[11], however, that doesn’t “include military educational benefits provided to veterans and active service members, which do not count towards the limit of 90 percent federal Title IV student aid revenues.”[12] Also, it was reported in 2014 that GI Bill funds were going to for-profit colleges that failed state aid standards.[13] So veterans are having their financial futures put in jeopardy by attending for-profit universities.

There are further problems with FPCs when the question of degree completion comes up. It was noted in 2010 that “among first-time, fulltime, bachelor’s degree-seeking students who enroll at for-profit institutions, only 22 percent earn degrees from those institutions within six years. By contrast, students at public and private nonprofit colleges and universities graduate at rates two to three times higher—55 and 65 percent, respectively.”[14] This is compounded by the fact that many student go into massive debt in order to finance their education and creates an even worse situation where they are now burgeoning large amounts of debt and don’t even have a degree to show for it. This results in students having higher default rates than their peers who go to non-profit colleges.[15]

However, all of this shouldn’t be surprising as FPCs run themselves like businesses. They are for-profit after all. A 2012 Senate investigation found that “many for-profit colleges set and raise tuition based on the internal financial projections of the company, rather than the cost of educating students.” Two major examples of this are that

The [CFO] of National American University emailed senior executives and campus presidents that ‘the university (as a system) was not successful in achieving its summer quarter profit expectations and ‘as a result’ a mid-year tuition increase’ and change in how the company bills students was necessary to hit these expectations.

In 2008 Westwood conducted pricing experiments to see if reducing tuition could increase revenue by attracting more students. An internal presentation showed that the company reduced tuition for a small number of its programs, but determined that the reduction had ‘no discernible impact’ on recruitment. As a result, the presentation recommended a tuition increase between 3.5 and 4 percent for the following year.[16]

For-profit universities also mislead students, such as with Heald College which “misled students and accreditation agencies about graduates’ employment rates.”[17] There are also racial aspects that aren’t much talked about. Specifically, many Black and Latino students go to FPCs as they are unable to get into more traditional colleges due to barriers such as cost, resulting in, for example, a disproportionate number of Black students winding up in for-profit universities.[18]

Finally, even if students do get a degree, it likely doesn’t mean much as employers have low views of for-profit colleges. CNN noted the story of Rosalyn Harris, a unemployed 23-year old single mother who enrolled in a for-profit university in an attempt to get a criminal justice degree, however, “all she ended up with was more than $22,000 in student loan debt. She said classes were terrible, she didn't receive any of the training she needed, and as a result, she spent months after graduation searching for criminal justice jobs without ever getting a call back.”[19]

The Center for Analysis of Postsecondary Education and Employment did a study in October 2014 which showed that “Employers are less likely to call back job applicants with business degrees from online, for-profit colleges than those with degrees from nonselective public universities”[20] while another study found that “Employers treated people with high school diplomas and coursework at for-profit colleges equivalently.”[21] Thus, going to a for-profit institution is an endeavor which will leave an individual much worse off than they already were.

With the success of the Corinthian College debt strike[22], possibly more students at these colleges will organize and fight back against the ruining of their futures. Yet, the best advice would be to not go at all.

Endnotes

1: Eduardo Porter, “The Bane and Boon of For-Profit Colleges,” New York Times, February 25, 2014 (http://www.nytimes.com/2014/02/26/business/economy/the-bane-and-the-boon-of-for-profit-colleges.html)

2: Caitlin Rosenthal, “The Long and Controversial History of For-Profit Colleges,” Bloomberg View, October 25, 2012 (http://www.bloombergview.com/articles/2012-10-25/the-long-and-controversial-history-of-for-profit-colleges)

3: Ibid

4: Emily Hanford, A Brief History of For-Profit Education in the United States, American Radioworks, http://americanradioworks.publicradio.org/features/tomorrows-college/phoenix/history-of-for-profit-higher-education.html

5: Daniel L. Bennett, Adam R. Lucchesi, and Richard K. Vedder, For-Profit Higher Education: Growth, Innovation, and Regulation, Center for College Affordability and Productivity (July 2010), pg 9

6: Jeffrey Selingo, “For-Profit Colleges Aim to Take a Share of State Financial Aid Funds,” The Chronicle of Higher Education, September 24, 1999

7: Tim Post, “For-Profit Colleges Fight Effort To Ban State Aid To Students,” Michigan Public Radio News, March 25, 2009 (http://www.mprnews.org/story/2009/03/25/for_profit_schools_loans)

8: Judy Lin, “Most California For-Profit Colleges Lose State Grants,” San Jose Mercury News, August 1, 2012 (http://www.mercurynews.com/ci_21208286/most-california-profit-colleges-lose-state-grants)

9: David J. Deming, Claudia Goldin and Lawrence F. Katz, “The For-Profit Postsecondary School Sector: Nimble Critters or Agile Predators,” The Journal of Economic Perspectives 26:1 (Winter 2012), pg 145

10: Steven Salzberg, “For-Profit Colleges Encourage Huge Student Debt,” Forbes, July 12, 2015 (http://www.forbes.com/sites/stevensalzberg/2015/07/12/for-profit-colleges-encourage-huge-student-debt/)

11: FinAid, 90/10 Rule, http://www.finaid.org/loans/90-10-rule.phtml

12: Bennett, Lucchesi, Vedder, pg 150

13: Aaron Glantz, GI Bill Funds Flow To For-Profit Colleges That Fail State Aid Standards, The Center for Investigative Reporting, http://cironline.org/reports/gi-bill-funds-flow-profit-colleges-fail-state-aid-standards-6477 (June 28, 2014)

14: Jose L. Cruz, Jennifer Engle, Mamie Lynch, Subprime Opportunity: The Unfulfilled Promise of For-Profit Colleges and Universities, The Education Trust (November 2010), pg 3

15: Clive R. Belfield, “Student Loans and Repayment Rates: The For-profit Colleges,” Research in Higher Education 54:1 (February 2013), pgs 18, 26

16: U.S. Senate, Senate, Committee on Health, Education, Labor, and Pensions, For Profit Higher Education: The Failure to Safeguard the Federal Investment and Ensure Student Success, 112th Congress, 2nd Session, July 30, 2012 (Washington D.C.: GPO, 2012) pg 42

17: Shahien Nasiripur, “Heald College Fined For Misleading Students About Job Prospects,” Huffington Post, April 14, 2015 (http://www.huffingtonpost.com/2015/04/14/heald-college-fine-jobs_n_7067056.html)

18: Hannah Appel, Astra Taylor, “Subprime Students: How For-Profit Universities Make a Killing By Exploiting College Dreams,” Mother Jones, September 23, 2014 (http://www.motherjones.com/politics/2014/09/for-profit-university-subprime-student-poor-minority)

19: Blake Ellis, “My College Degree Is Worthless,” CNN, November 2, 2014 (http://money.cnn.com/2014/11/02/pf/college/for-profit-college-degree/)

20: Capsee, Employers Value For-Profit Degrees Less, New Study Finds, The Center for Analysis of Postsecondary Education and Employment, http://capseecenter.org/employers-value-for-profit-degrees-less/ (October 6, 2014)

21: Lisa Wade, “In Many Employers’ Eyes, For-Profit Colleges Are Equivalent to High School,” Pacific Standard, September 3, 2014 (http://www.psmag.com/business-economics/many-employers-eyes-profit-colleges-equivalent-high-school-89940)

22: Tamar Lewin, “Government to Forgive Student Loans at Corinthian Colleges,” New York Times, June 6, 2015 (http://www.nytimes.com/2015/06/09/education/us-to-forgive-federal-loans-of-corinthian-college-students.html)