In about two weeks on June 23, Brits will vote in the EU or Brexit referendum to decide whether the UK should leave or remain in the European Union.

Before they vote, Brits should really heed the information below. If you have family, friends, or acquaintances in the UK, please send this post to them or share on social media.

As described by Simon Black of , some EU countries, such as Belgium and France, have punishingly high tax rates. Belgium's is the highest, where:

- The tax rate is as high as 50% if you earn even a modest income.

- Contributions to Social Security are 13% for employees and 35% for employers.

- 21% Value-Added Tax.

- Businesses are subject to a 30% corporate tax rate, a 3% "crisis surcharge", and a 5% "fairness tax".

- Altogether, the Belgian government's tax revenue eats up about 45% of GDP, which means that the government takes almost half of all economic output.

In contrast, Estonia and Ireland have some of the lowest tax rates in the EU:

- Estonia's profits tax is 0%! And yet the government consistently runs a budget surplus.

- Ireland has had a low-tax regime of just 12.5% on corporate profits for years, and recently announced a new tax regime for certain companies as low as 6.25%. These low tax rates have attracted substantial investment (and jobs) from huge multinational companies, all of which has boosted the Irish economy.

Black observes: "So the Irish government essentially takes a small slice of a rapidly expanding corporate pie, as opposed to Belgium and France's huge slice of a shrinking pie. It's not rocket science. If you create reasonable incentives, businesses will invest, the economy grows, and everyone wins."

But the European Parliament means to put an end to some of its member countries' low tax rates and tax havens through something called a Common Consolidated Corporate Tax Base, which in effect means the governments of EU member states will no longer have control over its tax systems. On May 27, 2016, the European Parliament (of unelected representatives) released details of a tax directive that will create a pan-European tax system, complete with a brand new Tax ID number for every European which, if the EU has its way, would be expanded into a Global Tax ID number for everyone in the world.The proposal ostensibly is to combat "tax avoidance" by multinational corporations - the boogeyman - and to enforce "fairness of tax systems" in the interest of "social justice". But its real purpose is to increase taxes across the board if the EU thinks a member state (like Ireland) doesn't charge "enough" tax.

The tax directive is outlined in Hugues Bayet's " Report on the proposal for a Council directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market," EU Committee on Economic and Monetary Affairs, May 27, 2016. Below are some important measures of the directive (words between quotation marks are from the Report):

(1) The Problem : "In an effort to reduce their global tax liability, cross-border groups of companies have increasingly engaged in shifting profits , often through inflated interest or royalty payments, out of high tax jurisdictions into countries with lower tax regimes. "

(2) Statement of purpose: "If we are to have a reliable single market, the Member States must come to an agreement on tax matters. [...] An OECD study has estimated that aggressive tax optimisation by multinationals causes losses to state budgets all over the world amounting to between USD 100 and 240 billion every year. This represents between 4 and 10% of global corporate tax revenues. Above all, it represents a significant loss of revenue for States, thus reducing their ability to invest in action that would promote employment, combat poverty and develop effective health systems for all. [...] the Commission's proposal as a positive step towards limiting tax evasion by multinationals. [...] The main aim of this report is to ensure that enterprises pay their taxes where they make their profits. [...] The Union believes that combatting fraud, tax evasion and tax avoidance are overriding political priorities, as aggressive tax planning practices are unacceptable from the point of view of the integrity of the internal market and social justice ."

(3) Proposed Solutions:- A single tax rate for all businesses in the EU : "The Commission . . . recognises that a fully-fledged Common Consolidated Corporate Tax Base (CCCTB) , with an appropriate and fair distribution key, would be the genuine 'game changer' in the fight against artificial BEPS strategies. In light of this, the Commission should publish an ambitious proposal for a CCCTB as soon as possible, and the legislative branch to conclude negotiations on that crucial proposal as soon as possible. [...] it is also urgent and necessary to lay down a single set of rules for calculating taxable profits of cross-border companies in the Union by treating corporate groups as a single entity for tax purposes [....] Specific measures are therefore proposed to use this directive as a tool to ensure compliance by current secrecy and low tax jurisdictions with the international push for tax transparency and fairness. [...] The Commission shall develop a common method of calculation of the effective tax rate in each Member State , so as to make it possible to draw up a comparative table of the effective tax rates across the Member States."

- Tax ID number for every European : "Proper identification of taxpayers is essential to effective exchange of information between tax administrations. The creation of a harmonised, common European taxpayer identification number (TIN) would provide the best means for this identification. It would allow any third party to quickly, easily and correctly identify and record TINs in cross-border relations and serve as a basis for effective automatic exchange of information between Member States tax administrations."

- Global Tax ID number : "The Commission should also actively work for the creation of a similar identification number on a global level , such as the Regulatory Oversight Committee's global Legal Entities Identifier (LEI)."

- Black list, with sanctions, to identify countries in EU and in the world with low tax rates : "An Union-wide definition and an exhaustive 'black list' should be drawn up of the tax havens and countries, including those in the Union, which distort competition by ing favourable tax arrangements. The black list should be complemented with a list of sanctions for non-cooperative jurisdictions and for financial institutions that operate within tax havens."

(4) Goal for action : " The Commission shall present a legislative proposal for a harmonised, common European taxpayer identification number by 31 December 2016. "

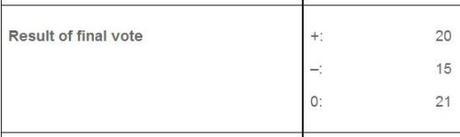

On June 8, 2016, the final vote on the EU's proposal to impose a single tax system on all its member states, as well as a Tax ID number for every European, was:

- 20 + (Yes)

- 15 - (No)

- 21 zero - 0 votes, which probably mean not-present or no-opinion.