The Canadian Dollar fell further this past week upon the release of the latest Canadian jobs data. The Canadian Dollar had stabilised since its last disappointing GDP release and concerns surrounding the Chinese economy.

The CAD-USD has tumbled from a 3 month high seen in late October when the pair touched 0.7663 with the latest jobs data condemning the CAD to further losses.

Canadian jobs data disappoints

Anticipated to show 14700 new jobs created last month Canadian employment change highlighted a reduction of 1800 role in the job market. The decline was caused by further job losses in the private sector making it the third month out of four that the job numbers in the sector have fallen. Manufacturing and construction also fell showing a loss of 23,100 and 21,300.

Jobs in the public sector, however, increased with by 28,700 following a previous upturn in the previous month of 32,600 although many of the roles were on a temporary basis.

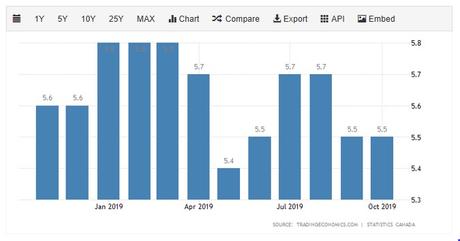

Unemployment in Canada remained steady sitting at a rate of 5.5% down mimicking that of the previous month.

Elsewhere average earnings remained strong with wage growth registering a 4.4% increase year-on-year. The data both highlighting that the jobs market might be reaching capacity and that pressure could be building for the Bank of Canada to cut rates.

Housing data also in decline

Last weeks jobs data was also accompanied by data from Canadian housing starts with a forecast 221,000 estimates new builds to have been developed. The building sector as with new job role creation also missed the target with 202,000 development being created. The decline caused by a slowing on multiple unit homes being built in October.

This week’s economic reports conclusively adding the run of bad data from Canada which has included a weaker trade balance coupled with slower investment growth. All highlighting a slow in demand for commodities and external trade. Especially as the US-China trade deal is far from concluded and demand from the Chinese superpower for commodities continues to wane.

Calls for the BOC to cuts rates

The BOC has remained extremely reluctant to cut Canadian interest rates but in the light of recent data runs may have to consider its position. The governor of the Bank of Canada acknowledged the bank’s lack of manoeuvrability with the governor recently stating

“it’s obvious that none of us has much room to manoeuvre, and some central banks have literally none left. This is when fiscal policy is most powerful and monetary policy is the least powerful”

Therefore, calls for stimulus will continue but many think there is just a moderate chance of a shorter-term rate cut and roughly a 50/50 change before March 2020.

Canadian dollar this week

The Canadian Dollar has declined against a number of currency pairs over the last few weeks with oil prices, poor economic data and the declining demand from China due to the trade war all effecting CAD pricing.

The Canadian Dollar which had enjoyed moderate gains against the USD over the last three months touching a high of 0.7663 but has been unable to hold on to these gains with notable losses occurring following the downbeat GDP data. This week has seen the CAD fall further with the CAD-USD pair falling to a 3-week low of 0.7560 before market close on Friday evening.

The pound has traded inconsistently against the CAD with GBP movement almost solely motivated by the latest election polls and the possibility of the conservatives securing a majority come the 12th of December.

The GBP-CAD have waivered this week with a low of 1.6857 being traded after Mark Carney’s comments on Thursday where the Governor highlighted the lack of UK growth and the ‘injected uncertainty’ that Brexit brings. The GBP/CAD pair closing at 1.6896 following Fridays treading session.

Canadian Dollar – a week ahead

The Canadian Dollar has finished the week with heavy losses against the US Dollar and next week offers very little in terms of economic data for CAD to seize gains. US data has quelled some fears of global recession and there appears to be a real possibility that the US and China could hash out some type of trade deal in the near future. Sentiment remains generally split on whether the CAD can consolidate some of its losses in the coming week, although the monthly sentiment chart indicates that traders believe the pair will remain range-bound.