Bond yields have increased significantly the past few months as central banks all over the world are raising interest rates. Banks are now offering fixed deposit rates at more than 2% again and another attractive investment which people see are bonds where the yield has increased significantly. The SGS bonds, which are issued by the Singapore government has yields of close to 3% for its 2, 5, 10, 20 and 30 years bond. This is 3x more than then average of 1% just 1 year ago.

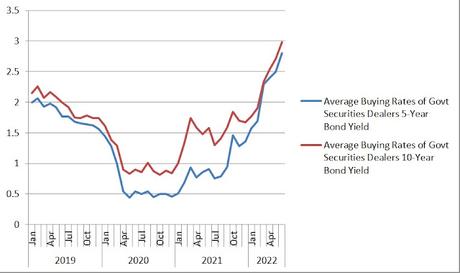

Looking at the chart below of a 5 and 10 year SGS bond, we can see that the yield has increased significantly from 2020 to now which corresponds to the increase in interest rates around the world. Is this a good time to invest into bonds now?

5 and 10 year SGS Bond Yield 2019-2022

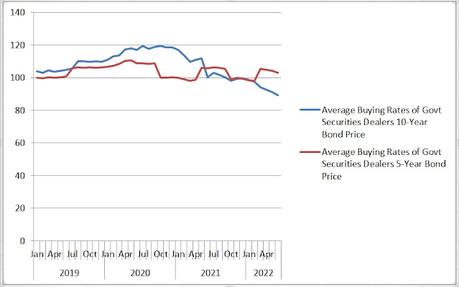

Unfortunately, bonds can be the worse to invest during rising interest rates environment. When you invest into a bond, the yield (coupon) you get is fixed. For example if you invest in a bond with yield of 3% now, this 3% will be given to you regardless if interest rates continue to increase later. The most scary thing is when interest rates continue to increase later, bond prices will drop where you will see a loss in your investment portfolio. When bond yield increases, bond prices will drop as it is inversely correlated. This is evident as seen in the chart below where interest rates rose from 2020 to 2022 while bond prices started to drop from 2020 onwards.

5 and 10 year SGS bond price 2019-2022

If you're planning to sell your bond in the short term, it wouldn't be advisable to invest in bonds now as the US is expected to increase interest rates even more for the rest of this year as what the Fed has announced recently. The Fed just raised another 75 basis points on 28 Jul 22 and has announced that another unusually large hike may come in September 22. This will cause bond yield to go up even more and bond prices to come down significantly.

If you're planning to hold the bond for long term and are buying 5, 10, 20 or 30 years bonds, then it may be a good choice as you get to lock in higher interest rates now and by the time you redeem the bond more than 5 years later, bond prices may have even risen significantly due to interest rates are low again 5 years later. That being said, nobody will be able to predict how long interest rates will stay high or when interest rates will come down.

Bond prices are trading at below 100 now which is lower than its face value and may represent an opportunity for the long term. Once interest rates stabilise and start to fall again, bond prices will go back up to 100 or even above 100 and at that time, investors who bought the bond below its face value will continue to enjoy the locked in high interest rate plus the capital gains from the bond price increase. This is if you're buying a long term bond and willing to hold on to the bond till its value goes back to par.

Rising interest rates present quite a lot of opportunities for savers who have cash on hand to invest in high yielding safe assets. If we know how to take advantage of the opportunities which is presented to us, we will end up better in life in the future.

Enjoyed my articles?You can Subscribe to SG Young Investment by Email or follow me on my Facebook page and get notified about new posts.