Airtel became the first telecom company in India to give a shot in the arm to Prime Minister Narendra Modi's Digital India Mission by launching Airtel Payments Bank earlier this year. Airtel Payments Bank became the first company in India to offer a UPI (Unified Payment Interface) equipped mobile app to its 25 million-plus customers making it easy for them to use banking services without visiting the bank.

Digital India Mission aims at providing Indian citizens with greater connectivity and broader financial freedom. Digital India program was launched to transform India into knowledge economy where every citizen is empowered with social and financial benefits. The Mission envisages to leverage from technological advancement for a better quality of life and greater financial inclusion.

Ever since Digital India Mission was announced, Airtel Payments Bank was in the news. However, terms, facilities, and benefits were unknown.

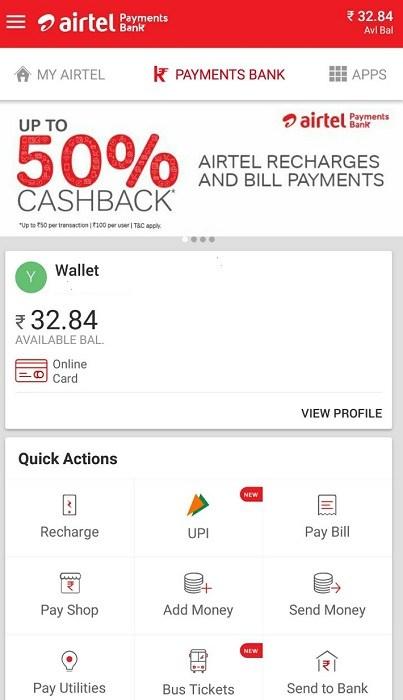

As Airtel Payments Bank started transacting in January this year, facilities and benefits attracted many to increasing popularity of India's first payments bank with integrated Unified Payments Interface (UPI)

Quick Highlights about Airtel Payment Bank -

- No limited duration of working hours

- UPI Integration for cross bank transactions

- Quick transactions at shopping and movie theatres

- Fund transactions at zero percent charges

- Highest security and safety of your precious money

- Airtal Payments Bank offers high-interest rates of 7.25%

Airtel Payments Bank customers can use their smartphone as their bank now without any additional requirement of extensions, such as POS machine or even credit or debit card. Banks usually offer value-added services but have limited duration during the working hours. With Airtel Payments Bank, those restrictions have gone as Airtel payments bank customers can enjoy those banking services now through their app. The Airtel App is your bank for 24*7.

This time Airtel Payments Bank is in the news, with its integration with UPI. As Airtel Payments bank uses the Unified Payments Interface (UPI), it ensures many benefits for Airtel users. The Airtel Payments Bank customer can link his or her My Airtel App with the bank account and can make quick transactions at shopping malls and movie theatres.

For an Airtel Customer (which is a telco consumer) can get a bank account by visiting a Airtel Recharge store and give his or her Aadhaar number | Biometric scan and open a Airtel Payments Bank savings account! He or She can use their savings account by using My Airtel App and then links his or her My Airtel App with the bank account and can make quick transactions at shopping malls and movie theatres.

Airtel Payments Bank app makes it easy for its users to send or receive the funds. This app offers highest security and safety for your fund transfer. Moreover, Airtel Payments Bank facilitates fund transfer at zero percent charges, which was unthinkable in India before. Also, it helps lift all the restrictions regarding fund transfer to the account of any other bank.

Your savings bank account offers maximum 4 percent interest per annum. Comparatively, Airtel Payments Bank not only secures your money in electronic form but also offers a better return. Airtel Payments Bank offers high-interest rates of 7.25% to those who add money to Airtel Payments Bank. This allows the customers to make use of the online application more frequently and conveniently.

Airtel Payments Bank does not require your account details or phone number. Instead, it allows you to create unique UPI ID for all the future transactions. While adding a beneficiary in NEFT system may take 4 to 12 hours for approval, Airtel Payments Bank App adds beneficiaries in no time allowing customers to start transactions. Besides, Airtel customers, unlike other payment banks, can link more than one account to Airtel app.

Not only for the customers, Airtel Payments Bank is nothing less than a blessing for the banks, as it increases the transaction volumes and reduces service charges accrued by the banks. The biggest possible beneficiary of the Airtel Payments Bank is businesses. They receive money instantly without worrying about cash being deposited to banks daily. Moreover, businesses now are spared from investing in payment mechanisms, such as POS machines. Since most of the banks offer free of cost services to the businesses, Airtel Payments Bank is set to increase the number of banking transactions against e-wallet apps.

One of the basic advantages that was focused while announcing the integration was that the 25 million bank customers will now be able to use and make digital payments through their UPI handles both in the online and offline spaces. This will enable more digital transactions as per the vision of digitalization.

The customers will also be able to use the My Airtel App in the bank section to scan their UPI handle with the QR code and make merchant payments. This will let the customers make effortless payments through the Airtel Payments Bank's payment mode. The UPI handle will allow making payments by scanning the UPI OR code while they shop. Above all UPI is all accepted by every merchant that includes, travel payments, insurances, and retail etc.

So, with Airtel Payments Bank becoming the first the greater financial inclusion received an unimaginable boost while customers can enjoy greater financial freedom without worrying about carrying cash or card for their shopping or fun.

Happy Banking with Airtel Payments Bank!! You may also enjoy reading -