The end is nigh!

At least that’s what we keep saying about Big Beer. As craft continues to eat up market share, macro breweries like AB InBev are clawing to try and maintain their hegemonic grip on the world of beer.

But as these Goliaths slowly begin to fall to the ground, they’re putting up a hell of a fight. Take for instance the most recent news out of Anheuser-Busch InBev, which announced this week it had invested $150 million to create a new, 16-ounce, resealable light metal bottle for Bud Light. In an age when beer drinkers are seeking craft beer because of the variety of tastes it provides, AB InBev is the tiger trying to change its stripes. (We’ve seen it before)

Here’s the thing. While sales of Budweiser and Bud Light slump and force AB InBev to look toward new ways of finding interest in their products, the bottom line is doing OK:

Volumes fell by 1.3% during the last quarter, but the company still delivered an increase of 3% in revenue for the period due to raising prices.

The number of units sold is decreasing, but AB InBev is finding new ways to pick up the slack. I kid you not, this is what Paul Chibe, vice president of U.S. marketing for AB InBev, said about plans for their new Bud Light bottle: consumers think the bottle is “more premium, more refreshing.”

And this brings me to my point: parents just don’t understand.

These changes, including the introduction of Bud Light Platinum, Budweiser Black Crown, Lime-A-Rita, Cran-Brrr-Rita and all the other Ritas coming your way (raspberry, mango), are geared toward young beer drinkers. We know this because as the largest segment of craft beer drinkers, the best way for AB InBev to boost sales is to get more Bud or Bud Light into the hands of Millennials (born between 1980 and 1995) as much as possible.

Oddly enough, the hip, party lifestyle portrayed by Budweiser and Bud Light actually plays well – on TV:

“Consumers form a positive impression of the brand from Bud’s TV ads and other marketing, but when they see the product on the shelf, away from the halo of the cool ad or the excitement of the sponsored event, the package does not communicate at the same level, while the beer brands around it are doing it better, “ said Blake Howard, svp of design solutions at Affinnova.

Why is this important? Because I’d bet Bud advertising doesn’t pass the sociological test of younger beer drinkers in a group. Broadly speaking, we know several things:

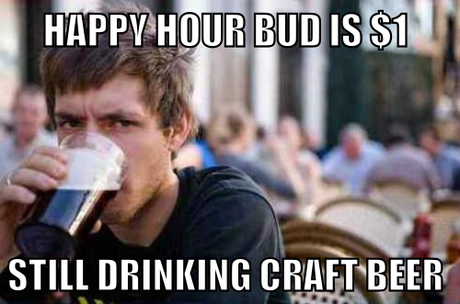

- Millennials love craft beer.

- Millennials love encouraging others in their peer group.

- Millennials trust friends over corporate mouthpieces.

- Millennial beer drinkers (like other age groups) can be subject to groupthink.

Add this up and here’s what you get:

Among nine mass-market beer brands studied, Anheuser-Busch’s Budweiser ranked first for being affordable, confident, energetic, fun, friendly and genuine—before people enter the store. But on the shelf, Bud ranks second to fourth in all those traits, except for genuineness.

The problem Bud and Bud Light have, then, is their image among the most important cohort of beer drinkers. AB InBev brands look good at home or on the go, but not when an actual transaction occurs. As the group that has the longest remaining beer-drinking lifespan (on a legal basis, at least) and a growing amount of purchasing power, Millennials are key for Big Beer.

Which brings me back to the initial problem: Bud and Bud Light can’t change their product. The recipe used for these fledgling brands is built into their history, which is why we get Black Crown, Platinum and more. It’s also why we get changes to packaging instead, as an attempt to skew perception. Fittingly, Millennials probably won’t buy it, literally and figuratively:

How do you get a Millennial to take action on your brand? Perhaps this quote from a 29-year-old male in the U.S. will help: “Focus on making an excellent product. If you do so, then all of your marketing will be true and most of the marketing will be done by us. We are all looking for great products and brands to share with our friends. The best way to help us spread the word is by first creating a great product.”

Which is ironic, because as the iconic brands of Bud and Bud Light have declined, another “low quality” beer, Pabst Blue Ribbon, has been doing just fine, mostly thanks to young beer drinkers. PBR has a small market share (about 3 percent), but sales grew 17.2 percent last year.

So what would happen if instead of effectively changing its clothing, AB InBev went nuclear and actually changed their marketing strategy? Instead of trying to position their core brands (Budweiser, Bud Light) as party beers for the hip, young crowd, what if they began pushing their beer as something classic, cool or hipster-friendly?

Until then, it seems clear that AB InBev is going to market their beers as a party beer for the young crowd when the young crowd just doesn’t want to party with it any more.

Then what’s left? Budweiser is the girl without a date to prom.