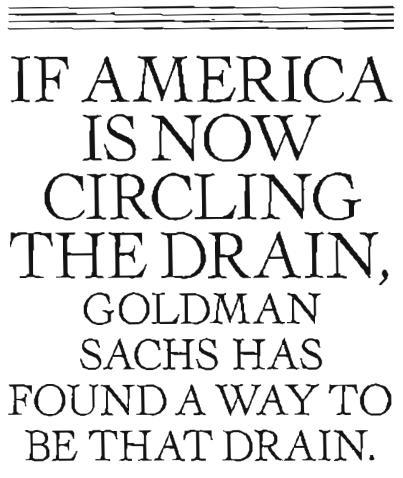

Ironically, some of the "news" outlets that generally carry my articles (who's names shall be protected because they are wimps) decided it was too controversial for their readers so we know that's not a topic we're allowed to discuss in America, for fear of being black-listed. Today we'll see if we can make it a two-fer in the Bracket of Evil, as I have a juicy resignation letter from Greg Smith of Goldman Sachs (thanks Rev Todd), who is not small player but the head of the firm's US Equity Derivative Business in Europe, the Middle East and Africa. Just a couple of excerpts:

I believe I have worked here long enough to understand the trajectory of its culture, its people and its identity. And I can honestly say that the environment now is as toxic and destructive as I have ever seen it. To put the problem in the simplest terms, the interests of the client continue to be sidelined in the way the firm operates and thinks about making money.

What are three quick ways to become a leader? a) Execute on the firm’s “axes,” which is Goldman-speak for persuading your clients to invest in the stocks or other products that we are trying to get rid of because they are not seen as having a lot of potential profit. b) “Hunt Elephants.” In English: get your clients — some of whom are sophisticated, and some of whom aren’t — to trade whatever will bring the biggest profit to Goldman. Call me old-fashioned, but I don’t like selling my clients a product that is wrong for them. c) Find yourself sitting in a seat where your job is to trade any illiquid, opaque product with a three-letter acronym.

I attend derivatives sales meetings where not one single minute is spent asking questions about how we can help clients. It’s purely about how we can make the most possible money off of them. It makes me ill how callously people talk about ripping their clients off. Over the last 12 months I have seen five different managing directors refer to their own clients as “muppets,” sometimes over internal e-mail.

So we established yesterday that you can't trust the MSM and clearly you can't trust your Investment Banker and we KNOW…

So we established yesterday that you can't trust the MSM and clearly you can't trust your Investment Banker and we KNOW…