2,000.02 – We did it!!!

2,000.02 – We did it!!!

Unfortunately, we can't afford to pop the champagne because the 0.03 we spend on it would put us back under – so we'll watch and we'll wait another day before celebrating a milestone we've been expecting since last week (see "Will Jackson Hole Give Us S&P 2,000?") and we went with that TNA trade we discussed in yesterday's post to cover the expected bull run.

We also picked up long plays on BAC and DBA in our Live Member Chat Room and BAC has already rocketed on the settlement news but DBA is only just making the turn and still makes an excellent play that we'll be adding to our Buy List (Members Only) along with 10 more picks we'll be making this week.

As you can see from Dave Fry's SPY chart, we have set a new record for this decade for low volume on a full market day. Last Christmas Eve was 43M on a half day, for example, but the Christmas Eve before that was 53M and those were the lowest two days I could find before I got bored looking (very scientific).

As you can see from Dave Fry's SPY chart, we have set a new record for this decade for low volume on a full market day. Last Christmas Eve was 43M on a half day, for example, but the Christmas Eve before that was 53M and those were the lowest two days I could find before I got bored looking (very scientific).

Anyway, the point is that 38.9M is VERY LOW VOLUME – so low that paying attention to a dot on a chart that is drawn in such a light touch is just silly. That makes yesterday's jaunt over 2,000 completely meaningless and more so with the additional evidence of the intraday action which, as Dave notes, could not have been more manipulated.

This is why we have been pressing our bear bets. Even though we have peace in Gaza and peace in Ukraine (for today) and even though we've forgotten about Europe's negative GDP and China's plunging property prices and Ebola – we still couldn't find more than 38.9M buyers for SPY – that's just sad!

Speaking of China, last Monday, for FREE, right in the morning post, we picked the following on FXI:

Speaking of China, last Monday, for FREE, right in the morning post, we picked the following on FXI:

We shorted India last week (EPI) and now FXI has got my mouth watering as a potentially good short. I'd feel better about taking up a short on FXI at $45, not $42 but the Jan $42/38 bear put spread is just $1.80 on the $4 spread and that makes it very interesting as it pays 122% on a less than 10% decline in the Chinese markets – a nice way to hedge your bullish China bets!

As is often the case, we were a bit ahead of the news and that trade is still about the same net but there's a nice article in Zero Hedge about China's collapsing Industrial Commodities Prices against the background of record inventories that are being stockpiled, unused in warehouses just one month after China's recent massive stimulus injection that took FXI from $38 to $42. You can see why we didn't want to wait, it was already running out of gas last week and soon, the opportunity for the trade may be gone – just a friendly reminder.

Yep, that's a sign of a healthy economy if ever I saw one – NOT!

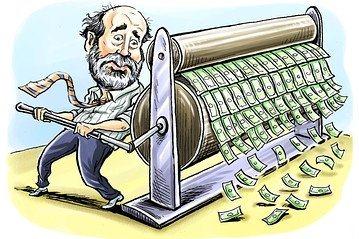

There's a good article from the Mises Institute (damned Austrians!) on "Why Isn't Monetary Pumping Helping the Economy?" that makes a lot of good points that apply to both China and the US, even as Europe embarks on their own printing adventure. Mises pull no punches, stating:

There's a good article from the Mises Institute (damned Austrians!) on "Why Isn't Monetary Pumping Helping the Economy?" that makes a lot of good points that apply to both China and the US, even as Europe embarks on their own printing adventure. Mises pull no punches, stating:

Any policy, which artificially boosts demand, leads to consumption that is not backed up by a previous production of wealth. For instance, monetary pumping that is supposedly aimed at lifting the economy in fact generates activities that cannot support themselves. This means that their existence is only possible by diverting real wealth from wealth generators.

Printing presses set in motion an exchange of nothing for something. Note that a monetary pumping sets a platform for various non-productive or bubble activities — instead of wealth being used to fund the expansion of a wealth generating infrastructure, the monetary pumping channels wealth toward wealth squandering activities.

I was being interviewed on last week on the Austrian(ish) "Financial Survival Network" and we talked about the "failure" of Keynesian Economics but, as I said in the interview, what the Fed is doing is not Keynesian, Keynes wants money to go into Government Spending and Infrastructure – NOT into making low-interest loans to the top 1% so they can buy up all the competition and fire all the "excess" workers – who in their right mind would think that's a good idea?

Tags: Austrian School of Economic philosophy, BAC, CHINA, DBA, Friedrich von Hayek, FXI, John Maynard Keynes, Keynesian economics, SPY, Stimulus

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!