You call this a correction?

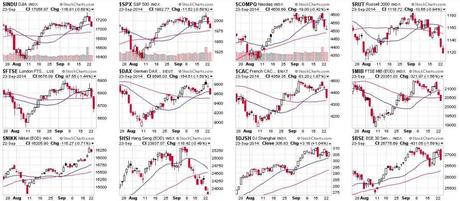

The Nasdaq is down 4%, Russell is down 5%, the Hang Seng is down 6% and the FTSE is down 3.6% but barely a pause from the rest of our Global Indexes. The problem is, it's been so long since we had a proper pullback that people think a tiny little correction is the end of the World. Even in the good old days, before high-frequency trading made a joke out of the market – investors didn't get too upset about a 5% pullback.

That may be the problem as well. The reason the market has marched off to record highs is BECAUSE investors have been led to believe that it's better than bonds, better than cash, even – to have your money in the stock market. We certainly seem to have convinced a lot of Boards of Directors that the best thing to do with their company's money is to buy back their own stock or the stock of their competitors – no matter how ridiculous the price.

That may be the problem as well. The reason the market has marched off to record highs is BECAUSE investors have been led to believe that it's better than bonds, better than cash, even – to have your money in the stock market. We certainly seem to have convinced a lot of Boards of Directors that the best thing to do with their company's money is to buy back their own stock or the stock of their competitors – no matter how ridiculous the price.

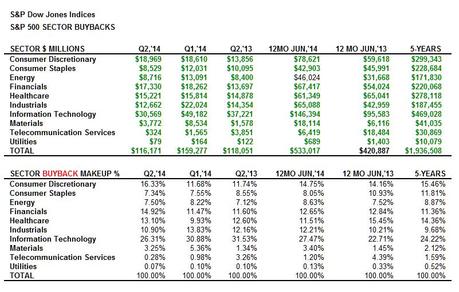

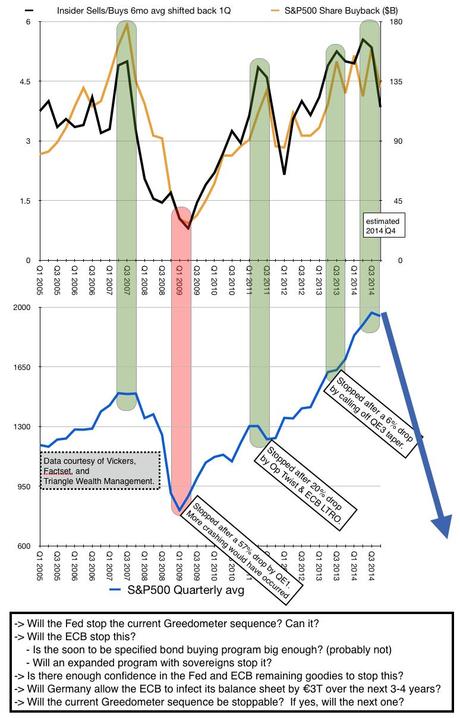

$533Bn of hard-earned Corporate Profits were spent buying just the S&P 500, by the S&P 500, in the past 12 months alone. That's 20% more than all of 2013 ($420Bn) and 30% over the 5-year average and that DOESN'T include M&A activity – also at a record pace. While this has been going on, insiders have been SELLING their company stock at a record pace – Interesting…

$533Bn of hard-earned Corporate Profits were spent buying just the S&P 500, by the S&P 500, in the past 12 months alone. That's 20% more than all of 2013 ($420Bn) and 30% over the 5-year average and that DOESN'T include M&A activity – also at a record pace. While this has been going on, insiders have been SELLING their company stock at a record pace – Interesting…

So the company uses it's profits, not to invest in it's own future but to prop up it's own stock price – making earnings seem better because you are dividing the profits by a lower number of shares than there were last year. This inflates the stock price and the insiders get out and that's when you buy – is that about right?

What a friggin' scam - I can't believe you fell for that! Seriously, that is such an obvious fraud that you would think people would run screaming away from equities. The problem is, there's nowhere to run to, is there. Your cash is being devalued, bonds don't keep up with inflation, real estate is still very iffy and the taxes on it have gone out of control and that leaves good old equites as the only alternative – so of course the market goes up, as long as the money keeps flowing in.

But therein lies the rub: So much of the money flow is based on stimulus from various Central Banks that we have no idea what is going to happen when it stops, let alone when it reverses (assuming they ever decide to fix their balance sheets before the next crisis hits). Perhaps that's why, as you can see from the "Smart Money" chart above, there's been a run for the exits in 2014.

If you think you are smarter than the smart money, by all means, dive right in. We, on the other hand, are still playing it cautious – especially while we still have red boxes on our major bounce lines (see yesterday's Live Member Chat Room for levels), per our 5% Rule™, while the minor bounce lines (for this week) are now:

If you think you are smarter than the smart money, by all means, dive right in. We, on the other hand, are still playing it cautious – especially while we still have red boxes on our major bounce lines (see yesterday's Live Member Chat Room for levels), per our 5% Rule™, while the minor bounce lines (for this week) are now:

- Dow 17,100 (weak) and 17,150 (strong)

- S&P 1,990 (weak) and 1,995 (strong)

- Nasdaq 4,525 (weak) and 4,550 (strong)

- NYSE 10,875 (weak) and 10,950 (strong)

- Russell 1,125 (weak) and 1,135 (strong)

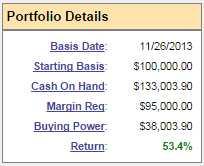

We went over the 5% Rule™ in detail in yesterday's Live Trading Webinar, a replay of which will be available for our Members later today. We also debated whether or not to take the virtual money and run on our Short-Term Porfolio, which finished the day up 53% for the year as our bearish bets finally pay off.

We went over the 5% Rule™ in detail in yesterday's Live Trading Webinar, a replay of which will be available for our Members later today. We also debated whether or not to take the virtual money and run on our Short-Term Porfolio, which finished the day up 53% for the year as our bearish bets finally pay off.

They're not all bearish, of course – we have bullish plays on YHOO (discussed last week), SLW, FAS (hedged) and CAKE but, yes, the rest are bearish but they are bearishly protecting our very bullish (and much larger) Long-Term Portfolio, which is now only up 19.3% for the year at $596,710. That plus the $153,413 in the Short-Term Portfolio gives us a total of $750,123 so it is time to raise our stop from $735,000 to $740,000, locking in a combined 23% gain for the year, even if we're forced to cash into the holidays.

We never fear going to cash at PSW. On the average, we find over 100 Trade Ideas each month for our Members, which is why our LTP is only using 25% of it's buying power – if the market does have a significant downturn, we are ready, willing AND able to take advantage of it.

Until the indexes show us they are capable of taking out those strong bounce lines, we reamain cautiously bullish. We EXPECT at least to see weak bounces off of these levels (up 0.5% today). If not – look out below!

Tags: 5% Rule, Bounce Levels, corporate buybacks, hedging strategies, insider selling, market correction, Money Flow, Smart Portfolio Management, Yahoo!, YHOO

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!