What a wild ride!

What a wild ride!

As you can see from the 6-month SPX chart on the right, we have a serious Spitting Cobra pattern setting up on the S&P and those babies rarely strike upwards. Until and unless we break that upper downslope, every move up is nothing but a head-fake and yesterday's was a doozy as we were goosed by more monetray meddling – this time by Minn Fed Gov Kocherlakota, who said:

Given my current outlook for inflation, I anticipate that, under a goal-oriented approach, the FOMC would not raise the fed funds rate target this year.

That, of course, is all it takes to set off a Global buying frenzy these days. Kochlerakota made his comments around 12:30 and reversed the lovely dip we were making good money on in the morning (see my shorts from yesterday's post). This morning, China has added fuel to the fire with an additional $85Bn stimulus via yet another 0.5% reduction in bank reserve requirements.

That, of course, is all it takes to set off a Global buying frenzy these days. Kochlerakota made his comments around 12:30 and reversed the lovely dip we were making good money on in the morning (see my shorts from yesterday's post). This morning, China has added fuel to the fire with an additional $85Bn stimulus via yet another 0.5% reduction in bank reserve requirements.

Oil also went flying up and the only Futures play that held up all day was Natural Gas (/NG) which ran up from our $2.69 long all the way to $2.77 before pulling back, good for $800 per contract in gains.

While our short Oil Futures (/CL) may have burned us, our long trades on USO and UCO benefitted tremendously as oil ran up almost 10% intra-day and we were able to cash out our leveraged options positions (with almost a perfect call at the top at 2:13pm from our Live Webinar) with 120% gains.

Don't blame me if you missed them, we've been talking about our various longs on oil and oil services all month and just this weekend, in our Top Trade Review, we discussed selling the USO 2016 $22 puts for $5.65 and buying the 2016 $12 calls for $5.75 for a net entry of 0.10. Even if you missed our perfect exit yesterday, the calls closed at $7.95 and the puts closed at $4.30 for net $3.65 – up $3.55 for each dime of cash put into the trade (+3,550%) in just 3 days!

Don't blame me if you missed them, we've been talking about our various longs on oil and oil services all month and just this weekend, in our Top Trade Review, we discussed selling the USO 2016 $22 puts for $5.65 and buying the 2016 $12 calls for $5.75 for a net entry of 0.10. Even if you missed our perfect exit yesterday, the calls closed at $7.95 and the puts closed at $4.30 for net $3.65 – up $3.55 for each dime of cash put into the trade (+3,550%) in just 3 days!

As I was saying yesterday, when we have leveraged plays like this to make, we don't need to bet a lot to make a lot. Let's say you were willing to own 1,000 shares of USO at $22 ($22,000). 10 contracts of that combo would have cost you just $100 in cash and returned $3,650 3 days later – that's 16.5% of your $22,000 commitment in 3 days. That certainly beats money markets, doesn't it?

In fact, all 13 of our Top Trades from the weekend review have done well this week, which probably explains why our LTP/STP combination jumped $13,000 (2%) for the week – even in this choppy market. All this Central Bank meddling makes it hard to get a proper read on the markets and, when in doubt, we defer to our 5% Rule™ to guide us through.

In fact, all 13 of our Top Trades from the weekend review have done well this week, which probably explains why our LTP/STP combination jumped $13,000 (2%) for the week – even in this choppy market. All this Central Bank meddling makes it hard to get a proper read on the markets and, when in doubt, we defer to our 5% Rule™ to guide us through.

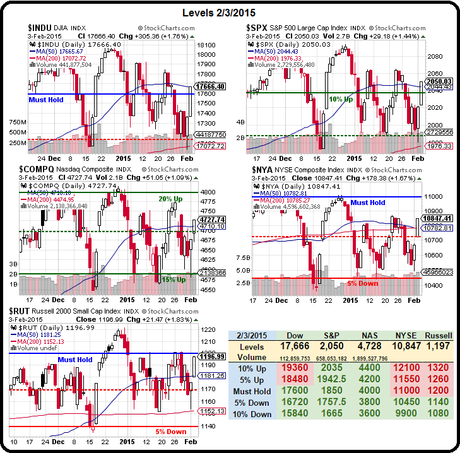

Yesterday, I closed the post by noting that we'd be watching for our Strong Bounce Lines at Dow 17,460, S&P 2,027, Nasdaq 4,656, NYSE 10,670 & Russell 1,185 and, as you can see from the Big Chart, we are over all of them as of yesterday's close. Now all they have to do is hold it for 48 hours and we will be happy to flip more bullish!

Meanwhile, although we're skeptical, we will be adding positions (or bulking up existing ones) in our very bullish Long-Term Portfolio today in our Live Member Chat Room as we don't fight the Fed(s) when they are in the mood to give away MORE FREE MONEY. It's a ridiculous way to invest but, unfortunately, this is the only market we've got so we're going to trade the cards we are dealt.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!