Wheeeee, what a ride!

Wheeeee, what a ride!

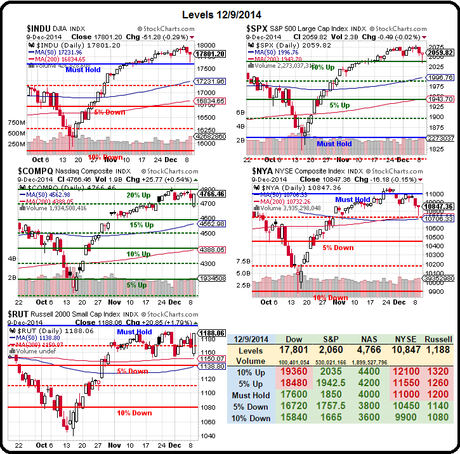

As you can see from the chart, we got a nice round-trip on the Russell in the last two sessions but it smelled a little like BS to us so we shorted into the close and picked up a nice winner (back to 1,182 for a $300 per contract gain) already this morning (see our Live, Pre-Market Member Chat Room) – and the Egg McMuffins are paid for.

We also got a near round-trip on the Shanghai, with the Chinese index popping back 3% this morning but, fortunately, we made the call to take 1/2 of our FXI puts off the table yesterday at $1.60 – up 80% from our Monday pick. If you don't like making 80% in 24-hours, DO NOT SUBSCRIBE HERE! How's that for reverse psychology?

If you are futures-challenged and looking for a good hedge, TZA is the ultra-short ETF that tracks the Russell and our logic on this trade idea would be that the Russell is unlikely to pop over 1,200 without pulling back and, if they do, it's an easy place to stop out with a small loss. That means you can take a position with the Jan $12/14 bull call spread at 0.70 and sell the Jan $12 puts for 0.45 for net 0.25 on the $2 spread that's 0.85 in the money at $12.85 this morning.

If you are futures-challenged and looking for a good hedge, TZA is the ultra-short ETF that tracks the Russell and our logic on this trade idea would be that the Russell is unlikely to pop over 1,200 without pulling back and, if they do, it's an easy place to stop out with a small loss. That means you can take a position with the Jan $12/14 bull call spread at 0.70 and sell the Jan $12 puts for 0.45 for net 0.25 on the $2 spread that's 0.85 in the money at $12.85 this morning.

That trade gives you a 700% upside on cash if the Russell even flinches lower and your worst-case if the Russell goes higher is you end up owning TZA at net $12.25, still 0.60 lower than it is this morning. That's how easy it is to take a hedged position. And you don't have to sell TZA – that's aggressive. You could instead sell puts on a stock you REALLY want to own if it gets cheaper, like FCX Jan $25 puts at $1.30, selling 5 of those for $650 lets you buy 10 of the spreads for $700 and gives you $4,900 of downside protection – not bad, right?

FCX was a new Top Trade Alert Yesterday. We reviewed our first few Top Trades back on Thanskgiving and it's almost time for another update. I see that our Nov 3rd Top Trade Alert was an early short on EWJ, where we took 10 of the Dec $12 puts for 0.25 ($250) in the $25,000 Portfolio and 40 of them ($1,000) for the Short-Term Portfolio. Those puts closed yesterday at 0.55, up 120% in 5 weeks!

FCX was a new Top Trade Alert Yesterday. We reviewed our first few Top Trades back on Thanskgiving and it's almost time for another update. I see that our Nov 3rd Top Trade Alert was an early short on EWJ, where we took 10 of the Dec $12 puts for 0.25 ($250) in the $25,000 Portfolio and 40 of them ($1,000) for the Short-Term Portfolio. Those puts closed yesterday at 0.55, up 120% in 5 weeks!

Whatever you do – DO NOT SUBSCRIBE TO THESE ALERTS!

Really don't because, if too many people start making money on these, we may have to raise the introductory prices. Our Top Trade on ABX from 11/14 hasn't paid off yet, that's a very good one to enter, with a huge upside. Just yesterday, in our Live Member Chat Room (don't join!) we were talking about how our 11/18 Top Trade on BHI may be our Trade of the Year for 2015, needless to say we still like that one!

Really don't because, if too many people start making money on these, we may have to raise the introductory prices. Our Top Trade on ABX from 11/14 hasn't paid off yet, that's a very good one to enter, with a huge upside. Just yesterday, in our Live Member Chat Room (don't join!) we were talking about how our 11/18 Top Trade on BHI may be our Trade of the Year for 2015, needless to say we still like that one!

Anyway, we'll do a full review of our November Top Trade Ideas this weekend or next but, more importantly, we're getting ready to announce our 2015 Trade of the Year (and I'll be on TV 12/17 to discuss it) as well as our Secret Santa Inflation Hedges – so it's going to be a very busy last two weeks of December at Philstockworld.

Meanwhile, we took advantage of yesterday's mysterious market save to get more aggressive on our short positions and, as I mentioned above, we shorted the Russell (/TF) Futures at 1,185 and they are still dropping. If you need a fresh horse, /ES (S&P Futures) are testing 2,050 and it would not be good for them if they break and, of course, we still like /NKD (Nikkei) Futures short at 17,600 with a 17,300 goal (goes with the EWJ puts).

As you can see, the overall picture on our Big Chart is turning a little sour and, as I told you last week, 2,060 had to hold on the S&P and here we are, a week later, still watching the same line. That's the same same line you are being fed by the MSM, who are desperately trying to run Retail Investors into the market to hold the bag for their Corporate Masters.

I can only tell you what is going to happen and how to profit from it – the rest is up to you!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!