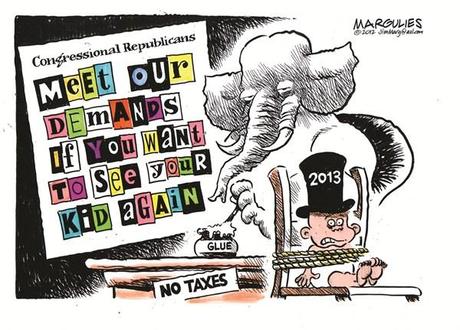

That's all the MSM is talking about but the markets are, so far, drifting along in the upper end of the year's range into this potential "fiscal disaster." Perhaps the catastrophe is already priced in or perhaps it simply won't be a big deal to go back to pre-2000 tax rates and to force some spending cuts.

If it's the former, a "solution" should rally the markets but, if the latter – fixing the Fiscal Cliff may actually weaken our markets as it puts the US on the continued path to endless debt through printing money.

Of course Japan has continued down the path of endless debt through printing money and their markets have been on fire this week. With the re-election of Helicopter Abe, who has vowed to weaken the yen by printing them by the Trillions, the Nikkei has jumped 2.5% this week – all the way back to 10,330 while the Yen falls to 85.36 to the Dollar – a 3-year low.

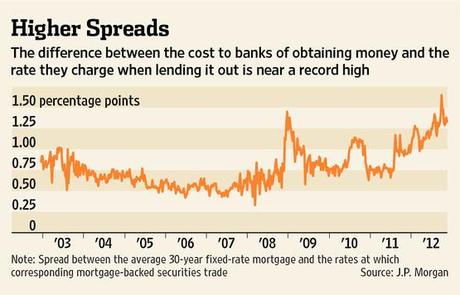

Despite making these usurious rates, they still offer the consumers less than nothing for deposits (as in, not enough to cover even "core" inflation) and they still can't attract investors, with the banking sector still down near half of where they were in 2007, when XLF was in the high $30s.

On the other side of the coin, the Obama Administration is looking to double the size of the popular HAMP Program, which helps modify mortgages, by making it possible for non Government-backed mortgage-lenders to work with…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.