Simple rules about creating value

I addressed a group of CEOs in Asia last month. Several had a problem. Their business was cash flow positive.  They had it coming in quicker than it was going out. Funds were piling up in the bank.

They had it coming in quicker than it was going out. Funds were piling up in the bank.

So what’s the problem?

The fact is, money in the bank earns well below the return on capital they usually generate in their business. The excess cash wasn’t really creating value.

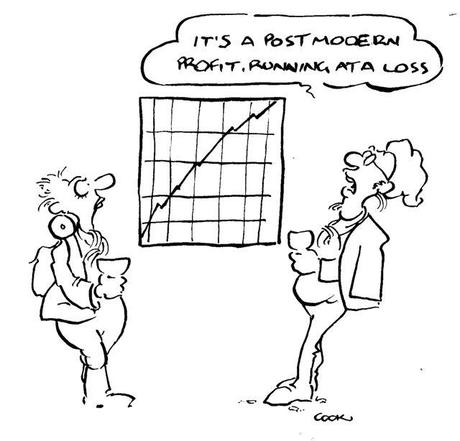

It’s the opposite of leverage, where, if you borrow money for less than the return you generate on that money, you create value. In theory, at least.

The mirror image is net cash. If your firm is returning 10% on the capital it uses but your cash on deposit gets only 5%, it drags down the overall return on capital employed by your business.

Not a bad problem to have, but the mathematics of it mean the value of your business is diminished.

Can you do anything about it?

Can you do anything about it?

Should you do anything about it? There is nothing wrong with a bit of cash in the buffer. Its one reason my audience were prosperous survivors.

At the same time, there may be opportunities going past the window. What’s a framework for making investment decisions in this environment?

The rules of risk management can help. They don’t only apply when things are going wrong. They also make sense when things are going right.

The first is “don’t bet the farm”. So work out just how big a buffer you want. After that, apply other rules when deciding if it’s worth betting a bit of the farm. Here are four of them:

- Do what you know. Look close to home. That’s where you know what you are doing. Can you buy into customers or suppliers? If you have market strength in delivering your product, is there an adjacent product you can put in the pipe? If you rent your premises, should you buy them?

- Identify negative triggers. What could go wrong? Don’t stop at the immediate impact of a disastrous event. Expect contagion. What are the knock-on effects? How exposed will you be if an unexpected Black Swan sails in?

- Impact. If it does go wrong, how bad will it be? If the return is right, it may be worth the risk. Just be clear what the risk is. Which brings us to:

- Probability. How likely is the disastrous scenario? Ultimately, that will decide the risk you are taking and what the return should be – and it needs be comfortably ahead of deposit rates.

Risk management doesn’t eliminate disaster, but it puts a framework around your decision. It reduces the chance of destroying more value than your surplus cash is destroying while it sits on deposit.

If you can’t find an investment that jumps over the risk bar, there is always an alternative. It’s called a dividend.