![What Can’t Be Paid, Won’t Be Paid National Debt Creditors About to Lose their Assets [courtesy Google Image]](http://m5.paperblog.com/i/156/1560609/what-cant-be-paid-wont-be-paid-L-9HGHPK.jpeg)

National Debt Creditors About to Lose their Assets

[courtesy Google Image]

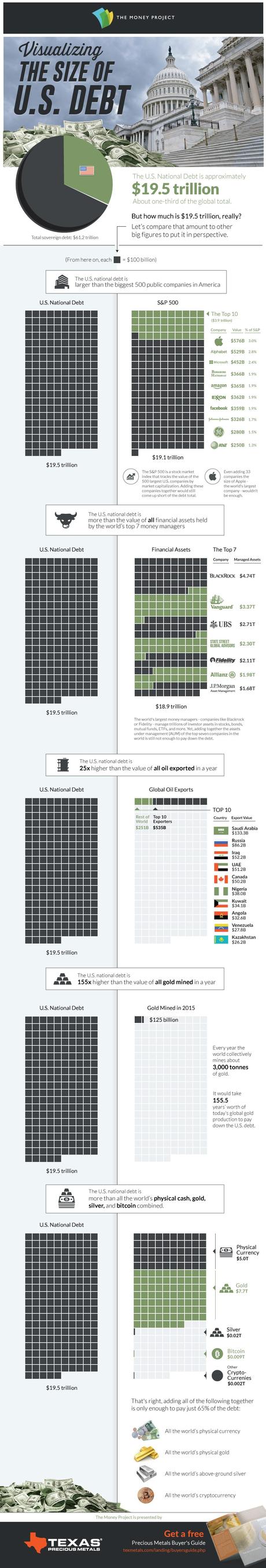

Here’s a graphic that illustrates my argument. If you take a few minutes to view the graphic, you’ll see the size of the U.S. National Debt is:

.

1. Larger than the 500 largest public companies in America;

2. Larger than all assets managed by the world’s top seven money managers;

3. 25X larger than all global oil exports in 2015;

4. 155x larger than all gold mined globally in a year; and, my personal favorite:

5. Larger than all of the world’s physical currency, gold, silver, and bitcoin combined.

In other words, there’s not enough actual money and currency in the world to repay the U.S. National Debt.

Obviously, the National Debt can’t ever be repaid in full–and therefore won’t ever be paid in full.

And we’re only talking about the “official” National Debt which is claimed to be about $20 trillion.

John Williams as shadowstats.com has estimated the true size of the National Debt is about $100 trillion. That’s five times greater than today’s “official” National Debt.

The Congressional Budget Office and, later, economist Laurence Kotlikoff have estimated the total National Debt (including unfunded liabilities) is over $200 trillion. That’s ten times greater than today’s “official” National Debt.

Sooner or later, the National Debt must be repudiated by 80 to 90%. When that debt is cancelled, the correlative paper wealth stored in the form of U.S. bonds will also be destroyed. That destruction will collapse the U.S. and (probably) global economies.

The Federal Reserve insists that public confidence is the foundation for the perceived value in the fiat, debt-based currency. When it’s finally admitted that most of the National Debt can’t be paid, the public will lose all confidence in anything that’s debt-based–including our debt-based currency.

Once the National Debt is recognized as unpayable, the public will flee from all fiat currencies and run for tangible assets like gold and silver. The prices and purchasing power of gold and silver should skyrocket.

What can’t be paid, won’t be paid. That fact will have enormous consequences.

Here’s the graphic: