It's been an impressive rally.

It's been an impressive rally.

But, as you can see from Dave Fry's SPY chart, the volume is total BS so here we are, back where we have been 5 times since December, at the top of a range that we never quite punch our way out of.

It's been a series of low-volume rallies followed by high-volume sell-offs with bouts of stimulus and Fed-speak talking us off the bottom of our range (S&P 2,000) while it takes nothing but gravity to pull us back from S&P 2,060-85ish.

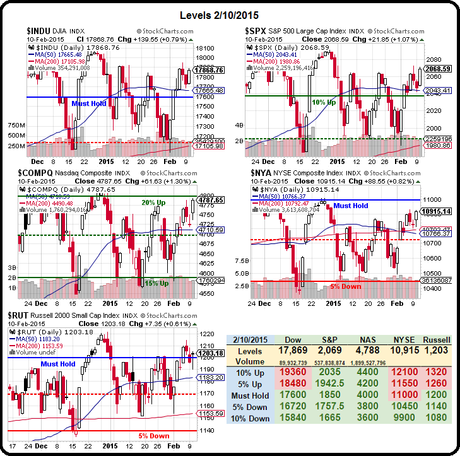

On our Big Chart, the NYSE usually gives the game away by never quite getting over the Must Hold line at 11,000, with the broadest market index dragging far behind the others. Usually, it's the very volatile Russell 2000 that shows us the way near the tops and the bottoms, either bouncing back at 1,160 or failing at 1,200 – which is what we're looking for today:

If the rally is real, we should quickly get over 1,210 on the Russell (/TF Futures) but, if not, then 1,200 will not hold and it makes a great short line as 1,160 is $4,000 per contract away. It may be a bit early, but TZA (ultra-short on the Russell) is often a fun trade at these levels. Now at $11.68, it's low enough where we don't mind owning it as a long-term hedge so the March $11/13 bull call spread at 0.70, selling the $11 puts for 0.50 is net 0.20 on a $2 spread. You make 10x your money back if TZA is over $13 in 37 days.

As noted yesterday, our paired portfolios (LTP and STP) were at $840,000 yesterday morning (up 40%) and they finished the day at $845,000 – up $5,000 (0.5%) on a day when the S&P went up 0.6%. That means, very simply, that we are balanced just a bit less bullish than the S&P.

That means that, if the S&P were to drop…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!