Things are getting serious.

Things are getting serious.

Yesterday morning, the IMF began what may be the endgame for Greece as they walked out of negotiations and flew back to the US, saying "There are major differences between us in most key areas and there has been no progress in narrowing these differences – thus we are well away from an agreement."

Faced with the decision to catch the last flight to DC or spend the weekend in Brussels, the IMF wisely decided to head home. At a meeting of EU Government staffers late Thursday, Greece was given less than 24 hours to come up with firm proposals to end the impasse. Policy makers are now examining all scenarios if Greece refuses to compromise, including the possibility that the country could eventually leave the Euro.

“There is no more time for gambling,” EU President Donald Tusk told reporters in Brussels on Thursday. “The day is coming, I am afraid, that someone says the game is over.”

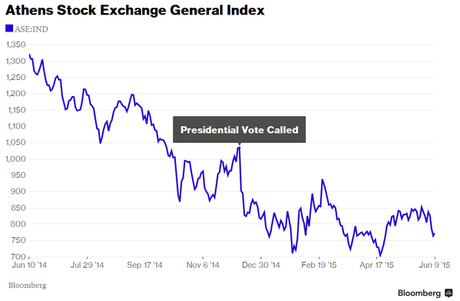

Greek banks fell as much as 8.1% and traded 7.1% lower at 11:30 am this morning in Athens. Greek bank stocks have lost more than 50% since the previous government of Antonis Samaras began to unravel in December. The Athens Stock Exchange Index, which has lost 24% since then, dropped another 4.2% this morning and now all of Europe is down about 1%, wiping out half of the last two day's gains.

Greek banks fell as much as 8.1% and traded 7.1% lower at 11:30 am this morning in Athens. Greek bank stocks have lost more than 50% since the previous government of Antonis Samaras began to unravel in December. The Athens Stock Exchange Index, which has lost 24% since then, dropped another 4.2% this morning and now all of Europe is down about 1%, wiping out half of the last two day's gains.

Today's deadline aside (as we've seen plenty of them come and go), If the two sides do not reach an agreement on how to extend a 240Bn Euro ($270Bn) loan program beyond June 30th (18 days), Greece will most likely default on its debts and would probably be forced to abandon the Euro.

As noted by the NYTimes, in order to move past the next 18 days, 18 other members of the Eurozone would have agree to forgive or delay the repayment of some (not all) of Greece’s crushing debt, which by itself is equal to 177% of their GDP. In exchange, the government of Prime Minister Alexis Tsipras must agree to changes that would increase tax collection, make the government more efficient and to boost economic growth by making it easier to start new businesses (ie less government oversight for the Top 1%).

"For any arrangement to work, the leaders of Germany and other eurozone nations have to be willing to lose some of the money they put up to repay Greece’s private lenders, many of whom were banks and investment firms in their own countries. But if the eurozone does not make this relatively small sacrifice now, it will suffer greater losses if Greece defaults and exits from the euro. That result, aside from increasing European losses, would undermine confidence in the common currency in future crises. And a default and euro exit would deal a devastating blow to the economy and financial system of Greece."

"For any arrangement to work, the leaders of Germany and other eurozone nations have to be willing to lose some of the money they put up to repay Greece’s private lenders, many of whom were banks and investment firms in their own countries. But if the eurozone does not make this relatively small sacrifice now, it will suffer greater losses if Greece defaults and exits from the euro. That result, aside from increasing European losses, would undermine confidence in the common currency in future crises. And a default and euro exit would deal a devastating blow to the economy and financial system of Greece."

Meanwhile, Italy, who did agree to the EU's draconian terms to stay in the EU is now suffering the severe consequences as the country is unable to keep their budget within the unrealistic spending levels demanded by the ECB and the IMF. This is the 2nd "crisis" for Italy in two months and last month the Government made their IMF payments by cutting pensions to retired workers, which sent their bonds tumbling. While past and future payment claims totaled as much as 19Bn Euros, the government decided to reimburse only about 1/10th of that through an emergency decree law that Renzi tried to pass off as a “bonus” for retired workers.

“The government can only limit the impact of negative rulings on public finances,” said Loredana Federico, an economist at UniCredit SpA bank in Milan. “In the long term, emergency measures, such as a salary or pension freeze, need to be replaced by a structural and comprehensive review of public spending.” The Government Debt in March rose to a record 2,180,000,000,000 Euros ($2.5Tn), the second-highest level in Europe as a percentage of gross domestic product, after Greece.

“The government can only limit the impact of negative rulings on public finances,” said Loredana Federico, an economist at UniCredit SpA bank in Milan. “In the long term, emergency measures, such as a salary or pension freeze, need to be replaced by a structural and comprehensive review of public spending.” The Government Debt in March rose to a record 2,180,000,000,000 Euros ($2.5Tn), the second-highest level in Europe as a percentage of gross domestic product, after Greece.

So Greece has to look at Italy, who have been "fixed" by the EU, and think about their future. The debt pile hasn't stopped growing but government salaries have been frozen and pensioners are getting 10 cents on the Euro in repayment for a life of hard work in order to pay back high-yield debts that the vulture capitalists jammed down their throats during the financial crisis using money the EU was handing to the banks for free while refusing to do anything to directly aid the Member States.

This is, on the whole, nothing more than a full-scale takeover of the EU periphery by the Banksters that control the ECB and, by extension, the EU itself. The IMF represents the US Banking Cartel and they are fed up and you don't hear anyone offering to take a haircut on their 20% interest loans, do you? It's all about Greece and the cutbacks they "have" to make in order to pay off their debts and stay in the EU (because you can't stay in the EU if you don't pay the Banksters?!?).

This is, on the whole, nothing more than a full-scale takeover of the EU periphery by the Banksters that control the ECB and, by extension, the EU itself. The IMF represents the US Banking Cartel and they are fed up and you don't hear anyone offering to take a haircut on their 20% interest loans, do you? It's all about Greece and the cutbacks they "have" to make in order to pay off their debts and stay in the EU (because you can't stay in the EU if you don't pay the Banksters?!?).

When the hell did our "civilization" devolve into this?

Have a great weekend,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!