Always in a hurry, I never stop to worry,

Don't you see the time flashin' by.

Honey, got no money,

You got to roll me and call me the tumblin',

Roll me and call me the tumblin' dice. – Stones

The chart on the left is from an excellent article by Charles Smith titled "Bernanke -The Only Game in Town: Really?" which is a quote from Senator Schumer as he incredulousy questioned the Fed Chariman as to the need for the Fed's constant monetary machinations.

As pointed out by Smith:

As pointed out by Smith:

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

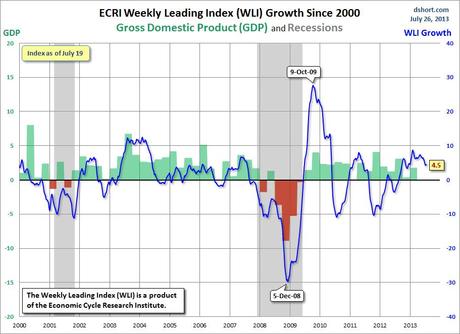

This morning, in Member Chat (see morning tweet), we discussed the possiblity that ECRI may be right and that the US may be headed back into a recession. Why else would the Fed be keeping their foot on the gas with the market up 200% from it's bottom?

This morning, in Member Chat (see morning tweet), we discussed the possiblity that ECRI may be right and that the US may be headed back into a recession. Why else would the Fed be keeping their foot on the gas with the market up 200% from it's bottom?

The leading indicators have been turning sharply lower since January, which means it's not very likely that our Q2 GDP number (released tomorrow at 8:30) is going to hit the expected 1.1% target set by leading Economorons. More likely we have a sharp dip, possibly below 0%, like the one we had in Q3 of 2011, that dropped the S&P off a very sharp cliff (in the last week of July), from 1,356 to 1,100 (19%) in just two weeks and, ultimately, to 1,074 – for the full 20% correction.

We are not worried about a correction – we NEED a healthy correction. Hopefully it won't be 20% but the expections reflected in equity prices simply aren't matching up with the reality of the economy, or the earnings…

We are not worried about a correction – we NEED a healthy correction. Hopefully it won't be 20% but the expections reflected in equity prices simply aren't matching up with the reality of the economy, or the earnings…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.