This is costing the Dow another 10 points pre-market and this comes after BA was the entirety of the Dow's losses (25 points with BA down $3.50) yesterday, robbing the index of it's sixth consecutive upward close as we followed through with our plan to ignore BA and the Dow and stay bullish.

News came out at 1:45 am that the FAA is grounding all 787 Dreamliners and that's what we were worried about yesterday, when I said in the morning post:

"NOW we have a problem that changes our investing premise in BA…. So, we won't be "taking advantage" of this dip to add to our entries but we won't be panicking either – we'll just wait for clarity for the moment. "

As we got more information and discussed the BA situation in our daily Member Chat, we decided to wait for BA and the FAA to issue statements. The FAA grounding is precautionary, of course, but we still need to see what BA's solution is and, more importantly, when they have it.

Meanwhile, is BA a good deal at $73? Probably, but we're not as confident as we were on Oct 1st,, when we added BA to our Income Portfolio at $69. Of course we hedged that by buying the 2014 $65/80 bull call spread for net $9.16 and then, when BA took another dive on 11/15, we added short 2015 $65 puts for $7.50. Since then, BA has gone straight up but we always have dry powder ready for BA because planes do crash and this stock can drop 30-50% on you very suddenly.

Meanwhile, is BA a good deal at $73? Probably, but we're not as confident as we were on Oct 1st,, when we added BA to our Income Portfolio at $69. Of course we hedged that by buying the 2014 $65/80 bull call spread for net $9.16 and then, when BA took another dive on 11/15, we added short 2015 $65 puts for $7.50. Since then, BA has gone straight up but we always have dry powder ready for BA because planes do crash and this stock can drop 30-50% on you very suddenly.

So we're not too impressed by a less than 10% pullback from the top ($78) since the beginning of the year – certainly not enough to go bargain hunting but neither are we worried enough to dump our positions. After all, it's just a battery problem (so far).

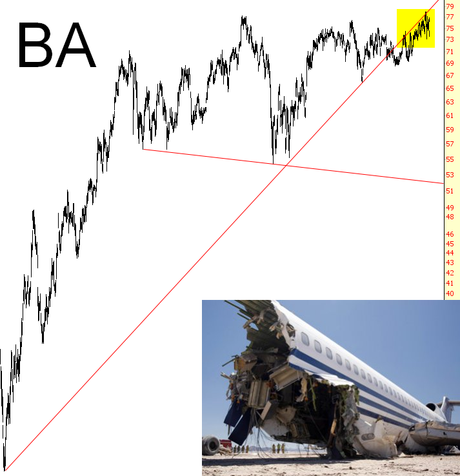

Unfortunately, as you can see from this Slope of Hope chart, there is not a whole lot of support for BA between here and that 30% drop we worry about. Fortunately, we are long-term value investors and our initial buy on BA in the virtual portfolio is around net $68 and if BA does fall to $52…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.