What a great day we had yesterday!

What a great day we had yesterday!

For those of you lucky enough to read our morning post (and you can have yours delivered pre-market, daily by subscribing HERE), we had re-picked a short position on S&P Futures (/ES) at 2,105 and, as you can see from Dave Fry's chart, we got a lovely drop down to 2,092, which was good for a gain of $650 per contract in the first 90 minutes of trading.

We also caught the incredibly obvious oil moves where our $61.50 entry gave us a ride all the way to $60 (up $1,500 per contract) by the day's end, though most of us were in and out during the day, profiting from the bounces as well as the drops. Like our Member, Craigsa620, who said:

Phil- I want to let you know that you really helped me make some money this morning when I probably would have lost on my own. I was stuck in doctors waiting rooms most of the morning starting at 8AM. By following the game plan you laid out and using my smartphone, I went short on oil whenever we got to 61.50 and long at 61 waiting for the spikes ahead of inventory. When 10:30 rolled around I was out after selling longs at 61.60 a few minutes earlier. I went short at 61.75-61.80 and voila, rode it down to 60.60 or so. Thank you.

All in all, it's the same general thing we did last Wednesday and we can do this on a regular basis because the oil market is MANIPULATED on a regular basis. Maybe the regulators can't see the blatant pattern of manipulation going on at the NYMEX but we sure can – so we may as well bet on it while it's going on.

Perhaps the reason no one is willing to call shenanigans on the NYMEX traders is because the biggest market manipulators of them all are our own Central Banks. In the last 3 weeks, the Dollar's value has declined by 4.2%, which is helping to prop up the markets while the smart-money flees for the exits.

Perhaps the reason no one is willing to call shenanigans on the NYMEX traders is because the biggest market manipulators of them all are our own Central Banks. In the last 3 weeks, the Dollar's value has declined by 4.2%, which is helping to prop up the markets while the smart-money flees for the exits.

Why should the Dollar be weaker against other currencies when the Fed hasn't changed their pace of QE for 6 months and is, in fact, much more likely to reduce it than increase it? Clearly Japan is still printing money like crazy, China JUST lowered their rates for the 3rd time in 6 months on Monday and Europe is still at the edge of a cliff with Greece hanging on by its fingernails.

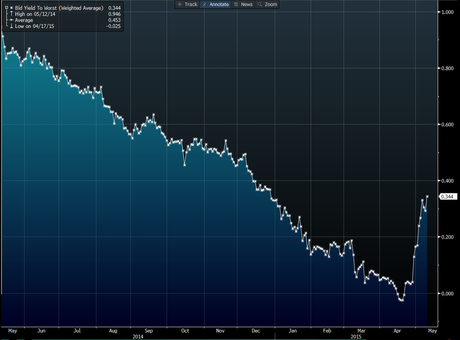

Between the ECB's bond buying and the threat of deflation, yields across Europe started to go negative this year, meaning investors were essentially paying for the privilege to lend their money out. That created a spill over effect into bond markets in the rest of the world as investors went in search of a better deal, pulling yields down in those markets too. The average yield across all Germany's debt went negative about three weeks ago. That seems to have been the straw that broke the camel's back. Since then that average yield has climbed to the highest level this year. Yields on about $2 trillion of bonds across 12 countries still linger below zero.

Between the ECB's bond buying and the threat of deflation, yields across Europe started to go negative this year, meaning investors were essentially paying for the privilege to lend their money out. That created a spill over effect into bond markets in the rest of the world as investors went in search of a better deal, pulling yields down in those markets too. The average yield across all Germany's debt went negative about three weeks ago. That seems to have been the straw that broke the camel's back. Since then that average yield has climbed to the highest level this year. Yields on about $2 trillion of bonds across 12 countries still linger below zero.

If the yields on 10-year notes climb from 0 to 1%, the loss to the note-holder is 10 (years) x 1 (percent) = 10%. If the yields climb to 1% in year 2, the loss is 9% – since you lose value relative to what a current bondholder can get because your bond is fixed at a crappy rate. What happens, though, when you also invested in a crappy currency? While the Dollar was fetching near 100 in mid-March and 10-year notes were 1.9%, now the Dollar is down to 93.33 and the notes are up to 2.3%.

That means the loss for someone foolish enough to loan our Government $100,000 for a 10-year note at 1.9% in March, who expected to get back $119,000 after 10 years, now has a face value on their note of just $96,000 and the Dollar the notes are paid in has dropped 6.7%, for an additional $6,700 loss. That puts the net value of the note (in steady currency) down to $89,300 (down 10.7%) in less than 90 days!

That means the loss for someone foolish enough to loan our Government $100,000 for a 10-year note at 1.9% in March, who expected to get back $119,000 after 10 years, now has a face value on their note of just $96,000 and the Dollar the notes are paid in has dropped 6.7%, for an additional $6,700 loss. That puts the net value of the note (in steady currency) down to $89,300 (down 10.7%) in less than 90 days!

That's why you see TLT, the ETF for the 20-year Treasury Bill, dropping from a high of $137 in early February, all the way down to $118+ (-13.8%) today – it's more reflective of your true loss, including rates and currency fluctuations.

This is causing a panic into silver, gold and, of course, equities – and is allowing the rally to have one more last gasp – even though the Central Banks are running out of firepower.

This is causing a panic into silver, gold and, of course, equities – and is allowing the rally to have one more last gasp – even though the Central Banks are running out of firepower.

“Higher stocks with low yields, or falling stocks with rising yields is a typical phenomenon when there’s excess money from central bank easing,” said Toru Suehiro, an economist at Mizuho Securities Co. in Tokyo. “If they moved based on fundamentals such as the economy or consumer prices, then the correlation should go back to higher stocks, higher yields.”

This is market manipulation on a MASSIVE scale and, if you are bullishly invested – you'd better hope those manipulators never get caught and – you'd better hope those people who bought $2Tn worth of 0% bonds decide to sit tight as rates rise and currencies fall!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!