This is the last post in a series on fundamental principles to keep in mind when managing your 401k or IRA account. I call these the Three keys to retirement investing. These are:

This is the last post in a series on fundamental principles to keep in mind when managing your 401k or IRA account. I call these the Three keys to retirement investing. These are:

- Contribute early and regularly

- Take appropriate risks

- Delay withdrawals as long as possible

Today we'll look at the last key:

Key #3: Delay withdrawals as long as possible.Like many people, you may be eager to retire early, which may also mean tapping into your 401k or IRA in your early sixties. Unfortunately, this can also mean giving up on a lot of additional income since it is the later years when you really start making a return from your investments. Delaying withdrawals by working a couple of extra years or saving up money outside of your retirement funds can make a big difference. This is because of the high returns you get at the end. To see this, let's look at the difference between two individuals. The first is contributing $12,000 into a 401k plan starting this year, and the other has $5 M already built up in her 401k plan and is contributing the same $12,000 per year. Let's assume that both are getting a 12% annual return during each of the five years we examine. (Note, this is totally unrealistic, but this assumption is useful to illustrate the point. We'll come back around and discuss actual probable returns in a moment.)

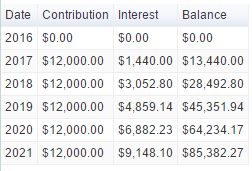

Above see the contributions and the interest received for a new account. During the first year, $12,000 is contributed, but only $1440 is received in interest payments. Even by the fifth year, only $9148 is being received in interest payments. Over the full, five-year period, $60,000 has been contributed, while only $25,000 has been received from interest on the money invested.

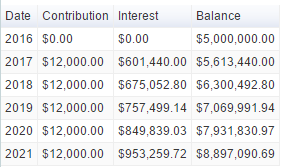

Now let's look at the last five years for an account with $5 M at the start of the period. Here, the investor receives more than $600,000 from investment returns to start, and then receives about $75,000 more each year after that. During the same period she has contributed the same $60,000, but received more than $3.8 M in investment returns. Really, it would not have mattered if she had not contributed anything at all - the investment returns dwarfed her contributions.

When you first start a 401k, it will seem like nothing is happening. The returns you get from your investments will be very small compared to how much you're contributing. At some point, however, the account will grow to a large enough amount that suddenly the five to twenty percent returns you get during a given year are much bigger than your contributions. This usually happens fairly suddenly. Once it does, it is usually fairly amazing how big the returns are during a given year in terms of actual dollar amounts.

If you start to take the money out in large amounts, you start cutting back on the size of your portfolio, causing your investment returns to decline. You don't only spend the money you pull out - you also lose the investment return that money would have generated in future years. In general, you can withdraw about 3-4% of your account value per year with only a small chance of causing the account value to decline over time since your investments in general (assuming you're in a mix of stocks and bonds) will normally be able to replace the money you're withdrawing at those withdrawal rates.

A look at investment returnsNow, let's look at those returns. While assuming a simple, 12% return each year is good for illustration, there is nowhere you can currently get a steady 12% return without taking significant risks. If you could, it would mean that inflation was at 10-15% per year as well, so you effective rate of return might actually be negative.

Really, the greatest return you could get with a reasonable amount of risk and a somewhat predictable return would be through investing in a diversified set of high-quality bonds, which would pay around 4-6% at the current time. This would still be a respectable $20,000 - $30,000 per year in investment returns, but not the $75,000 shown. Even there you could see your portfolio decline in value if interest rates increased, although you would recoup that money if you held the fund long enough for the bonds you owned to be redeemed and/or interest rates to decline again.

If you were investing in stocks, you would see better returns, but not predictable returns. Even though the average return for a diversified stock portfolio has been around 12% per year, during a given one year period you could see returns of plus or minus 30% or more. Instead of seeing steady, reliable returns as in our example, you would actually see unpredictable returns, both positive and negative. You might gain $250,000 one year, then lose $100,000 the next. There would also be years when the portfolio value doesn't change much at all. There are also exceptional years like 2000 and 2008 where you could see declines of 40% or even 50%. This means your $5 M portfolio would be worth $2.5 M at the end of the year. Thankfully, these types of significant declines are rare, and they are often followed by years with large gains, but you must still take this into consideration when investing near the time when you'll need the money.

To guard against a retirement - destroying disaster, while still giving yourself the chance for good returns, consider the following:

- Take the portion of the money you really need during the next 3-5 years and put it into cash. Having a cash reserve will allow you to wait out downturns and enjoy the rebound in prices that normally follow while still having the cash you need for daily living expenses.

- Invest the portion of your portfolio that you really need like that is all that you have. If you need $60,000 per year for expenses, you'll need twenty to thirty times as much, or about $2 M, in your portfolio. If you have $4 M, take $2 M of it and invest about 50% in stocks and 50% in bonds. The bonds will provide steady returns and stability (an all bond portfolio actually went up during the 2008 stock market decline), which the stocks will grow with inflation to provide the additional income you'll need later in retirement. The remaining money can be left in stocks since it would not affect your retirement if you lost half of that money. During great years in the market, you can use some of this additional income to add to your bond portfolio and increase your income or to pay for one-time items like a trip or an RV.

Got an investing question? Please send it to [email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.