Depending on what we are analyzing there are different demand elasticities that can be considered (e.g. price elasticity, cross-prize elasticity, income elasticity). The most relevant of them is the price elasticity of demand which describes to what extent the quantity demanded of a good is affected by a change in its price. There are many factors that influence the elasticity so we will start off by looking at its most relevant determinants.

Determinants

The price elasticity of demand is determined by a multitude of economic, social, and psychological factors that each influence consumer preferences and choice in a unique way. Being familiar with the most relevant of those determinants will be crucial for analyzing and comparing elasticities of various products.- necessity of the product: If a good is considered a necessity (e.g. water, bread, toilet paper, etc.), a change in the price of the good will not significantly affect its demand. Since people always have to satisfy their basic needs they do not respond much to price changes for basic goods. If a product is considered a luxury good however, demand will be much more elastic, simply because people do not actually need those products to survive.

- availability of close substitutes: Close substitutes allow consumers to switch between different goods that satisfy the same (or similar) needs, thus if a good has one or more close substitutes, demand will be rather elastic. In that case people can just buy the substitute to satisfy the same needs if the price of the original product increases. On the other hand if there are no close substitutes available, consumers cannot just switch between equivalent products so they will not respond as strongly to a price change.

- proportion of income devoted to product:Products that are expensive (i.e. take up a high proportion of the available income) tend to have more elastic demand. Absolutely speaking, a 1% increase in the price of an expensive good is more significant than a 1% price change of a cheap good. As a result, consumers generally respond more strongly to price changes if they have to devote a larger proportion of their income to a certain product.

- relevant time horizon: In most cases demand is more elastic in the long run as compared to the short run. There are many occasions where consumers face significant switching costs in the short run (because of binding contracts, opportunity costs, etc.). Those costs are usually lower in the long run because contracts can be allowed to expire and there is more time to prepare and to evaluate all available options.

Now, please note that there may be additional determinants that are not mentioned here but are applicable in certain situations. This is not supposed to be a complete list. Basically every aspect that affects consumer preferences in any way will have an effect on the elasticity of a good or service and can thus be considered a determinant of elasticity.

Types of Elasticity

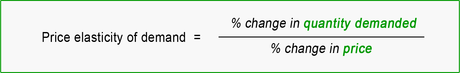

There are different types of elasticity. In particular, a demand curve can be elastic, isoelastic or inelastic. In fact, since elasticity is always measured at a certain point a single demand curve can have segments of all three types simultaneously. To see how this is possible, we will have to crunch the numbers and look at how elasticity is computed. The price elasticity of demand is defined as the percentage change in quantity demanded divided by the percentage change in the price of a good. This can be illustrated using the following formula.

To give an example, let's assume that an increase of 2% in the price of ice cream causes consumers to buy 6% less of it. According to our formula the elasticity in this case can be computed as 6% / 2% = 3. So the elasticity of demand equals 3.

However we still need some kind of classification to actually work with that number, right now it does not really say much. This is where the different types of elasticity mentioned above come into play. With their help we can classify the demand curve and thus interpret the result.- If the elasticity is greater than one, a demand curve is said to be elastic. In this case consumers respond strongly to price changes. As a result the quantity demanded changes proportionally more than the price.

- If the elasticity is equal to one, a demand curve is said to be isoelastic. In that case consumers respond proportionally to price changes which means the quantity demanded will also change in the same proportion as the price.

- If the elasticity is less than one, a demand curve is said to be inelastic. In this case consumers do not respond strongly to price changes. Therefore the quantity demanded changes proportionally less than the price.

Hence, since elasticity in our example is equal to 3 we can conclude that demand for ice cream is elastic at this point. Once again it is important to note that this elasticity may change as we move along the demand curve, so there may be other examples where the ice cream has different elasticities on the same demand curve. This is due to the fact that we use relative proportions to calculate the elasticities.

Additional Demand Elasticities

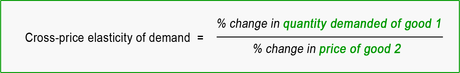

The cross-price elasticity of demand is used to measure by how much the quantity demanded of a certain good changes as the price of a different good changes. It is defined as the percentage change in quantity demanded of a certain good 1 divided by the percentage change in price of a good 2. This results in the following formula.

If the cross-price elasticity is a negative number the two goods are said to be complements. In this case an increase in the price of good 1 reduces demand for good 2. On the other hand if the elasticity is positive, the goods are said to be substitutes, since an increase in the price of good 1 results in an increase in the quantity demanded of good 2.

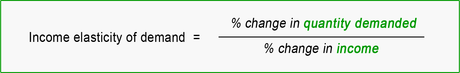

The income elasticity of demand is used to measure to what extent the quantity demanded of a good changes as consumer income changes. It can be computed as the percentage change in quantity demanded divided by the percentage change in consumer income. Again, this can be illustrated using a simple formula.

If the income elasticity of a good is a positive number it is considered a normal good, because a higher income increases the quantity demanded. However there are goods that have a negative income elasticity, they are considered inferior goods. For those goods a higher income will result in a lower quantity demanded.