Photo courtesy of iStockphoto.

In July of 2011 the political and economic story in the US was the partisan fight over raising the debt ceiling. Angry debates in the media brought volatility to the markets, and for a while there it seemed like the government borrowing limit would not be increased, and the US would default on its bond holders for the first time ever. There were warnings from the three credit rating agencies, Standard and Poor’s (S&P), Moody’s, and Fitch, who all threatened a downgrade of the pristine American credit rating. The disagreement featured Democrats and Republicans arguing over tax increases and spending cuts, a dangerous game of brinksmanship over how to address high federal budget deficits and a mountain of accumulated national debt, played recklessly at a precarious time of US economic weakness.

A deal was reached without a moment to spare right before the dreaded default date, the debt ceiling was raised, modest deficit reduction was achieved, and a bipartisan committee was tasked with finding agreement on further deficit reduction. But unfortunately some of the damage had already been done. S&P downgraded America’s AAA credit rating, and the stock market had its worst week since the 2008 financial panic. A lack of moderation caused real economic harm last summer and our disagreeable political factions still don’t seem to be able to make any reasonable compromises in order to deal with the national debt.

Budget Deficits and the National Debt

The federal budget deficit, or surplus, is the annual gap between government outlays and government revenue. If the government takes in less than it spends this results in a deficit, which the government must cover through borrowing by issuing treasury bonds. The national debt is the accumulation of all past budget deficits plus interest. Since the end of World War II the US government has run a budget surplus a meager 11 times, with only 4 of those years coming since I was born in 1976. In the 36 years that I have been alive on Earth there have been federal budget deficits about 88% of the time. These deficits have accumulated over the years, adding to the total national debt, and as of the time of this writing the debt has reached $15.3 trillion, about $49k per citizen. You can watch the debt accumulate in real time by watching the National Debt Clock. This is alarmingly high, and since 2008 both the deficit and debt have grown substantially. It is clear that a deficit remedy is essential.

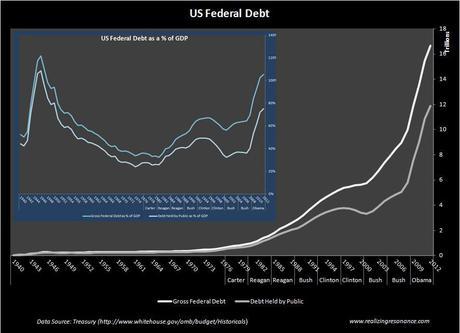

Click on chart for bigger version.

The chart above depicts the gross US federal debt, as well as the amount which is held by the public, the net debt. Debt not held by the public is the amount of money that one government agency owes to another government agency. The smaller chart within a chart, framed in blue, is the US federal debt as a percentage of GDP. Economists like to look at the national debt in the perspective of GDP because this shows the relative difficulty that the debt burden presents for a national economy, and is an indicator of a government’s ability to meet payment obligations. The US national debt reached a peak of 120% of GDP at the end of World War II, but this declined steadily until 1979. The debt to GDP ratio grew again during the 1980s, but in the late 1990s the accumulation of debt reversed, with budget surpluses and debt the ratio to GDP declining for a few year, but then reversed again and began a new expansion in 2001. Since 2008 the national debt as a percent of GDP has accelerated its growth due to historically large budget deficits. It is estimated by the Treasury that our debt to GDP will reach 105% this year, although this ratio will only be 75% for the net debt held by the public. These large numbers help to explain why the debate over how to slow the growth of government debt has taken on more urgency in the last few years.

Rather than working diligently to solve the debt problem, the partisans spend a significant amount of time debating who is to blame, arguing over the false dichotomy of spending cuts versus tax increases. The Democrats contend that it was the Republicans under President George W. Bush who ran up the debt by spending heavily on the war in Iraq and tax cuts to the rich. The GOP counters that it was the Democrats under President Barack Obama who increased government spending to record heights with a massive fiscal stimulus and healthcare legislation, and that Bush’s tax cuts actually stimulated the economy and raised revenues. The Republicans point to the fact that the deficit has grown to record levels every year since 2009, all during Obama’s first term, with an average annual deficit around $1.2 trillion. While Bush did run large deficits, they only averaged about $250 billion a year (“Historical Budget Data”, CBO). For the GOP this is a no brainer, but the Democrats insist that much of the deficit problem is due to policy changes under Bush in conjunction with the impact from the Great Recession, not new Obama policies. The dispute over blame leads to a dispute over how to resolve the issue, so an honest assessment of the causes of the budget deficit is needed as a first step to an honest solution.

In 2001, the independent nonpartisan Congressional Budget Office (CBO) projected an average budget surplus of $850 billion for the 2009-2012 term. However, with actual average deficits of $1.2 trillion during the first term of the Obama Presidency, there is a need to account for a change of about $2 trillion a year from the expected surplus to actual deficit. The 2001 CBO projection was not a forecast, but a baseline to measure the impact of policy and economic changes, a task which the CBO has subsequently undertaken, analyzing the reasons for the average budget deficit from 2009-2012 (“Changes in CBO’s Baseline”, CBO).

About 33% of the blame can be placed specifically at new policies enacted by President Bush, such as large tax cuts, the Iraq war, the Medicare Part D prescription drug benefit, and the Troubled Asset Relief Program (TARP), and another 20% of the blame results from President Obama’s renewal or continuation of some of these programs. New policies enacted by President Obama, such as the American Recovery and Reinvestment Act (ARRA) and healthcare reform, account for around 10% of the blame. The remaining 37% of the culpability lies with economic factors, the bursting of the dot-com bubble and short recession of the early 2000s, plus the 2008 sub-prime mortgage crisis, the financial panic, the Great Recession which lasted from December 2007 to July 2009, and the subsequent slow recovery that we are still enduring.

To be moderate and fair, I will parse blame equally between President Bush and President Obama on the continuation of Bush policies and the economic factors. This temperate treatment suggests that about 62% of the blame for the large deficits during President Obama’s first term in office should be given to former President Bush. Even so, President Obama is still responsible for 38% of the current budget deficit, which is no insignificant share of the guilt. Under these assumptions I can do a back-of-the-napkin calculation to determine that President Obama is responsible for a 15% of the total national debt to date, while President Bush is responsible for 51%, and the remaining 34% falls on the shoulders of past Presidents, primarily Reagan. It is illusory to blame Obama for the lion’s share of our national debt, but he certainly deserves shared culpability.

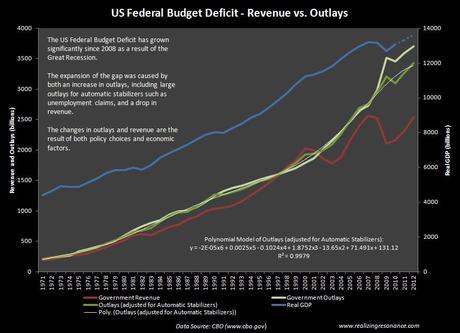

Click on chart for bigger version.

The chart above illustrates the changes in federal revenues and outlays since 1971. I have also included Gross Domestic Product (GDP), and an adjusted line for outlays which removes the spending on automatic stabilizers such as unemployment insurance claims. When the line for outlays is above the line for revenue there is a budget deficit, with the inverse pattern representing a surplus, the latter of which is a rare occurrence during the time period in the chart. Since 2008 the gap between revenue and outlays has opened up like the mouth of a sand worm from Dune or Critters, opening up to swallow the economy, a horror movie called, The Deficit’s Hunger. This terrifying budget gap is a combination of policy decisions and economic factors, with the latter receiving much more weight in my estimation. The biggest part of the dip in revenue, plus the spending on automatic stabilizers and stimulus, would not have occurred without the Great Recession. While I balanced the blame between Bush and Obama in my assessment of the CBO analysis above, when looking at this chart of revenue and outlays I am more inclined to say that much of the deficit problem is based around factors that neither Bush nor Obama had much control over.

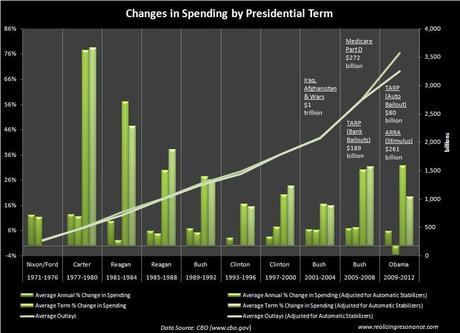

The rate of change in spending growth can be measured by subtracting the outlays in the prior year from outlays in the current year, then diving the resulting difference from the outlays in the prior year. In the chart above, the average annual percent change in spending is the rate of change averaged over a four year Presidential term. Adjusted for automatic stabilizers, Bush oversaw a growth in average annual spending of about 6.1% and 7.3% in his first and second terms respectively, compared to -3.7% average annual percent change in spending during the first Obama term. If you measure the rate of change in spending by Presidential term another way, by calculating the percentage change in average spending over each four year term, then under Bush’s first two terms the rates of growth were 15.9% and 31.3%. President Obama grew average spending by 19.4% in his first term under this alternate measurement, but without adjusting for automatic stabilizers his rate is equivalent to the growth in spending during Bush’s second term. The chart below shows spending growth by Presidential term since 1971 under these various measurements.

Click on chart for bigger version.

If you only focus on changes in government spending it is difficult to account for the entire size of the deficit. Looking at the budget deficit chart with revenue vs. outlays illustrates that both sides of this budget calculation moved in opposite directions after the financial crisis. Outlays would have needed to be cut drastically during the recessionary gap in order to compensate for the falling revenue if balancing the budget was compulsory, as in the case of a Balanced Budget Amendment to the Constitution. This is not pragmatic or realistic, since it would preclude the use of automatic stabilizers, instituting instead a system of automatic austerity, and sure way to reinforce a positive feedback loop of declining consumption and production during a recessionary gap.

The contention that Obama is a reckless spender, because drops in revenue should have been matched with corresponding cuts in outlays, is disingenuous coming from the GOP. Under President Bush, massive tax cuts were maintained, while spending was increased to fight two different wars, an expansion of Medicare with a prescription drug benefit designed by the pharmaceutical industry, and a bridge to nowhere in Ketchikan, Alaska. A guns and butter policy if I ever saw one. The budget was not balanced under Bush, but the Democrats were saying many of the same things then that the Republicans are saying about Obama today. This tells me that the deficit hawk identity is a favored strategy of the party that is not in control of the White House, which makes sense since American voters have been known to blame Presidents for too much spending, while also reelecting their own Congressional representatives when they bring home the pork.

There is a strategy that some conservatives have talked about since the beginning of supply-side economics in the late 1970s called Starve the Beast. The intention here is to end popular government programs that some conservatives oppose on philosophical grounds, such as Social Security and Medicare. It is virtually impossible to come out directly against these programs on principle for a politician, although sometimes I hear hints of this with the labeling of Social Security as a Ponzi scheme. So the strategy is to defund the programs through the also popular tax cut, and create an artificial budget crisis. The resulting deficit will frighten the public and then all one needs to do is convince the voters that gutting entitlements is a better alternative to a tax hike. Starve the Beast has not really been effective yet, and I’m not even sure how many conservatives really support this strategy in the form I have described, but looking at it from this angle makes me feel like I can better understand GOP behavior in the budget fight, given their pledges to Grover Norquist and their commitment to cutting spending only when they are not in office.

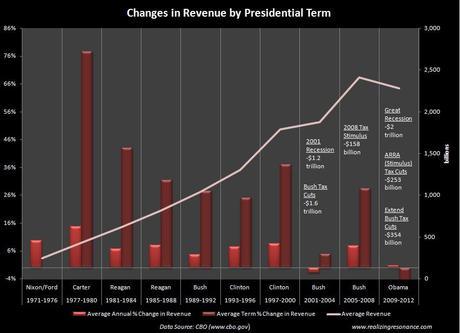

Looking at the chart below, which captures the changes in government revenue by Presidential term, it is obvious that revenue has reversed a long term upward trend since Obama took office. This has been because of tax cuts and recessionary impacts on revenue. Tax cuts have been justified by both sides of the political spectrum. Republican supply-siders will argue that cutting tax rates actually increases total nominal revenue since the economy is stimulated by lower tax rates. Democrats want to raise taxes for the wealthiest individuals in order to reverse this drop in revenue, but a large drop in nominal tax revenue came from lower rates for the middle class as well. When GDP rises enough to collapse the current recessionary gap, I expect revenue to increase steadily again, but to balance the budget revenue will need to rise at a faster pace than spending. This indicates higher tax rates in the future for Americans of all stripes, so get ready, but we should be patient in our desire to increase revenue and wait until the recessionary gap has been filled in first.

Click on chart for bigger version.

Fallacies and Red Herrings

Politicians on both sides of the political spectrum have compared government budget deficits to family budget deficits. Balancing the national budget was an election issue even back when Herbert Hoover and Franklin D. Roosevelt were competing for the White House, with both candidates reasoning that if responsible families had to tighten their belts in tough times, then a responsible government ought to do so as well. This is a great political argument, because it has common rhetorical warrant, it is intuitive and easy for families, businesses, and individuals to identify with. But I call this the family budget fallacy, and disagree with the logic of this political reasoning.

In economics, the fallacy of composition is the mistake in reasoning when one uses the analogy of a single entity to apply to a group of entities. This applies to going from a family budget to a national budget, two things which may be linked because of the word ‘budget’, but which are different technically and substantively. I say technically, because the changes in revenues and outlays for family budgets are different in kind from the federal government versions of these things. Government revenue is variable in rate and source under the discretion of Congress, and can be raised or lowered by a majority vote of representatives, for economic or political purposes. A family’s income typically increases slowly over time, or takes a significant hit all at once when a job is lost. Family spending is for subsistence at a minimum, and then prioritized between many other free market choices with higher levels of income. Government spending is for public goods like national defense, veterans, social safety net insurance, education, scientific research, transportation and infrastructure. These technical differences in the budgets have different implications for individuals and society.

There is an internet meme currently working its way around, which compares the family budget to the national budget by subtracting 8 zeros from all of the relevant national statistics to get a hypothetical family budget. This results in a comparison that shows a family on a small income of $21.7k irresponsibly adding new annual debt of $16.5k to an already accumulated family debt of $142.7k. The example I have come across uses credit card debt, so it sounds flaky, but these monetary amounts could describe a family who decided to finance a new car when they already owed on a mortgage. In all likelihood this happens plenty in real life. It may not be responsible on an income that low, but if a family expects income to increase in the future, and the equivalent here is a government that expects GDP to increase in the future, then financing large capital purchases that pay dividends over time is worth the interest payment, in order to spread the total payment burden over time while reaping benefits that will begin to multiply right away. A family income that is only $21k is at the top of the lowest 20% of household incomes, and in 2010 dollars the income for this group has only risen 6% since I was born in 1976. In the same period of time real GDP has grown 155% (US Census). If a family knew that their income would increase relative to GDP in the future, they would not worry as much about balancing the family budget during a recession.

The technical differences between family and government budgets lead to substantive differences as well. If a family’s main financial provider loses their job in a recession, a layoff that is simultaneously experienced by a significant number of other families, as was the case at the end of 2008 and beginning of 2009, then a loss of available work opportunities can appear all at once for an extended period of time, leaving a family with no income. In America since the Great Depression, government spending goes up automatically to provide subsistence support in order to prevent catastrophic failure of the family budget. This relationship between the family and the government in regards to how their different budgets interact with each other demonstrates that they cannot be the same things in kind. In a situation where a family must live on a small unemployment check for a time, they certainly understand the need to tighten their belts. However, if the government tightens its belt during this same moment in time, in some sort of show of solidarity with the family, then it cannot afford to provide the family with an unemployment check, leaving the family without any income whatsoever. Clearly family budgets and government budgets can’t substantively be reduced to the same thing, and to reason this way abstractly, for argument’s sake or simplicity’s sake, is rhetorical illogic.

There are many red herring solutions to our budget problems that need to be confronted. Complaining about the salaries of the President and Congress is a waste of time, because these costs have actually declined in relation to total outlays over the years. In 1976, The Executive Office of the President accounted for 0.02% of the federal budget and this is the same share as in 2012. The entire cost of supporting the Legislative Branch was 0.21% in 1976, but has declined to 0.14% of the budget in 2012 (Treasury). Taking away Congressional salaries would not impact the budget outlays in any material way, and would create a serious disincentive for honest people working in Congress since it would elevate the need to find alternative sources of income, and likely these sources would be of the corrupting variety.

Another red herring is the focus on waste, fraud, and abuse. I never hear about how much this truly saves the budget, or even how you go about scoping it out. Don’t get me wrong, I think we should address waste, fraud, and abuse as much as possible, but without substantive example of these costs to discuss the tendency is to characterize everything government does as wasteful, or to pick programs you disagree with for a different reason than the budget per se. Much of what we think of as waste, such as bridges to nowhere, comes from earmarks, but the wasteful status of this spending is also in the eye of the beholder, and the economics of public choice suggests that this sort of spending is rewarded by local voters. The proportion of the budget that is impacted by waste, fraud, and abuse is probably immaterial compared to the real budget busting expenses we face. Again, we should address these issues, but it is a distraction to turn the focus on them while skirting around the edges of the real problem.

Foreign aid is another red herring budget target. This is less than 1% of the budget, but most American citizens believe it is something like 20% of the budget. America reaps the benefits of goodwill from foreign assistance programs and although I did not dive into any specific research of the pros and cons on this, I think the budgetary amounts under discussion don’t really warrant the argument that we should cut foreign aid altogether. This part of the budget should be examined, but we should not have any illusions about a 20% reduction in outlays, and that no negative impacts will result from a path of isolationism by ending our foreign aid programs.

In the tax debate, the issue is typically presented as a decision between a tax code that benefits the lowers classes versus a tax code that tilts favor toward the wealthy. Democrats should be more willing to embrace real tax reform, but Republicans also need to recognize that a flat or regressive tax system encourages inequality. The tax code and income inequality are cans of worms that I don’t have the time to jump into with this article, so I will simply say that extracting more revenue from the least able to absorb the cost is likely to be more economically damaging than extracting it from those individuals who have incomes that can absorb it the easiest. The tax debate needs to be more honest as to the real implications of taxes on different levels of income and job creation, so that we can sort out what the true impacts of reforming the tax code will be.

The last red herring that I want to point out is one that is used by both sides of the aisle in the national debt debate, the clichéd defense of the future for one’s grandchildren. When I hear old politician’s talking about their grandchildren it makes me wish they would just retire. It’s not that this argument is not noble and valid, or that I hate the future and grandchildren. It’s that this argument applies to the national debt and everything else, like the economic infrastructure, the environment, the scientific achievement, the moral legacy, the cultural legacy, the job market, our education system, and our place in the world. Everything we build is ultimately for the future, and it is the job of our leaders to balance future looking decisions between competing priorities. I consider the national debt is a very important issue, or else I would not have written a six thousand word essay about it, but the legacy we leave behind is bigger than America’s national debt if we are considering everyone’s grandchildren. This rhetorical cliché has not advanced a solution as far as I can tell.

Solution of Moderation

When it comes to spending, the elephants in the room are Defense, Social Security, Medicare, and Medicaid. President Obama is currently proposing cuts to Defense spending, which I think are essential, although these will most certainly be opposed by most Republicans and possibly many Congressional Democrats. Of course Democrats make quite a public display of defending Social Security and Medicare so they will surely oppose cuts to these programs in the future. The theory of generational accounting indicates that the implicit promises that will result from future entitlement spending are as real as the debt already owed today, because the democratic process will ensure their fulfillment, and these numbers are staggering. A moderate solution calls for addressing Defense and entitlement outlays, because without balancing between these we won’t have the capacity to fill the budget gap that is ahead on the horizon.

America has an aging population, and this means that retirement and medical expense are increasing for a massive demographic that will not be adding to production in the future. Even before the Great Recession opened up the current budget deficit, generational accountants were forecasting the future gap between revenues and outlays to reach an accumulated $66 trillion that will be passed along to unborn generations of Americans, if we assume the current promised entitlement outlays and the current tax code (Whaples). This large deficit is mostly the result of rising costs for Social Security and Medicare. It is uncontroversially expected that Social Security costs will increase from 4.2% of GDP in 2005 to about 6.4% by 2075, and Medicare costs will increase from 2.4% of GDP in 2005 to about 10.4% by 2075 (Taylor). Our aging population and the anticipated skyrocketing of healthcare costs are the largest fiscal head winds that we face as a country. Entitlement reform is unavoidable, and we need a real plan for how to handle this, but I have to admit that a fix for healthcare costs is a problem that alludes me right now. An analysis of healthcare reform will have to be a topic for a different essay.

In the debt ceiling debate there were competing plans put forward by the Democrats and Republicans in Congress, each trying to balance the budget based on their partisan preferences. The nonpartisan CBO scored these proposals based on their impact to the deficit, and they also scored the final deal. The plan offered by House Speaker John Boehner (R) on July, 27th, 2011 would have cut the deficit by an estimated $917 billion over the 2012-2021 time frame, while the counter plan offered by Senate Majority Leader Harry Reid (D) would have reduced the deficit by $2,194 billion over the same time period. If you removed the cost savings that were anticipated for ending the Iraq war, Reid’s plan only cut the deficit by $927 billion. The Budget Control Act that was actually passed reduced the deficit by the lower amount of $917 billion, but set up a deficit reduction “super” committee tasked with agreeing to more deficit reduction, or else an additional $1.2 trillion in automatic cuts would go into effect (“Debt Ceiling”, CBO). The “super” committee has failed to compromise already, and it is widely expected that Congress will legislate away these cuts before they even go into effect. We need to demand that politicians in both parties put everything on the table, and balance the pain between the partisan priorities.

It is very likely that the Republicans will maintain control of the House of Representatives in 2012, and they have a good chance of winning a majority in the Senate as well. If the GOP also wins the White House, and unless the nominee is Ron Paul, this might not improve the deficit beyond the natural improvement from economic growth. History has shown that united government encourages spending through the lack of checks and balances. Also, if second terms are better for deficit reduction, then reelecting President Obama is a prudent choice under these first two indicators. I think Obama gets the trifecta here because a Democrat is also the best choice for cashing in the peace dividend, with the exception in the GOP field being Ron Paul of course. In the end I will likely support President Obama over Paul though, even though supported Paul in 2008, because after four years of deep study into economics, Paul’s solutions are simply way too radical and untested for this moderate independent, and I think they would lead to many bad unintended consequences. My analysis of the national debt has not been a setup for an Obama endorsement by the way, I am just stating my personal preference and its relation to history’s statistical outcomes. Reasonable and rational readers of the unbiased facts in this article will come to a different assessment about the effectiveness of various Presidential candidates when dealing with the debt. But remember that I am calling for moderation, not libertarian principles.

Monetary expansion by the Federal Reserve (Fed) and monetization of the national debt is a helpful tool in our current predicament. The Fed can create money out of thin air and lend it to the government, but this expansion of the money supply can lead to devaluation of the dollar, inflation, and potentially destabilization the world economy, especially if prices become too volatile as a result. Inflation can be looked at conspiratorially in this light, but I think inflation is a much less destructive way of handling an impossibly large debt, and will be more conducive to growth, since a policy of inflation, if moderate, will be expansionary, rather than contractionary, as a policy of austerity would be. Other countries, such as Greece and Italy, have not had the benefit of monetary expansion for having moved to the shared Euro currency, and this has only exacerbated the debt crises there. In my judgment the Fed has performed well during this crisis and the low interest rates it is promoting will make deleveraging our debt much easier, both for individuals and for government.

Inflating away our national debts through monetary base expansion is a time honored tradition for the US, but we have been modest enough about this that it has not scared off investors yet, so I think that we should ignore the doomsday warnings of gold traders and inflation hawks and let reality prioritize our choices. The credit downgrade that came from S&P did not impact the treasury market as expected, with investors demanding even more US governments bonds in the wake of the downgrade. This means that the markets do not yet see the US national debt, or its monetary expansion, as indicators of a future default on its commitments. The theory here is that even with the US experiencing unprecedented financial weakness, it is still the cleanest shirt in the dirty laundry. This tells me that much of the reality is relative to the situation, the US is still one of the least riskiest places to lend money to and to invest in.

A centrist solution for austerity is the most pragmatic choice and I believe it has the best chance of success. Conservatives need to moderate the to-the-death defense of tax cuts, betray their pledges to Grover Norquist, and stop their coddling of the wealthiest Americans. Liberals need to moderate their need to save the populace and the planet from the realities of scarcity, stop promising utopia, and start honestly offering entitlement reform proposals of their own. And if they won’t do this, moderates and independents should start electing centrists. If we insist on letting our two parties pull us to the left and the right, our wrangling over the ship’s wheel will just end up slamming us into the rocks on the shore. The risk of continuing partisan patterns in regards to the budget deficit should be clear after the debt ceiling debacle.

I believe that independents and moderates can find reasons to be engaged passionately in politics. The urgent problem of the national debt is the right issue for promoting moderation. Rather than turn in disgust from these divisive debates, moderates and independents, the generally apathetic center of the American body politic, needs to get in the game. All Americans are impacted by the large national debt, the current obligation of $48k per household effects Democrats, Republicans, and everyone else. Non-partisans need to ardently embrace proposals that balance cuts to spending, enact sustainable entitlement reform, cash in the peace dividend, and enact effective and fair tax reform. Moderation of political views has a tendency to make one moderate in the pursuit of political goals, so centrists need to be more enthusiastic about the principles of pragmatism and compromise. With a problem as large as our national debt, I care less about conservative and liberal principles, and much more about truly cooperative efforts at honest negotiation.

After pumping everyone up about the insistent need to deal with the federal budget deficit and debt, I need to offer some additional moderation. Timing is everything in economic policy, and the best thing we can do right now is to promote productive growth. Focusing on austerity is at odds with this in many ways, so balancing the budget as a priority during a recessionary gap is not really a prudent decision, even if it makes the budget gap worse in the near term. In 1937, FDR balanced the budget and this contraction of fiscal outlays led to a double dip during the Great Depression, setting back the recovery for a long time. It was not until World War II that the US finally broke out of our slump and we reached a national debt of 120% of GDP in order to reach these new heights of production. After the war we kept our momentum and basically grew ourselves out of debt when it became a lower and lower share of our growing GDP. Focusing on growth now and austerity later is the best plan, but this calls for a moderation of our impatience for debt reduction right away.

In summary, I am recommending an evenhanded and nuanced plan for dealing with the budget deficit and the national debt. We wait to begin austerity until we have reached full economic capacity, because growing our economy is the best cure for the sickness, while austerity right now would focus on the symptoms only. This includes an inflationary policy of low interest rates and fortitude about suffering high debt in the near term. Then, once we have reached full productive capacity we need to be honest with ourselves, which means we should concentrate on the truly massive factors in the budget, reforming the tax code, Defense, and entitlements, with a fair balance between increases in revenues and decreases in outlays. Additionally, we should look to real factors in history for guidance, because we have grown out of considerable debts in the past. The endorsement of moderation, temperance, and compromise from our political representatives is going to be the most essential and difficult element in solving our debt problems, but I believe it is the only way out of this mess.

I must admit that finding a solution to the national debt crisis is much harder than honestly describing the problem, and even that is too difficult for most of our politicians, who prefer to deal with red herrings and straw men. My solution here is not detailed or specific as to what to spending to cut and who to tax more. Before that we need a commitment to do these things, and a philosophy of accommodation and compromise so that progress will truly be made. The first step is to be honest with ourselves as voters and citizens, to moderate ourselves in this debate, and demand restraint and temperance from our representatives. The Tea Party movement and Occupy Wall Street should not have the monopoly on political inspiration, and their ideological retreats to respective partisan corners has provided little but fierce demagoguery, at a time when we need passionate pragmatism. If these groups want to pull away from the center, then centrists and independents should take advantage of this gap and fill in the middle with activists of moderation. This is a change in the status quo that is difficult to imagine, but I believe the time is right for building a new political center around the policy of prudent deficit reduction. Who’s with me?

Jared Roy Endicott

Leonhardt, David. “America’s Red Ink Was Years in the Making.” The New York Times. 9 Jun. 2009. Web. 5 Jan. 2012.

Taylor, Timothy. “Budget Deficits and National Savings.” Economics, 3rd Edition. Chantilly, Virginia: The Great Courses, The Teaching Company, 2005. Video.

Whaples, Robert. “Budget Deficits-Past, Present, and Future.” Modern Economic Issues. Chantilly, Virginia: The Great Courses, The Teaching Company, 2007. Video.

“Budget and Economic Outlook: An Update.” Congressional Budget Office, Budget and Economic Information. Aug. 2011. Web. 20 Jan. 2012

“Changes in CBO’s Baseline Projections Since January 2001.” Congressional Budget Office, Budget and Economic Information. 2011. Web. 20 Jan. 2012

“Comparison of Updated Budget Control Act Proposals.” Congressional Budget Office, Debt Ceiling. Jul. 2011. Web. 20 Jan. 2012

“Debt Ceiling.” Congressional Budget Office, Special Collections. 2011. Web. 28 Jan. 2012

“Historical Budget Data.” Congressional Budget Office, Budget and Economic Information. 2011. Web. 5 Jan. 2012

“Historical Tables.” Office of Management and Budget, Treasury. Web. 25 Jan. 2012

“Income.” U.S. Census Bureau. 13 Sep 2011. Web. 25 Jan. 2012