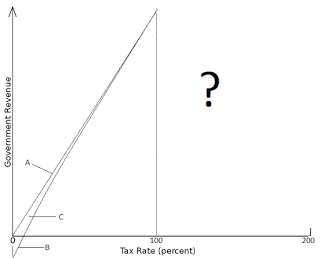

However, this doesn't apply to taxes on the scarcity value of natural resources. In the bottom graph, straight line A shows the effect of a land value tax where markets are perfect. That is a market where we all rent our property from a landlord.

Curve B shows the effect of the alleviation and elimination of deadweight losses, area C, due to the fact owner occupiers can impute their rent (thus over consume immovable property).

But what would happen to revenues after more than a 100% tax was applied to the rental value of land? How would you extend that line? Please share your thoughts.