After falling from $705 all the way to $585 on the initial announcement last night, common sense was re-established and AAPL floated back to $610 after hours – down a nasty 13.4% from the top (see Dave Fry's chart) but still up 50% for the year and, since we began the year at $400, ran up to $700 (+300) and then did a nice 33% retrace to $600 – we're not at all uncomfortable loading up on AAPL here.

Sure people were disappointed that they "only" made $8.67Bn this quarter and that they project to "only" earn $11.7Bn next quarter but their market cap is down to "just" $571Bn but that includes $121Bn in cash and marketable securities so really they are being valued at $450Bn, which makes the projected $45Bn worth of income for 2012 a 10% return on your AAPL investment while next year's projected $52Bn (15% bottom-line growth) will drop the p/e to 8.65 after taking that cash hoard into account.

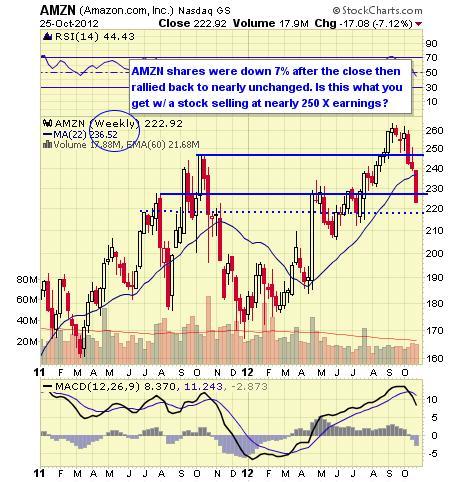

Maybe I'm old-fashioned but that seems kind of cheap – especially when compared to something like AMZN's generous p/e estimate (because they are actually losing money at the moment) of 271. In fact, AAPL lost AMZN's ENTIRE market cap in this drop, which is really amazing because AAPL makes more in profits than AMZN ha in total sales last year ($48Bn) yet AMZN is priced at over 30 times AAPL's value. I'm not going to badmouth AMZN (because we sold short puts on them!) but I will just put it to you that you might want to consider that AAPL may be slightly under-priced at $600 (we're long on them too).

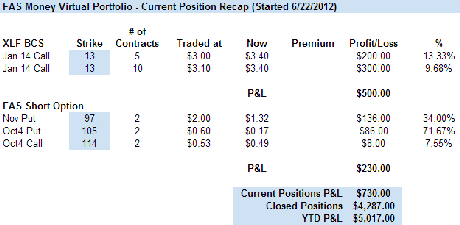

To that end, at PSW we have decided to initial and AAPL Money Portfolio. Much like our very successful and very popular FAS Money Portfolio, we'll be setting up a virtual portfolio aimed at taking a long-term bullish position on AAPL and then collecting a weekly income by selling front-month (or front-week) puts and calls as we move up and down in the channel, which should stabilize a bit now that we've finally had some earnings.

To that end, at PSW we have decided to initial and AAPL Money Portfolio. Much like our very successful and very popular FAS Money Portfolio, we'll be setting up a virtual portfolio aimed at taking a long-term bullish position on AAPL and then collecting a weekly income by selling front-month (or front-week) puts and calls as we move up and down in the channel, which should stabilize a bit now that we've finally had some earnings.

Speaking of channels – I mentioned on Wednesday morning that we had no reason to turn bullish until and unless our weak bounce levels held and we made if over our strong bounce levels and yesterday, despite the good opening in the Futures, we once again failed to break over weak bounce levels so we took immediate action in our Morning Alert to Members, where I made the following suggestions for bearish adjustments:

Dollar back over 80 – not a good start. Euro $1.297, Pound strong at $1.613 and Yen weaker at 80.30 and the Nikkei is loving it at 9,125 and might make a good short (/NKD) when the Yen tops out or even tonight as a way to hedge AAPL earnings because they will be slower to react than our indexes so we can play them down and add more if AAPL tanks or buy them back real fast if AAPL has good numbers.

TZA still a great hedge – Jan $12/16 bull call spread still just $2.20 with TZA at $15.70. Another good one for tonight is QID Nov $31/32 bull call spread at .26 – makes almost 3x if the Nas falls about 3% so should cover bad news from AAPL so, if you have $20K on AAPL and you want to hedge against a 50% drop, you can put $2.5K into the QID spread and you've got $7,500 of downside protection, but only against a sharp move down, not a dip. The TZA is better for dip protection as it's already in the money.

We shut the Nikkei trade early this morning as it dropped 200 points to 8,925 (up $1,000 per contract) and the Nikkei was still at 9,075 after AAPL earnings and held it through 10:20 last night so, as I said, it's a fantastic was to play a late hedge as the US indexes had flagged failure long before that. While we took the money and ran on that one, we're not quite ready to go long yet as we are STILL waiting for at least our weak bounces to cross.

We shut the Nikkei trade early this morning as it dropped 200 points to 8,925 (up $1,000 per contract) and the Nikkei was still at 9,075 after AAPL earnings and held it through 10:20 last night so, as I said, it's a fantastic was to play a late hedge as the US indexes had flagged failure long before that. While we took the money and ran on that one, we're not quite ready to go long yet as we are STILL waiting for at least our weak bounces to cross.

TZA we discuss all the time and we love using that one for a hedge whenever we get nervous while the QID spread was necessary because we had a lot of long plays on AAPL and AMZN in our $25,000 Portfolios and couldn't afford a naked loss. As it is, we're extremely pleased with last night's results – especially AMZN, which burned us so badly with it's snap recovery last earnings that we learned our lesson and cashed our shorts ahead of earnings and went long into last night – because it just doesn't seem possible to scare away the AMZN faithful.

8:30 Update: Looks like we won't get to cash in our QIDs with a big profit because the GDP report for Q3 came in at 2% vs 1.3% in Q2 and 1.9% expected and our futures are swinging back to even. Keep in mind that 2% is an annualized pace as was 1.3% so Q3 had to do a Hell of a lot of heavy lifting to pull the first 6 months up from 1.3% to 2% (roughly 3.4% for the Q on it's own) so don't let the MSM try to convince you this is not evidence of a recovery that backs up the improving jobs numbers they told you to ignore – it's all part of the media effort to paint Obama as being bad for the economy – something that is simply not true.

Real Personal Consumption was up 2% in Q3, 0.5% better than Q2 and Durable Goods were up 8.5% after falling 0.2% in Q2, Non-Durable goods jumped 2.4%, 4 times the 0.6% recorded in Q2 but Services slowed to 0.8% from 2.1% last Q. The housing recovery marches on as Real Residential Fixed Investment jumps 14.4%, up from 8.5% last Q and even the Government finally spent some money, up 9.6% this quarter after decreasing 0.2% last quarter.

Real Personal Consumption was up 2% in Q3, 0.5% better than Q2 and Durable Goods were up 8.5% after falling 0.2% in Q2, Non-Durable goods jumped 2.4%, 4 times the 0.6% recorded in Q2 but Services slowed to 0.8% from 2.1% last Q. The housing recovery marches on as Real Residential Fixed Investment jumps 14.4%, up from 8.5% last Q and even the Government finally spent some money, up 9.6% this quarter after decreasing 0.2% last quarter.

Our Current-dollar GDP — the market value of the nation's output of goods and services — increased 5.0 percent, or $190.1 billion, in the third quarter to a level of $15,775.7 billion. In the second quarter, current-dollar GDP increased 2.8 percent, or $107.3 billion – so a big improvement there as well.

That's another $190.1Bn available to spend on IPad Minis and IPhone 5s in the Appleconomy! Christmas is looking good…

My stock of the decade, TASR, reported earnings this morning and had a nice beat and are up 5% pre-market. 3 counties in Florida ordered 849 units, presumably in preparation for the upcoming elections and their possible aftermath if Romney gets elected and seniors suddenly realize they've been cut off their meds at the same time as their SS checks begin shrinking in order to "extend" the benefits under the Romney-Ryan plan (see also "Republican Budget Creates a Fast Track to Cut Social Security and Ends Medicare as We Know It").

We had a rough day yesterday with 32 companies guiding down and only 11 guiding up (150 not guiding) but this morning DLR, MCO and VTR are in a positive mood with only DAN and HMSY giving gloomy guidance but still plenty of misses (about 1/3) and we approach Halloween with still plenty to be spooked about so let's be careful out there and watch those bounce levels before we even consider giving up on our hedges (see also "Hedging for Disaster – 5 Plays that Make 500% if the Market Falls").

Have a great weekend,

- Phil