We're up from 1,275 to 1,363 on the S&P and that's 7% and, for those playing the upside since October's 1,074 low – it's been a fantastic 27% run in 4 months so we have nothing to complain about in 2012, do we? Of course the US markets gained $10Tn in value in 120 days – that kind of stuff happens all the time and is nothing to be concerned about. I'm sure the net $20Bn that flowed into the markets during that time period had many, many babies to fill up the empty space – or at least that's how Rick Santorum explained it to me.

Fortunately, with over 80% of the trading in the market being conducted by HFT Bots that bring the average hold time for ALL positions (including your long-term retirement fund) down to an average of 22 seconds – we don't need any actual money – or even human participation to have a nice-looking market rally. While "Drill Baby, Drill" may be the rallying cry of the GOP, their Super Pac contributors in the Financial Sector prefer "Churn Baby, Churn" as Billions of shares are traded in the stock market every day that are held for less time than it takes you to read the word "held".

This post is a bookend, in a way, to my September 30th's "TGIF – Closing a 12% Down Quarter," which followed our bullish prediction the previous day's "Thrill-Ride Thursday – Finding Bottom" where my comment on why we were taking bullish positions in the middle of a catastrophic collapse was:

This post is a bookend, in a way, to my September 30th's "TGIF – Closing a 12% Down Quarter," which followed our bullish prediction the previous day's "Thrill-Ride Thursday – Finding Bottom" where my comment on why we were taking bullish positions in the middle of a catastrophic collapse was:

We only fear missing a rally as we may never get another chance at these lows. While it’s possible that we get that 25% decline, we don’t fear that either as we will simply scale an and take net entries that are 40% lower than we are now and, if the markets fall that far and never recover – we’ll be a lot more concerned about stocking the shelter up with ammo than we will be about whether or not our XLF trade is performing well!

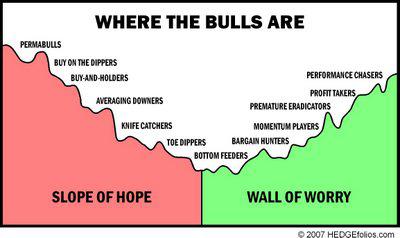

At the time, we had been moving into our September's Dozen Portfolio on each dip since the August crash (S&P 1,100) and we did bottom out on…

At the time, we had been moving into our September's Dozen Portfolio on each dip since the August crash (S&P 1,100) and we did bottom out on…