A bit more violent than we expected but now you can see why we went to cash on Wednesday. We even took a bullish bet on the Qs at the end of the day as we were hoping for a bounce this morning and we had really cleaned up with DIA July $124 puts from the morning Alert to Members, which came in at .95 and ran all the way to $1.85 but we took the money and ran at $1.40 for a nice 47% gain on the day.

We also picked up AAPL weekly $570 puts for .50 and those made a quick 40% as well, closing at .70 at the day's end.

In the afternoon, we took our winnings and played the QQQ next weekly $63s for .75 and they dropped a dime to .65 but we're playing with house money and a stop at .50 on the hopes there will be a rumor of stimulus that spikes the market back up.

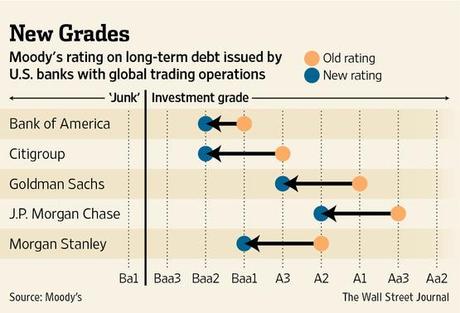

We were too scared to play the Financials bullish with the Moody's downgrade looming but we will be restarting our FAS Money Portfolio today in the hopes that this will be a bottom for the Financials (about $14 on XLF) that we can begin to makes some bets on. Fas Money was, by far, our most profitable portfolio in the first half of the year, cashing in Wednesday with a virtual $12,175 profit with almost no cash in play (but using margin to sell FAS puts and calls on a regular basis).

We don't trust MS enough to bet on them directly but, if they DON'T blow up, XLF should do quite well and, even if they…