"Virtue untested is no virtue at all" – Milton

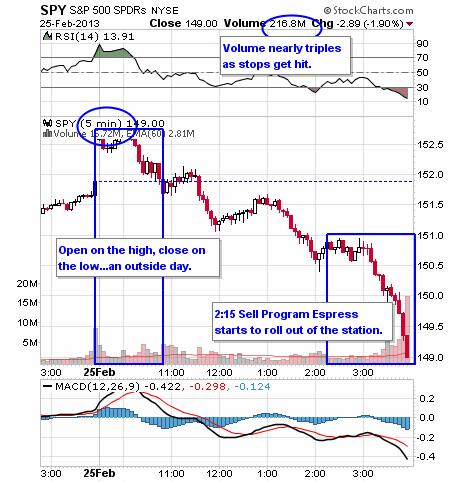

The same can be said for support lines and yesterday we tested two of them as both the Nasdaq and the NYSE tumbled down to EXACTLY the levels we predicted they would hit last Thursday. See that post for the full explanation of what happened yesterday (even though I actually wrote it last Thursday morning) but the key note, which is our action item for the day, was in the 3rd paragraph, where I said:

We are NOT expecting to test 13,600 though, that's just the worst-case, where we would be BUYBUYBUYing on the dip but we HOPE to see 13,800 tested so we can get over it and consolidate for a real move (not a spike) over 14,000.

So let's not call it a shocker when I put out our morning Alert to Members and included this quick cover note for our portfolios at 10:34 yesterday:

Dollar coming back now – 81.43 so good time to cover. SQQQ March $34 calls at $2.20 are just .50 of premium with SQQQ at $35.70 and that's very fair. Good ones to keep an eye on if AAPL fails $450 or the Nas can't hold 3,175 (right on the line now). NYSE 8,900 is a good confirmation spot too.

As it was urgent and a very important note, I also tweeted it out, so everyone could be properly protected from the drop we predicted but, of course, our Members had other downside hedges like our TLT longs in the $25,000 Portfolios, which gained a very nice 92% from our entry on the 13th but the SQQQ trade was a real winner, finishing the day at $4 – up 82% in a single day!

As it was urgent and a very important note, I also tweeted it out, so everyone could be properly protected from the drop we predicted but, of course, our Members had other downside hedges like our TLT longs in the $25,000 Portfolios, which gained a very nice 92% from our entry on the 13th but the SQQQ trade was a real winner, finishing the day at $4 – up 82% in a single day!

This is something I was just talking about with Dereck (Opesbridge Trader) last week – you should ALWAYS have a position in mind that you will use if the market either runs up or runs down on you. Just a simple momentum trade you are mentally prepared to jump on if key technicals break so you can either take additional advantage of a run or just to put the brakes on your losses while you re-group. Our SQQQ trade fell into the latter category as we were still pretty bullish over the weekend…

This is something I was just talking about with Dereck (Opesbridge Trader) last week – you should ALWAYS have a position in mind that you will use if the market either runs up or runs down on you. Just a simple momentum trade you are mentally prepared to jump on if key technicals break so you can either take additional advantage of a run or just to put the brakes on your losses while you re-group. Our SQQQ trade fell into the latter category as we were still pretty bullish over the weekend…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.