Bernanke gave a whole speech last night titles "Fostering Financial Stability" at the Federal Reserve's Stone Mountain, Georgia conference and didn't say one thing about more quantitative easing – not even a hint. Without an endless supply of MORE FREE MONEY from the Fed – what is going to hold our markets up at these inflated levels?

Goldman Sachs immediately covered their assets, putting out a note indicating "A number of factors reinforce our desire to be more cautious about the data in the near term:"

First, our US forecast has continued to embody a relatively flat 2%-ish type GDP growth trajectory, so the notion that acceleration is now coming to an end is consistent with that forecast view.

First, our US forecast has continued to embody a relatively flat 2%-ish type GDP growth trajectory, so the notion that acceleration is now coming to an end is consistent with that forecast view.- Second, we have become more confident that the weather has played an important role in some earlier data strength. The payback here may have begun, but there is probably more ahead. There is also rising focus on the US "fiscal cliff" at the end of this year, as Alec Phillips has described.

- Third, in the current post-bust setting, even modest slowing in growth feels more dangerous than normal. Fiscal policy is consolidating and conventional monetary policy has been exhausted in many places. And with plenty of leverage in parts of the global economy, slowing growth quickly also raises questions about debt sustainability in places. As a result, financial risks can re-emerge more quickly than normal as growth slows.

And, as pointed out by Business Insider – Goldman Sachs can't possibly be wrong. Not because they are smart, nor because they are amoral, evil, greedy, manipulative bastards (allegedly) – but because they talk out both sides of their Corporate mouth so they can always point back at something to "prove" they called it. Kind of like Cramer's daily flip-flop scam only with more people.

Business inside points out that while Jim O'Neill is on CNBC standing behind Peter Oppenheimer and Abby Cohen's bullish calls for the retail suckers who watch TV for investing advice, the official firm stance of David Kostin (Chief Equity Strategist) and Stuart Kaiser, who put out the above note – is, in fact, BEARISH.

Business inside points out that while Jim O'Neill is on CNBC standing behind Peter Oppenheimer and Abby Cohen's bullish calls for the retail suckers who watch TV for investing advice, the official firm stance of David Kostin (Chief Equity Strategist) and Stuart Kaiser, who put out the above note – is, in fact, BEARISH.

That's the funny thing about Corporations, they want to be treated like people when it comes to bribing the politicians of their choice but when they do something that would land people in jail, like promoting a position on TV that they are actually dumping – then they want to be treated like a company that can't possibly be held responsible for the actions of it's individual workers – no matter how senior their positions.

We're flip-floppers and damned proud of it. We like to play our trading ranges and, when we are high in the range, we go bearish and, when we are low in the range, we get bullish. Even at our most bearish or bullish we tend not to go past 70/30 one way or the other and we were happy to take some profits off the table yesterday in our virtual portfolios as we hit our initial goals for the sell-off and expected a bounce.

We're flip-floppers and damned proud of it. We like to play our trading ranges and, when we are high in the range, we go bearish and, when we are low in the range, we get bullish. Even at our most bearish or bullish we tend not to go past 70/30 one way or the other and we were happy to take some profits off the table yesterday in our virtual portfolios as we hit our initial goals for the sell-off and expected a bounce.

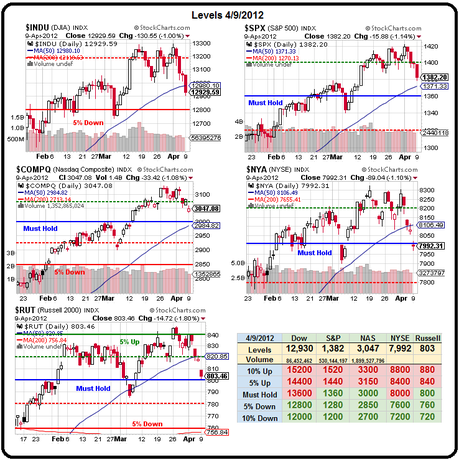

We did not, in fact, get much of a bounce and now we'll see if the Russell can hang on to 800 today but I doubt it and, as I predicted last week, that means we're probably on the way to my 775 target on that index (see March 5th interview), which lines up with 12,500 on the Dow, 1,310 on the S&P, 2,850 on the Nasdaq and 7,750 on the NYSE.

As I noted to Members yesterday, our 5% Rule gives us a very clear set of lines that would define a bullish recovery and those are currently Dow 13,060, S&P 1,396, Nasdaq 3,070, NYSE 8,105 and Russell 817. As you can see from our Big Chart – they all have their work cut out for them today to get back to their levels and, with Europe down 1% this morning and no QE on the menu – it's not looking very likely.

Don't forget, Treasury still has $66Bn worth of notes to sell this week so we NEED to panic people into bonds or rates will go up and that will open a whole other can of worms we don't want to deal with. There are still plenty of well-trained dip-buyers out there but I see ICSC Retail Same-Store Sales up just 0.5% this week (ended 4/7), DESPITE the Easter weekend (which wasn't until 4/24 last year). That's a TERRIBLE number folks!

Don't forget, Treasury still has $66Bn worth of notes to sell this week so we NEED to panic people into bonds or rates will go up and that will open a whole other can of worms we don't want to deal with. There are still plenty of well-trained dip-buyers out there but I see ICSC Retail Same-Store Sales up just 0.5% this week (ended 4/7), DESPITE the Easter weekend (which wasn't until 4/24 last year). That's a TERRIBLE number folks!

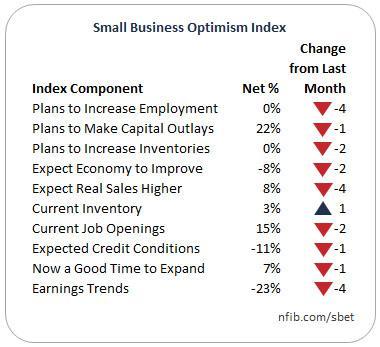

That probably explains why the Small Business Optimism Index fell 1.8 to 92.5 in March, down from 94.3 in February. “March came in like a lion, with Main Street seeing significant job growth in March — but it appears to have gone out like a lamb, and with no cheer in the forward-looking labor market indicators," said the report. One can only assume they must have read my 3/30's "Friday Fade – March Goes Out Like a Lamb (to The Slaughter)" or maybe we just have our pulse on the real sentiment of small business – as opposed to these bozos on Wall Street or in the MSM.

After a promising start to the year, nine of ten index components dropped last month, most notably hiring plans and expected real sales growth each taking a significant dive, in spite of owners reporting the largest increase in new jobs per firm in a year. Reports of positive earnings trends lost 4 points in March, falling to a net negative 23 percent. Not seasonally adjusted, 14 percent reported profits higher (down 2 points), and 43 percent reported profits falling (up 4 points). This does not bode well for earnings season!

After a promising start to the year, nine of ten index components dropped last month, most notably hiring plans and expected real sales growth each taking a significant dive, in spite of owners reporting the largest increase in new jobs per firm in a year. Reports of positive earnings trends lost 4 points in March, falling to a net negative 23 percent. Not seasonally adjusted, 14 percent reported profits higher (down 2 points), and 43 percent reported profits falling (up 4 points). This does not bode well for earnings season!

As usual, Redbook's Chain Store Sales are stronger than the small businesses as consumers rush to the sales that only large distribution networks, cheap Chinese goods and minimum-waged workers can provide. Month over month, Redbook sales were up 0.8% – still not impressive for Easter and, of course, it remains to be seen if any of these sales are coming at a profit – as it's become more and more difficult to entice consumers to spend $20 at the stores instead of at the pump.

Food prices are also eating into those discretionary consumer Dollars and the USDA says there is no end in sight to that nightmare as Global corn stocks drop by 4.3M tons due to rising demand for feed from – you guessed it – CHINA! Overall, demand for corn was down 3M tons so not that big of a difference but that never stops oil speculators from rallying and I'm sure we'll get a pop in corn to add to the woes of the Global consumers. Don't forget, in 2/3 of the World, food is 50% of the household budget!

Speaking of food, our beloved SVU finally got a chance to blow off the bears with the ACTUAL EARNINGS after being endlessly beaten down by rumors that are now clearly ridiculous. They are already up 17% ahead of the bell and should open around $6.25. We just put up a pre-earnings trade idea on them last week in Member Chat which should be looking good this morning:

Speaking of food, our beloved SVU finally got a chance to blow off the bears with the ACTUAL EARNINGS after being endlessly beaten down by rumors that are now clearly ridiculous. They are already up 17% ahead of the bell and should open around $6.25. We just put up a pre-earnings trade idea on them last week in Member Chat which should be looking good this morning:

SVU – You have to believe they'll survive long-term but, at $5.80, you can buy the stock and sell the 2014 $5 puts and calls for $3.30 for net $1.50/3.25 and then the .35 dividend is 23%

Of course SVU is also in our Income Portfolio, where our 2014 target is $7. Congrats to all the SVU faithful today and, I believe, to the bearish faithful as well as we look to pass the halfway mark to our sell-off targets.