Wow, what a downer yesterday was.

Wow, what a downer yesterday was.

Our Members were loving it as we reviewed our Short-Term Portfolio on Friday afternoon and it was up just 68.7% for the year at $168,680 and, of course, we were bearish into the weekend. Those same positions, with no adjustments, finished the day yesterday up 81.7%, at $181,680 – gaining $13,000 on that little dip – not bad for a "down" day!

Today we expect a bit of a bounce in the market but we already had our fun this morning playing oil long in our Live Member Chat Room beginning at 5:18 am with a bullish trade idea at $48.80 on /CL (Oil Futures). We already stopped out of that at $49.25 for a nice $450 per contract gain – enough money to buy a nice breakfast while we wait for the markets to open.

We also went long on /NG (Natural Gas Futures) in our Live Member Chat at $2.825 this morning and, already we're up to $2.90 on those for a $750 per contract gain on those contracts. This is why we love trading the Futures. We'll discuss Futures trading in our Live Webinar today at 1pm (EST) and, since this is our first official one of the year, it will be FREE to join AT THIS LINK. If you want to learn more about how we make these trades – come join us!

I can tell you what we're trading in the morning post (this newsletter has 17,720 active subscribers) like, for example, this morning we will re-enter a bullish position on oil (/CL) back at $48.85 and stop out at $48.75 and re-enter on a cross back over $48.85 (same plan as I told you yesterday) and then again at $48.50 - baiting our hook with $100 worms while we wait to catch a $500 fish. We can tell you this because the oil market is fixed, it's MANIPULATED (not by us) and we know HOW it's manipulated, so we can use our knowledge to our advantage.

We do these trades EVERY DAY, so we can afford to show off once in a while. As usual, we stop giving away free trade ideas once earnings season kicks in (1/15) – so enjoy them while you can. In addition to Futures Trading (which we mostly do for fun as a side bet), we are pretty good with our index calls. Yesterday, for example, the title of the post, published at 8 am, was: "Monday Market Momentum – Gathering Downhill Steam."

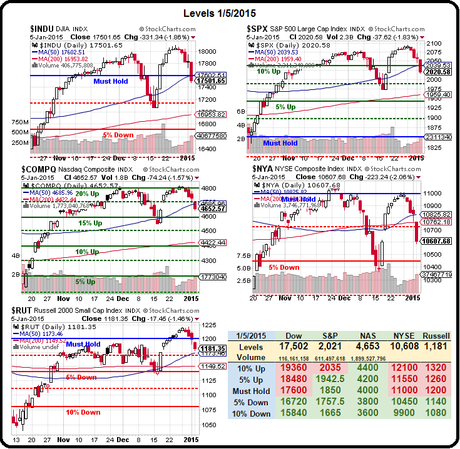

At the time, the Futures were actually green but we can see through the BS and tell you what's really going to happen. We even had a nice chart to illustrate it for you. Below is our Big Chart and that's showing us the major long-term lines and, as you can see, we're kind of in-between at the moment:

As noted in today's title, the S&P must hold that 2,020 line today and the Dow needs to retake 17,600 or we're staying very bearish. The S&P won't be in recovery until it takes back that 2,035 line but we're down from 2,090 to 2,020 and that's a 70-point drop so, according to our 5% Rule™, we expect a 15-point weak bounce right to that 2,035 line and, if the S&P is REALLY recovering, that should be no problem and then we'd move on to 2,050 (strong bounce). Anything less would likely indicate this is just a pause in the move back to 1,984 (as charted in yesterday's post).

IN PROGRESS

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!