I already sent out a morning Alert to Members titled "Busy Morning Already – Dow Futures Short" with a trade idea to short the Dow below the 11,000 line, which is a nice, fat resistance line to take advantage of. As I said to Members: "That’s such a good line, there’s really no point in playing anything else!" As I’m writing this, at 8am, the Dow Futures already dropped to 10,930 and, at $5 per point per contract, that’s a nice $350 per contract winner and a good enough way to start our morning as we can take that money and run.

We mainly we sat on the sidelines yesterday, not buying into the rally but doing a little bottom-fishing as things pulled back. This morning’s move up came from a decent Asian session and good PMI numbers out of Europe which boosted the Pound and Euro and dropped the Dollar down to 73.63 (from 74.25) but now the Dollar climbed back to 73.78 and that’s what caused the dip we expected in the Futures.

Still, we are probably going to have a nice open and we can now afford to watch and wait again while we decide which side to deploy our $350 per contract profits on. I published a full list of long-term puts earlier this morning for Members, 17 stocks and ETFs that should make a nice payout if Bernanke fails us this week and tanks the markets. As we are very much in cash, these are more speculative bets than portfolio protection but they have an advantage over our recent Disaster Hedges of being easier to trade in and out of with 3 of Friday’s picks (from that morning’s Alert) making over 20% in 24 hours already.

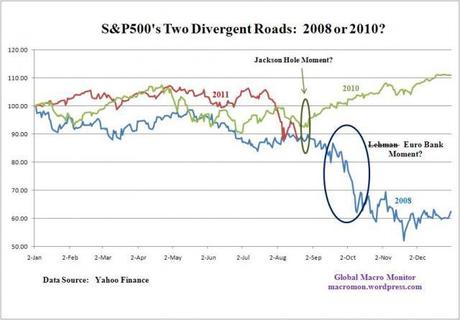

Make no mistake about it, we’re heading into a MAJOR inflection point this week with Bernanke’s Friday morning speech from Jackson Hole. As you can see from the chart on the right (thanks Barry!), it won’t take much of a push to send us off a 40% cliff while ONLY QE2 saved us last September.

Make no mistake about it, we’re heading into a MAJOR inflection point this week with Bernanke’s Friday morning speech from Jackson Hole. As you can see from the chart on the right (thanks Barry!), it won’t take much of a push to send us off a 40% cliff while ONLY QE2 saved us last September.

THAT is why we are picking up our long-term shorts NOW – just in case. It’s also why we remain CASHY & CAUTIOUS because, if we’re going up – we have a lot of room to run and, if we’re going down – there are miles to fall as well.

Investments in GLD have now hit $76.6Bn, topping investments in SPY ($74.4Bn) for the first time ever. Some may say that’s completely crazy – how can people put more money into gold than the S&P 500? Others (including Ron Paul) might say it’s the end of the World as we know it, and they feel fine about their decision. I understand the appeal of holding gold, gold was, in fact, one of my Disaster Hedges from earlier this year that is doing very well but I turned anti-gold $400 Dollars ago as the trade has simply gotten too crowded and yesterday we took an aggressive short on silver as it headed back over $42, which seems a bit much to me as well.

You can’t MAKE the markets behave rationally – all you can do is wait and, USUALLY, sanity reasserts itself over time. As I pointed out to Members yesterday, what’s the point of having a lot of short positions if you wake up in the morning and your Broker is shut down? What good does GLD flashing in some electronic portfolio do you if the system collapses the way the gold bugs are hoping it will? Wake up and look around you people – if things go as bad as the doom and gloomers think they will then the words of The Clash take on a new meaning:

Kick over the wall ’cause government’s to fall

How can you refuse it?

Let fury have the hour, anger can be power

D’you know that you can use it?The voices in your head are calling

Stop wasting your time, there’s nothing coming

Only a fool would think someone could save youIn these days of evil presidentes

Working for the clampdown

But lately one or two has fully paid their due

For working for the clampdown

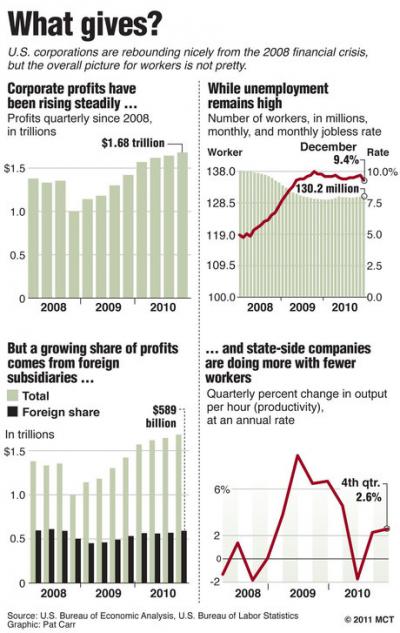

We only narrowly escaped a complete Global financial melt-down in 2008 and 2009 and here we are again in 2011, AFTER the World Governments have spent well over $10Tn (20% of Global GDP) trying to "fix" things and we’re right back in the same place we started. The only thing that has been fixed is the top 1% got about $4Tn richer while the rest of that stimulus money fell into the black holes that are bank balance sheets these days.

The real question is, AFTER all that effort, will they now let us fail and take their chances against the riots and insurrections that are sure to follow or will they continue to paper over the problems, buying some time – even though nothing will change until the STOP papering over the problems and putting money to work STIMULATING the economy rather than covering up mistakes made by the investing class (ie. the "job creators").

The real question is, AFTER all that effort, will they now let us fail and take their chances against the riots and insurrections that are sure to follow or will they continue to paper over the problems, buying some time – even though nothing will change until the STOP papering over the problems and putting money to work STIMULATING the economy rather than covering up mistakes made by the investing class (ie. the "job creators").

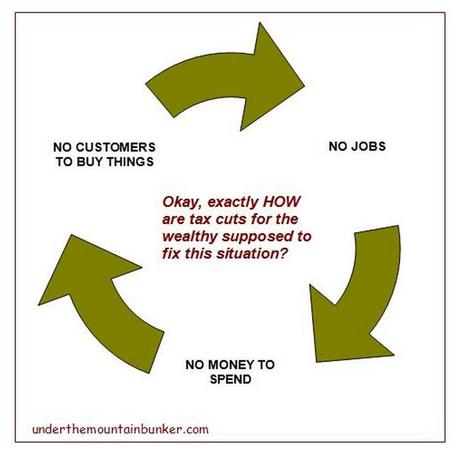

You may have noticed I’ve turned a bit negative lately, which my Conservative readers tend to view as "Liberal" but is really simply a repudiation of the status quo, which is keeping us locked in a vicious circle or completely irrational behavior on the part of our Government and almost all Global Governments that have been taken over by Business Interests and no longer serve the people – as they were theoretically elected to do.

Until and unless some effort is made to break this cycle, all the Quantitative Easing in the World is going to do nothing more than kick the can down the road but, since the logical thing to do is to SPEND MONEY ON POOR PEOPLE to create jobs (in America) and to help families keep their own homes (rather than helping banks to mitigate the losses on homes they foreclose on) and to encourage the growth of SMALL BUSINESS – who actually are the job creators, rather than making FREE MONEY available to Big Businesses and removing regulations that allow them to merge, get bigger and wipe out the competition, which allows them to lower wages and "efficiently" ship jobs overseas.

Until and unless some effort is made to break this cycle, all the Quantitative Easing in the World is going to do nothing more than kick the can down the road but, since the logical thing to do is to SPEND MONEY ON POOR PEOPLE to create jobs (in America) and to help families keep their own homes (rather than helping banks to mitigate the losses on homes they foreclose on) and to encourage the growth of SMALL BUSINESS – who actually are the job creators, rather than making FREE MONEY available to Big Businesses and removing regulations that allow them to merge, get bigger and wipe out the competition, which allows them to lower wages and "efficiently" ship jobs overseas.

Good for the stockholders but bad for America only works for as long as the downtrodden American Citizens put up with it. We’re already seeing the people of Egypt, Libya, Algeria, Syria, Yemin, Bahrain, Tunisia, Iraq (yes Iraq), Jordan, Morocco, Israel and even Saudi Arabia begin to rise upand push back against the abuses of the system that is creating the greatest wealth disparity seen on planet Earth since the Great Depression.

It’s the same kind of disparity that led Russia to revolt in 1917 and France in 1848. There were riots in Bangkok last year, and people seem to forget Iran is what it is today after a revolution as are the Soviet States, Mexico, Cuba, Argentina, Bosnia… Americans tend not to think of these things as revolution because we are generally taught that revolution is a great thing – it’s how we founded our country – yet the same people who wrap themselves in our flag and carry the constitution around in their pocket to reference like scripture are too blind to see the seeds that are fomenting right here in the good old USA.

The people are mad as hell and I’m not sure that they are going to take it any more. That’s why we have list of 17 stocks and ETFs to short – as the possibility of the next great catastrophe is looming large yet you listen to the Mainstream Media and you would think this is nothing more than a few lazy people who want a free ride from the rich.

Well attention rich people – this is heading to a class war and you are in grave danger of underestimating your enemy!