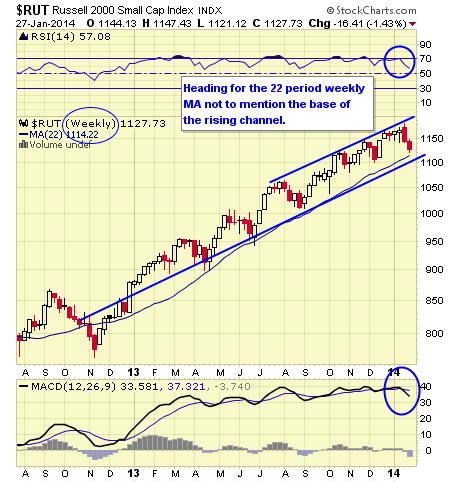

That's the chart pattern that is now shaping up (if you are into such things) and, in fact, it will be marked by a small bouncy "rally" that ultimately fails before our strong bounce lines and ultimately cracks below the bottom of the old channel.

Like my accurate SuperBowl predictions from 1/3, I can only tell you what's going to happen in the future – how you decide to trade on that information is up to you.

Like yesterday, in our Member Chat Room, I said I thought the best risk/reward play for AAPL was playing them for an earnings miss by picking up the next week $500 puts for $2, which could be $10 if AAPL disappoints. Well, disappoint they did and we'll see if we hit our 400% target gains on that one today.

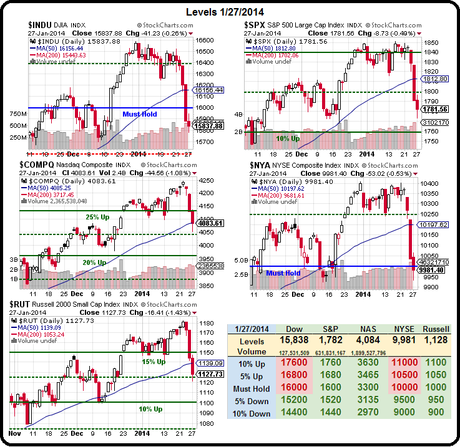

The Nasdaq was only saved by the 50 dma and will open today below it (4,085) while the the rest have plowed through theirs and may be on the way to visit the 200 dmas – 5% below this point and on the way to the 10% correction we expected.

We were not fooled into making any bullish bets yesterday (other than some fun Futures plays on the bounces) because our weak bounce lines were never crossed. Now, as the market gets weaker, we'll have to redraw our bounce lines to accomodate the wider range.

- Dow 15,940 (weak) and 16,080 (strong)

- S&P 1,794 (weak) and 1,808 (strong)

- Nasdaq 4,100 (weak) and 4,135 (strong) (includes moring

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.