That's just before the bell. We're hoping FCX misses so we can put it in our virtual Income Portfolio (see yesterday's update), which is now up so much (19.7% in 7 months) that we should really consider cashing out, because the chances of matching that performance for the next 7 months is statistically unlikely and our goal was to use a $500,000 account to make $48,000 a year in a conservative portfolio that would be low-touch and suitable for someone who is retired and looking to draw an income.

Since $95,175 is almost 2 year's worth of our earnings goal in our first 7 months and, since we're only 50% invested so far (never had a chance to go full), we could just shut it down, take the cash and reward ourselves with a nice cruise or whatever it is old people do when they make bonus money.

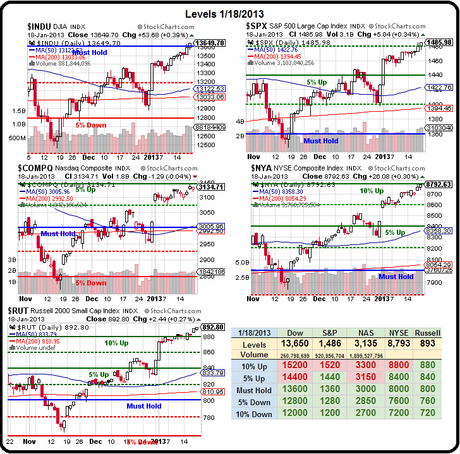

One of the reasons we're out-performing is the low VIX (Dave Fry's chart, left), which is at multi-year lows. Since we concentrate on selling premium (being the house) and not buying it (being the sucker), a falling VIX is very much to our advantage in a portfolio where we've sold a lot of long-term volatility. That, of course, can be a temporary situation and paper losses can disappear as fast as they appear.

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.