As a fundamentalist, it's a time to go over the data and get a better picture of how these companies we invest in are doing. How each sector is performing gives us a clearer picture of the overall economy and, of course, there are tons of quick-trading opportunities as those crazy speculators are willing to pay us huge premiums on both sides any bet we're willing to take – we just have to play the role of bookies.

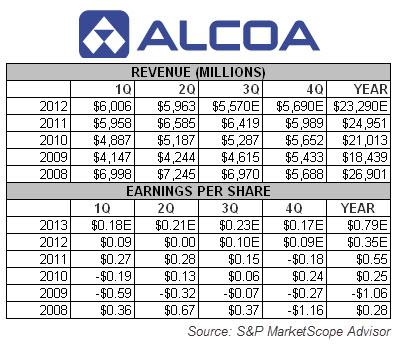

Take AA, for example, who report this afternoon. Although the stock is just $9.10, we can sell the Jan 2015 $7 puts for .80. That would, at worst case, put us into the stock at net $6.20, which is a 32% discount to the current price. In fact, if we're willing to risk owning AA at net $7.70 (still a 15% discount), we can buy the 2015 $7/10 bull call spread for $1.50 and now we're in the $3 spread that's already $2.10 in the money for net .70 – it's up 200% at our entry and all AA has to do is hold $9.10 for 2 years. Our maximum gain at $10 in Jan 2015 is $2.30 but that's a very nice return on our money (there is also a net .70 margin requirement according to TOS) and, if you REALLY want to own AA for net $7.70 as a long-term investment – there's not much downside.

On ALU, for example, although we've already made 166% off our initial entry, we still have another 38% to go through the end of the year. While 38% sounds very dull compared to 166% – it's so deep in the money now that it's attractive as a new trade – even with the lower rate of return. I had mentioned our ALU play in our Morning post, way back on October 18th, when the stock was still $1.10 (now $1.73) yet there are still people who don't think it's worth less than $2 a…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.