Down we go again. This time it's ostensibly because the BOJ, who are already pumping 15% of their GDP into BOJ stimulus, isn't doing MORE to boost the economy (which was up 4.1% on the 15% stimulus in yesterday's GDP report). Dave Fry's chart is from yesterday but the Nikkei neatly gave up everything it gained since Friday with a 500-point dive (which is why we wisely took the money and ran on EWJ yesterday morning!). I believe it was Prince who said:

Maybe you're just like the markets

They're never satisfied

Why do we ease qualitative?

This is what it sounds like

When (Fed) doves cry

Our Members are very satisfied with the drop as we got aggressively bearish in our Short-Term Portfolio on yesterday's little pop, which is now almost 200 Dow points ago! I called for making adjustments to our virtual portfolio in Member Chat at 10:08 and we hit all of our intended targets by 11:42 and there was not much else to do but sit back and enjoy the ride for the rest of the day.

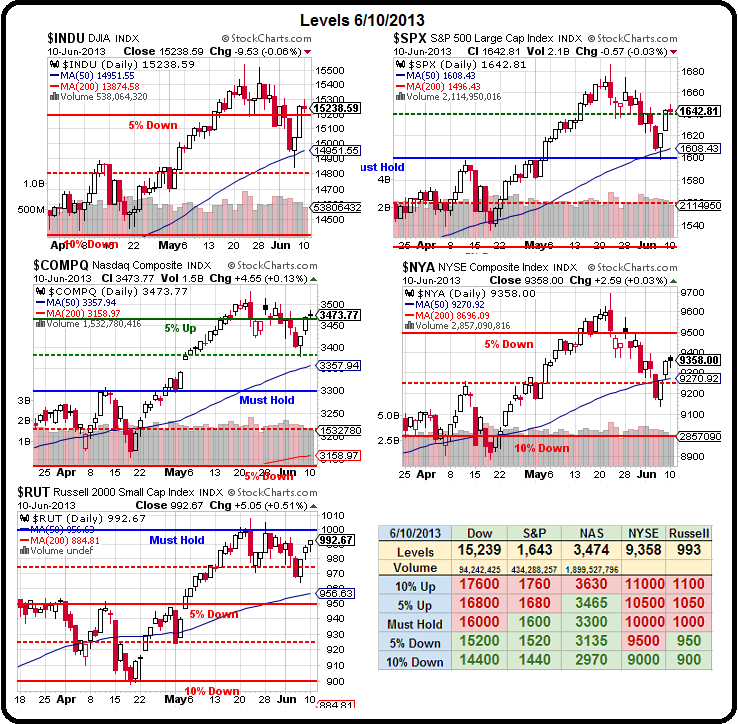

What we'll be looking for today are re-tests of our weak bounce lines (see Thursday's post for details), which are:

What we'll be looking for today are re-tests of our weak bounce lines (see Thursday's post for details), which are:

- Dow 15,108 (weak bounce) and 15,216 (strong bounce)

- S&P 1,622 and 1,634

- Nasdaq 3,420 and 3,440

- NYSE 9,280 and 9,360

…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.