With just 4 trading days left to the month and then just 19 more to close out the year – it's already been a wild ride but, as you can see from Doug Short's S&P chart, we're up a very solid 200 points for the year (16.66%) and not likely to give much of that back and, of course, 1,400 on the S&P represents a 100% recovery off those 2009 lows.

That's 25% a year folks! What are you complaining about? No, we didn't go up in a straight line but sticking with pretty much any stock over the past 4 years has been a winning strategy and that's been replenishing 401Ks and IRAs and Pension Funds and has allowed the investing class to recoup most of their losses from the crash and NOW the question is – what happens next?

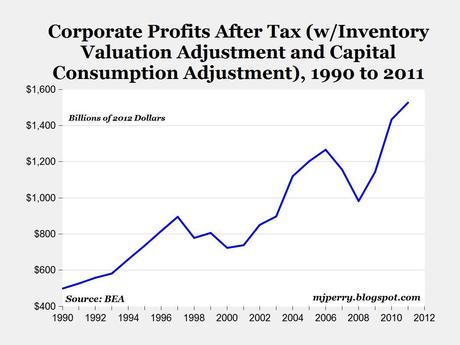

Clearly we still have plenty of economic challenges to deal with and the World is not growing as fast as we thought it was in 2007 but it did grow and Corporate Profits are higher now than they were in 2007 and, if anything, tracking at the top of their 20-year trend so it makes sense that the S&P should be reflecting this – risk on or risk off.

IN PROGRESS

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.