On the Russell (774) and the NYSE (7,866) anyway. We already nailed our Must Hold targets on the Dow (11,590), S&P (1,235) and the Nasdaq (2,603) and we’re now looking to take those +5% lines on the majors and that’s the first time I’ve had occasion to use "+" and "5%" in the same sentence since July!

1,300 is our next goal on the S&P (1,297 to be exact) and it’s just 4% to go so we’ll be watching that 76 line on the Dollar for a breakdown that will give us the thrust we need to break the S&P out of the gravity well of the lower half of our trading range. Fortunately, for S&P fans, the Dollar initiated a "death cross" back on Oct 12th and is in the process of confirming a move down if they break below the 200 dma at 75.77 so let’s watch that line for some real bullish fun this week!

The Euro, on the other hand, formed a "life cross" on October 5th and just broke over the 50 dma at $1.388 and is heading up to test the 200 dma at $1.4065 and, as I said to Members earlier this morning, above that level will be a squeeze on the Euro Bears that will have them gnawing their legs off to get out of that trap.

It was rising rice prices that kicked off the collapse of 2008 and, as nicely illustrated in this cartoon, it’s food prices in general that are most likely to bring about revolution. You can force people to work long hours with no pay, you can freeze them in the winter and broil them in the summer by raising the price of energy to the point where they can’t afford to heat or cool their homes, you can provide them with inadequate educations (and then tell them it’s their fault they can’t find jobs) and you can even let them die with inadequate health care and, for the most part – the masses will just shut up and take it.

But starvation is a different thing. When people get hungry they get angry and that’s something the American Bourgeoisie fail to understand because they’ve never missed a meal in their lives. Rising food prices are the fastest way to turn Occupy Wall Street into Occupy Main Street – something I mentioned in my interview yesterday on BNN.

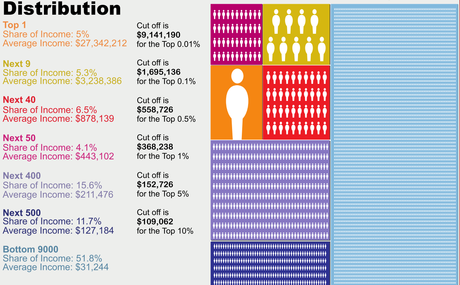

That’s right, the top 0.01% (30,000 taxpayers) earn an average of $9,141,190 PER YEAR and that is NOTHING compared to the top 400, who AVERAGE $400M PER YEAR – over $1M per day of taxable income, which is far less than their actual accumulation of wealth – EVERY DAY!

The Banksters, as a group, have another $1,500,000,000,000 ($1.5TRILLION) of EXCESS reserves on their books – money they are refusing to lend, even though they are able to borrow from the Fed at 0.25% while forcing homeowners to pay 4.75% for a mortgage – the biggest borrowing spread in US history.

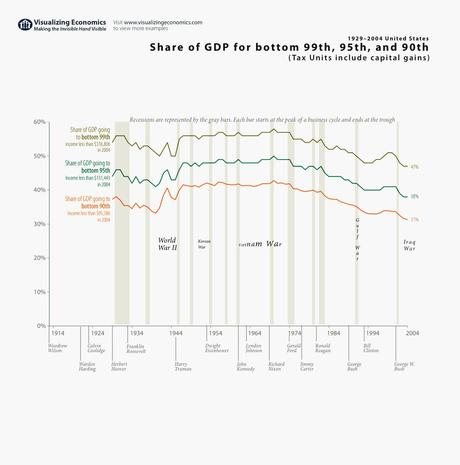

That’s the money funnel I was talking about on BNN yesterday. Since Richard Nixon first took us off the Gold standard in 1972 to allow the Fed and the Treasury to hand free money out to their pals, the share of our nation’s GDP belonging to the bottom 99% has dropped from 60% to 43% (chart on the right stopped in 2004).

At $15Tn a year, that’s an extra $2.5 TRILLION EVERY YEAR handed to the top 1% (and taken from the bottom 99%) and keep in mind that’s JUST the personal income – Corporations are running this scam on a much higher level – sucking ALL of the life away from the bottom 99%, which is what is killing innovation and jobs in this country.

This dysfunction of the US Government is sending negative signals to Europe and that caused us to exercise caution yesterday, ahead of the EU meeting tomorrow – the outcome of which is still up in the air. We are hoping (not a valid investing strategy) that our levels hold but we’ll face a test this morning and it’s all up to Europe tomorrow.

Early this morning, in Member Chat, I said we’d have to wait for the open but hopefully we’ll have reasons to add to Friday’s more bullish bets but the Dow is already up 400 points from Friday’s open so we remain "Cashy and Cautious" ahead of the EFSF decision tomorrow because, without firm leadership from our senior nations – all we will be left with is the Circus Minimus of the US Congress and that’s a very sorry state of Global affairs indeed!