This has been the flow of Bloomberg's "Smart Money Flow Indicator" and, as Zero Hedge wonders: Just who is soaking up what the smart money is selling? Company Buybacks, Johnny 5 (tradebots) or the Greater-Fool Retail Investors?

What is clear is the institutional investors, the so-called "smart money" are dumping shares like there's a crash – only there isn't any apparent crash – the indexes are pretty much holding on fine, making their losses back on low-volume days while steadily selling off on higher-volume days, which needs to a massive net outflow of "smart money" replaced by a steady supply of "dumb money".

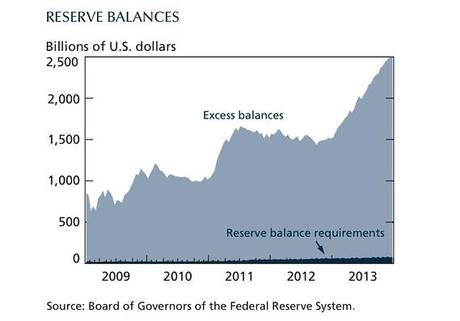

Rather than show you the Fed's $4Tn balance sheet again – let's take a look at where the money went. Oh, there it is – right in the banks! The Fed has essentially borrowed money, on your behalf, and GIVEN it to their member banks at 0.25% interest (ie. FREE) who CLEARLY are not lending it out.

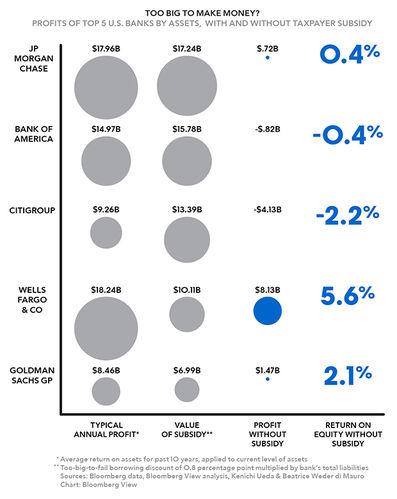

As you can see from the chart on the left (from Q1 last year), taxpayer subsidies account for essentially ALL of the Big Banks' profits. They simply wouldn't exist without us and we have it drummed into us that they are "too big to fail" so we support a system that continues to hand them tens of Billion of Dollars per month to keep them alive while, at the same time, cutting Government programs that help actual human beings survive – MADNESS!!!

IN PROGRESS