Of course, this week’s manic Monday came in the wake of Standard & Poor’s cutting its outlook on U.S. government debt to negative for the first time ever (note, they haven’t actually lowered the U.S. debt rating – yet). It was like a traffic cop handing out a warning rather than a ticket, but the message is clear on what path they think this country is on (and S&P is not some politically conservative think tank).

Nevertheless, the market has rallied the last two days, led by Technology, Basic Materials, and Energy. And, heck, why not? The Fed remains accommodative, forward valuations remain historically attractive, and stocks are merely tracking the V-shaped recovery in corporate earnings. Investors have focused on reports from bellwethers INTC, AAPL, YHOO despite less positive reports from GOOG and IBM. Also, housing starts and building permits for March improved, which boosted building materials and homebuilders.

The speculation has begun about what might happen when QE2 expires. The program had the objectives of keeping down long term interest rates and supporting the wealth effect of the stock market. Most seem to believe that there will not be a “QE3” (even if they are wishing for it). But when the Fed ends its $600 billion asset purchase program at the end of June, it will likely continue to reinvest maturing assets by buying Treasuries.

So the Fed won’t really be ending stimulus quite yet, so long as it continues its reinvestment policy. As it is, the Fed reinvests around $20 billion each month to replace maturing assets, which is much less than the $75 billion per month of QE2. Shrinking the balance sheet by not reinvesting would be a drag on the economy, but ending the introduction of freshly printed bills hopefully will not be, although there is uncertainty as to how bond yields would react. Most are still betting on higher yields (i.e., weaker bonds).

The SPY chart can be interpreted to be showing two bullish formations – a reverse head-and-shoulders and a bull flag, as shown.

RSI has given us some head fakes in both directions, but now has crossed back up through the neutral line. Similarly, MACD is turning back up with some apparently bullish intent. SPY indeed got support at 131, and has bullishly jumped well above all of its daily moving averages with today’s exceptional performance. Unfortunately, the volume on days like today does not match the volume we’ve seen on down days.

The TED spread (i.e., indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) closed at 21.80, which is down slightly from last week but still well above its recent lows in the range of 14 to 15. Fear as measured by the CBOE market volatility index (VIX) briefly spiked above 31 in mid-March during the initial reports from Japan, but it has since come back down. It hit a 52-week low today (Wednesday) at 14.30 and closed at 15.07. No sign of distress here.

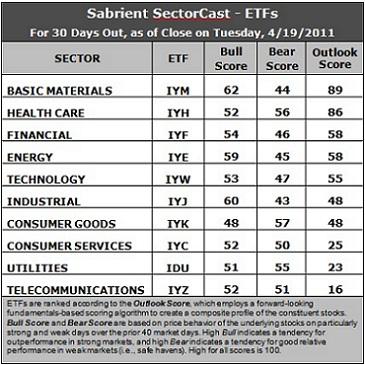

As I have been saying lately, I still see weakness as a buying opportunity. On balance, the chart is bullish. For its part, Sabrient’s SectorCast-ETF rankings continue to show a mostly bullish tilt, although I would prefer to see higher rankings for Technology, Industrial, and especially Consumer Services. In general, the analysts seem to be tempering their optimism somewhat, given all of the global challenges we face at the moment.

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

The most notable observations in this week’s Sabrient’s SectorCast rankings are: 1) as the performance for Telecom (IYZ) improves (as reflected in Bull and Bear scores), its Outlook score has fallen, 2) Energy (IYE) has fallen back substantially in its Bear and Outlook scores, 3) the continued strength in Bull and Outlook scores for Basic Materials (IYM), and 4) the continued weakness in the Outlook score for Technology (IYW) after having led the rankings for so long.

Basic Materials (IYM) maintains its strong hold on the top spot with an impressive Outlook score of 89, although Healthcare (IYH) has made a strong push back up to an 86. You’ll often notice that sectors that underperformed will rise in their scores due to valuation, or due to analysts coming out in support. After rising 30 points to in two weeks to take second place with a 79, Energy (IYE) has fallen this week to an Outlook score of 58 – which ties a resurgent Financial (IYF). It appears that the analysts have not been upgrading growth prospects in the Energy patch with quite as much fervor. But IYF now has the lowest projected P/E, which helps boost its relative score. Technology (IYW) is still sporting a mediocre Outlook score of 55, which is down a few more points from last week.

After a few weeks out of the cellar, Telecom (IYZ) returns to that spot with an Outlook score of 16, which is down 10 points as the analysts appear to think that the sector has gotten ahead of itself. Utilities (IDU) remains in the bottom two with a 23.

Looking at the Bull scores, Basic Materials (IYM) has been the strongest during strong markets, followed by Industrial (IYJ) and Energy (IYE). No one else is very close to these three. Consumer Goods (IYK) is the biggest laggard on strong market days, and in fact, IYK is now the only one with a Bull score below 50.

As for the Bear scores, we are seeing the weak Bull scores leading and strong Bull scores trailing. Consumer Goods (IYK), Healthcare (IYH), and Utilities (IDU) are the favorite “safe haven” sectors. Energy (IYE) fell substantially this week (from 52 to 45) as the sector has shown weakness rather than its previous resiliency during market pullbacks. Industrial (IYJ), Basic Materials (IYM), and Energy, which perform the best on strong market days, show the lowest Bear score, reflecting quick abandonment by investors on weak market days.

Overall, Basic Materials (IYM) still displays the best combination of the three scores, but Healthcare (IYH) is catching up. Energy (IYE) no longer reflects the best combination of Bull/Bear. Instead Basic Materials (IYM) and Healthcare (IYH) tie for that honor, with IYH showing all-weather balance and IYM shining best on bullish days.

Top ranked stocks in Basic Materials and Healthcare include Innospec (IOSP), First Majestic Silver (AG), Medco Health Solutions (MHS), and Humana (HUM).

Low ranked stocks in Telecom and Utilities include Viasat (VSAT), American Tower (AMT), DigitalGlobe (DGI), and EnerNOC (ENOC).

These scores represent the view that the Basic Materials and Healthcare sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued, based on our 1-3 month forward look.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.